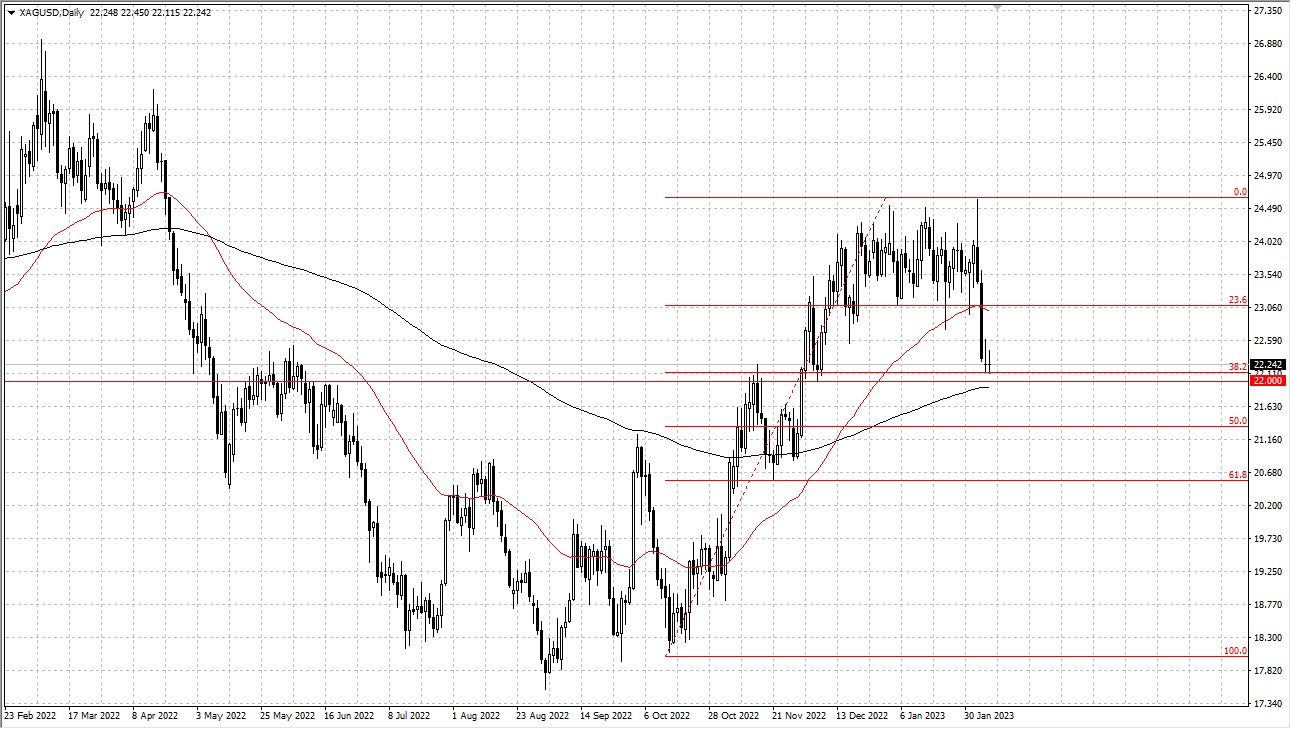

Silver has had a choppy couple of sessions over the last 48 hours, as it looks like the $22 level is possibly going to offer a significant amount of support. That being said, it’s probably worth noting that the 38.2% Fibonacci were little from the move higher it sits there, right along with 200-Day EMA.

Silver has been very noisy as of late, mainly due to the fact that there has been so much noise with the US dollar. The US dollar tends to have a negative correlation to silver, but it doesn’t necessarily have to, as silver is also an industrial metal, so there are other things going on that could come into the picture. After all, there are a lot of questions right now about whether or not industry is going to pick up or drop, and therefore the industrial part of the equation comes into question. With central banks around the world tightening monetary policy, one would have to think that there is a little bit of bearish pressure on silver overall. However, there has been a recent push for precious metals to simply preserve well. Is it because of this that the normal correlation may be struggling.

Nonetheless, when you see the massive negative candlestick that we had on Friday, these almost never happen in a vacuum. If you are bullish of silver, what you want to see is more sideways action. If we slice through the 200-Day EMA, then the $21 level will be targeted, as it was previous support. Quite frankly, when you are between the 50-Day EMA and the 200-Day EMA indicators, you quite often have a lot of noise and eventually an impulsive move.

When the market sets up like this, quite often the best thing you can do is wait for the next large candlestick and follow right along. With Jerome Powell seemingly ready to stay tight with monetary policy, that does create a headwind for silver. However, you need to be cautious about getting overly aggressive in this market, and it normally serves a traitor quite well to scale in. Silver is one of the more volatile markets, and in this macroeconomic environment, it will continue to be bumpy. Nonetheless, pay attention to the 2 moving averages, because once we break out of that range we should have a bigger move.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.