Last week a small activist hedge fund called Engine No.1 won two seats on the board of Exxon Mobil by persuading other investors that there was not much of a plan in the company to handle climate change.

Engine No.1, which shocked investors and analysts last week by taking the board positions at Exxon’s annual shareholder meeting, is now planning to launch its first exchange-traded fund.

According to a regulatory filing, the Transform 500 ETF’s goal is to encourage changes at the companies it holds through proxy voting.

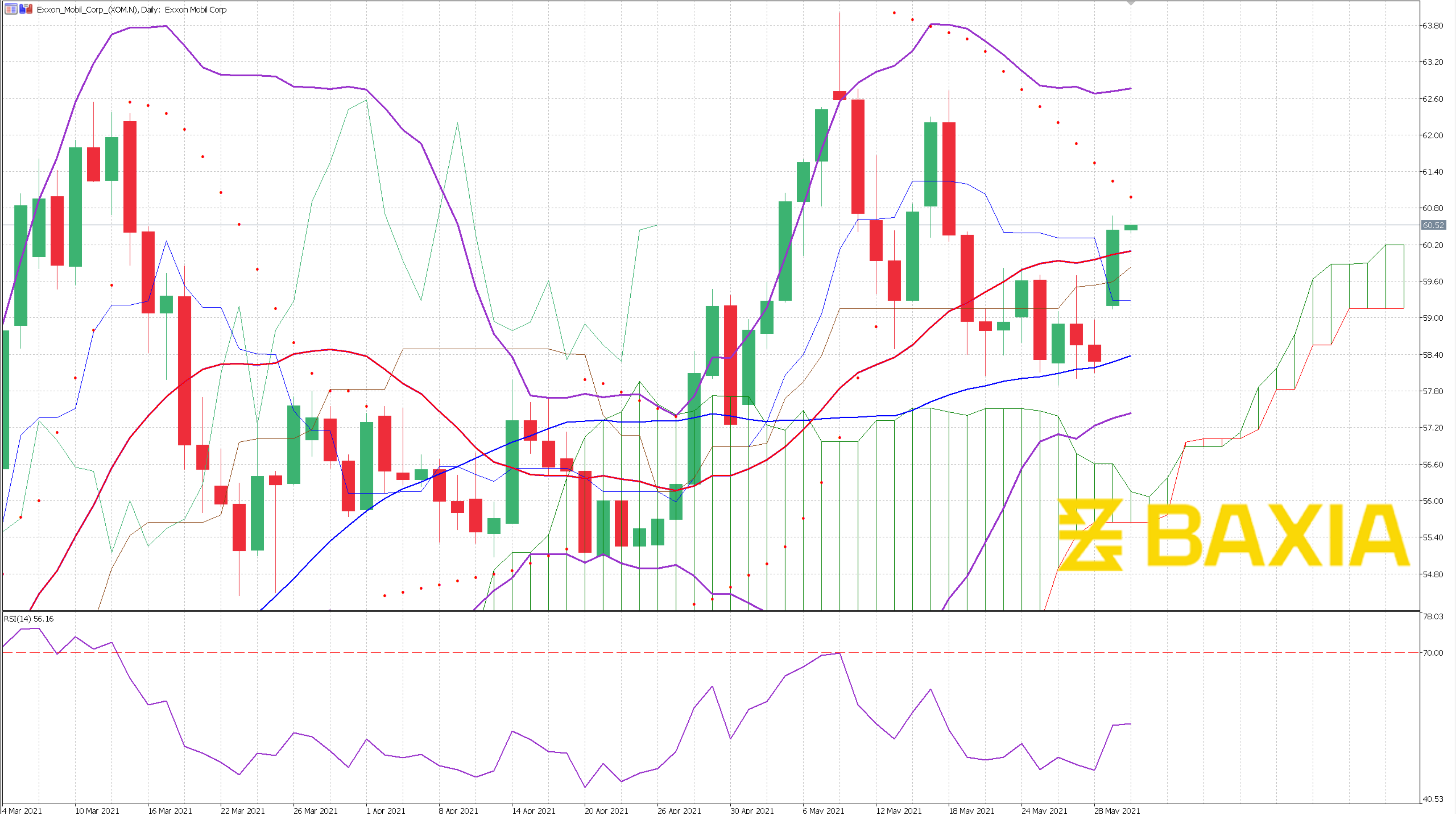

Engine No.1 is looking to measure how companies are investing in their employees and the environment, using different metrics like workforce diversity, employee health and safety, carbon emissions, and land use, which already impact the stock price of Exxon Mobil.

The hedge fund owns only about 0.02% of Exxon’s shares. It was able to get support from the three largest U.S. investment firms; BlackRock Inc., Vanguard Group, and State Street Corp., as well as the nation’s three most significant pension funds to overhaul the oil giant’s board.

The win “marks the first successful proxy fight with a focus on environmental or social issues,”

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.