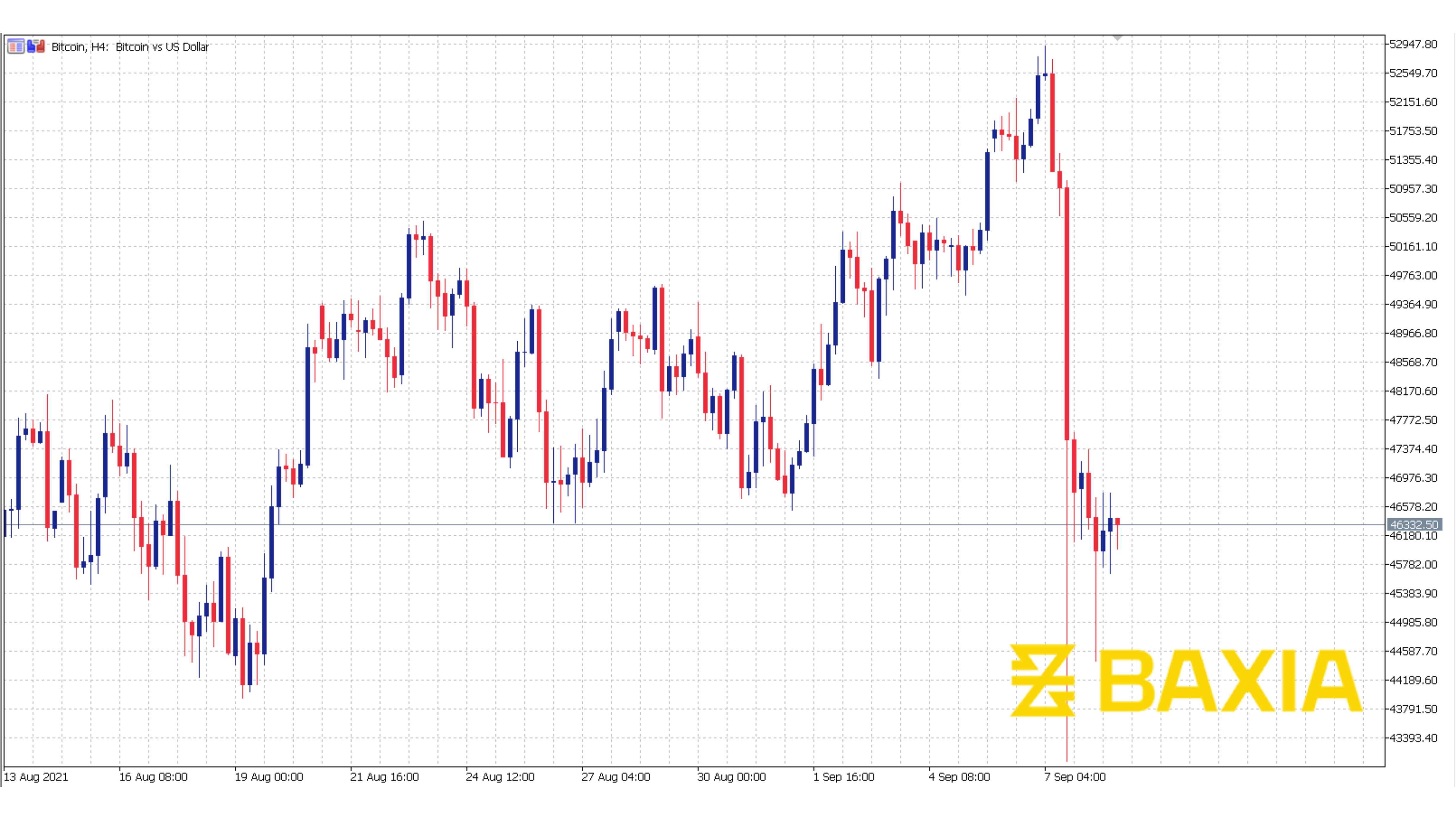

The largest cryptocurrency by market value edged about 1.9% lower from its 5 p.m. ET level on Tuesday to trade at about $45,896.30 a piece, according to CoinDesk. It briefly dropped 17% over the course of a few minutes on Tuesday and ended the day down about 10%. Other digital assets also have lost steam: Ether, the second-largest, slid 1.1% Wednesday. El Salvador’s process for adopting Bitcoin isn’t as smooth as everyone wanted. Protestors took their frustration on the street, and El Salvador’s debt has fallen into the garbage territory.

Analysts are still optimistic about Bitcoin’s future, with Standard Chartered’s cryptocurrency forecast team believing a %115 gain late this year is on the horizon. The bank's team said it "structurally" values bitcoin between the range of $50,000 to $175,000. "Cyclically, we expect a peak around $100,000 in late 2021 or early 2022," they said in a note Tuesday. As Bitcoin was recovering from its summer swoon, two of Saylor’s top lieutenants -- Chief Financial Officer Le Phong and Chief Technology Officer Timothy Lang unloaded stock in August after exercising about 30% of the options they were awarded. Each realized cool gains of around $7 million from the sales. Saylor, one of the digital currency’s most vocal proselytizers, hasn’t sold any shares, SEC filings show.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.