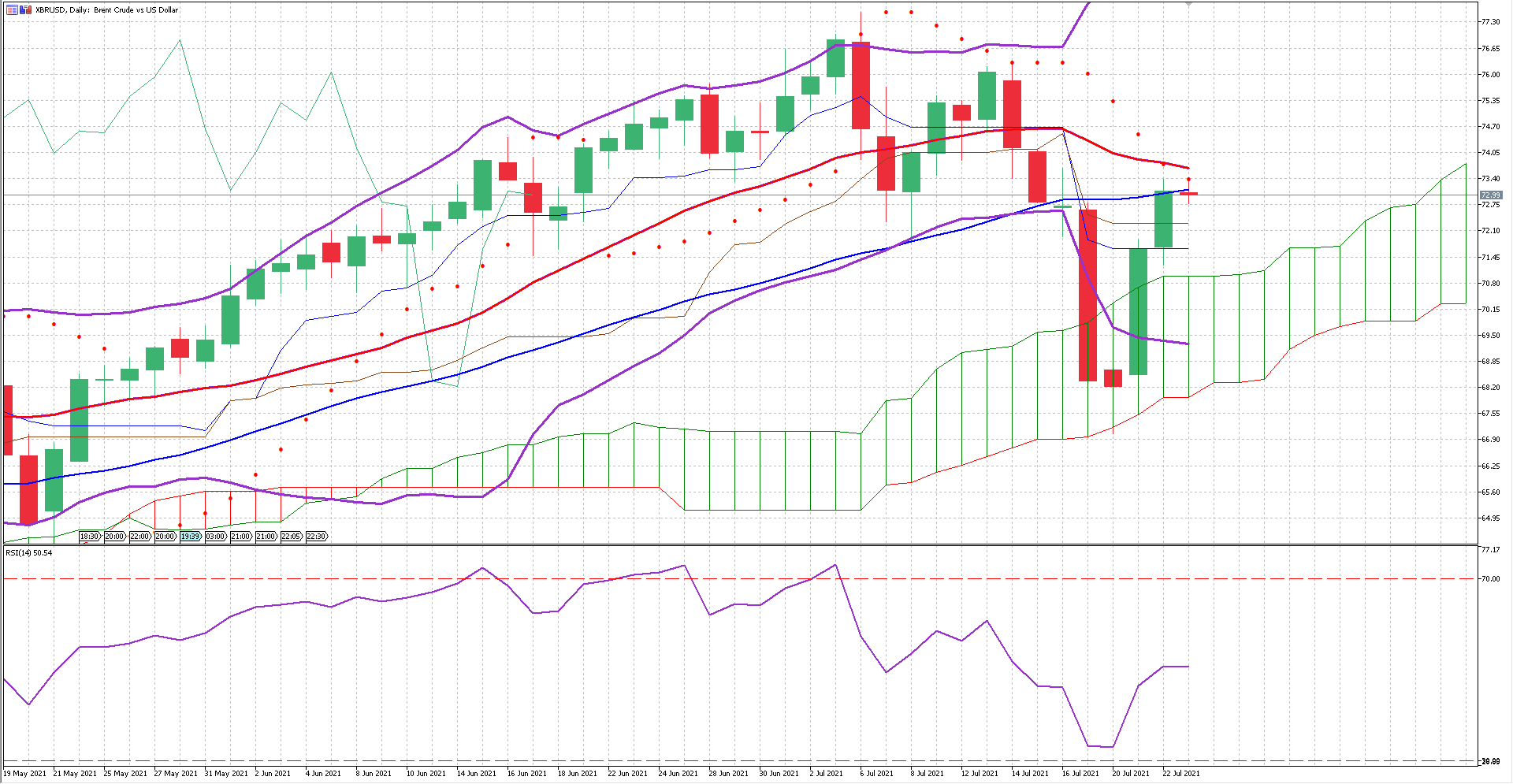

After plunging into the high 60’s XBRUSD is making a solid comeback. The price managed to break three resistance levels in the last two trading sessions; the previous resistance breakout has not yet been consolidated. Still, the conditions are set for the commodity to do it in the following sessions.

The Bollinger bands are wide, and the price trades in the middle; this will allow the price to continue its uptrend and possibly break the $77.82 barrier.

The moving averages came very close to a crossing; however, the gains obtained recently have prevented the crossing, which indicates that the general trend is upwards. As we mentioned in a previous analysis, the drop is helping the price of Brent Oil recover and potentially reach a new high in more than two and a half years.

The relative strength index is at 51%, which improves the chance of breaking the $77.8 barrier. The price will first have to consolidate the breakout of the $73.74 resistance at our 23.6% Fibonacci retracement. We could see the pair in the $74.5 levels very soon.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.