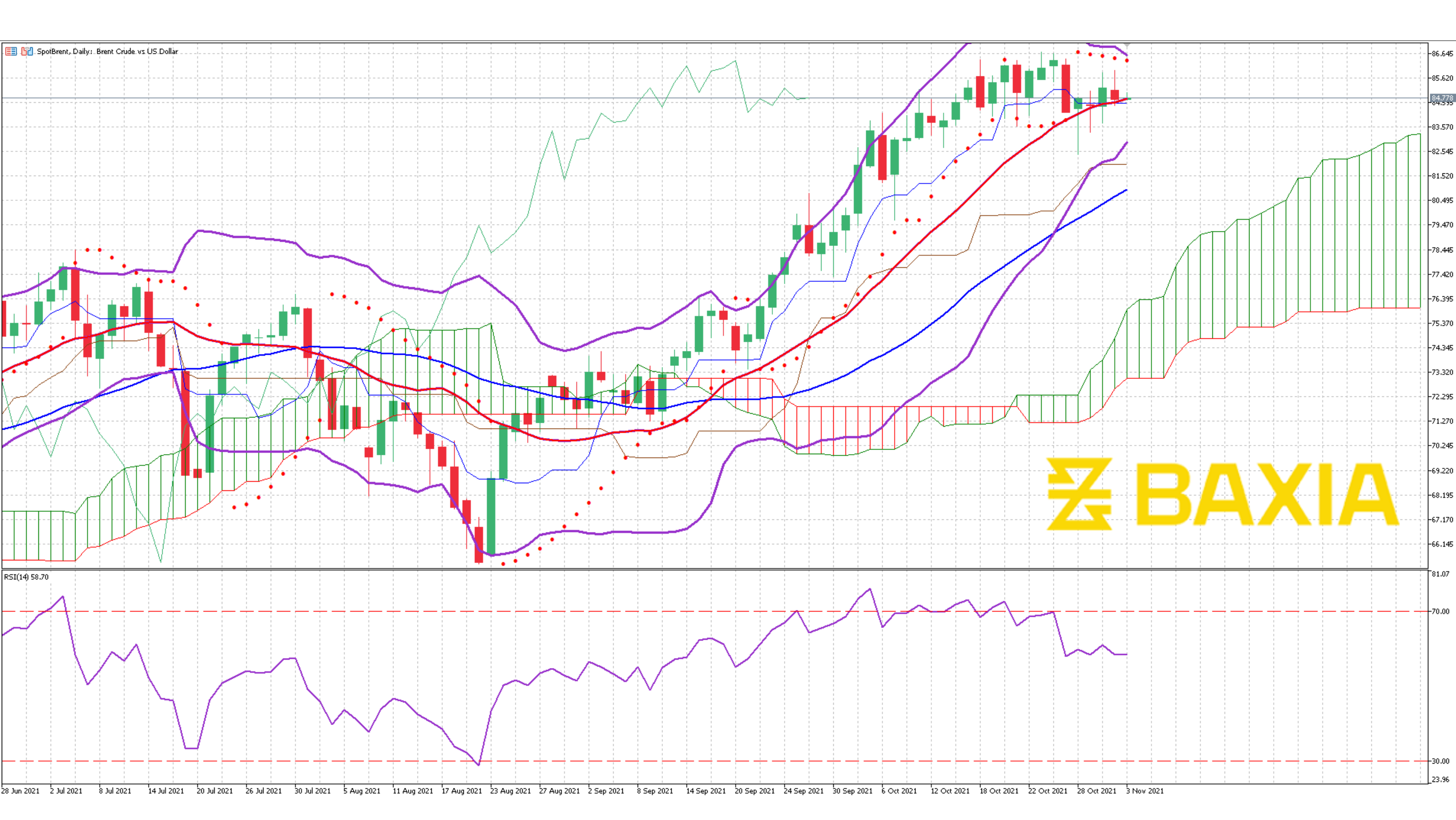

The energy commodity suffered a loss after reaching the highest level in a few years, the price was overbought, and a retracement was expected after the rally. Now the price remains close in price to the previous five days.

The Bollinger bands are closing up, which means that volatility should be lower. We would expect the price to move laterally for some sessions, as the market seems exhausted. Some of our technical indicators suggest that the price could fall a bit more, finding support at the 81.55 level.

The relative strength index is recovering from an overbought status. It currently is at 56%, which is good news for the price in the mid-term; such correction is necessary for the price to continue moving up in the mid-term.

Our parabolic SAR suggests that the price will continue to lose ground, the price trades below the short-term moving average, giving us a sign of a downtrend.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.