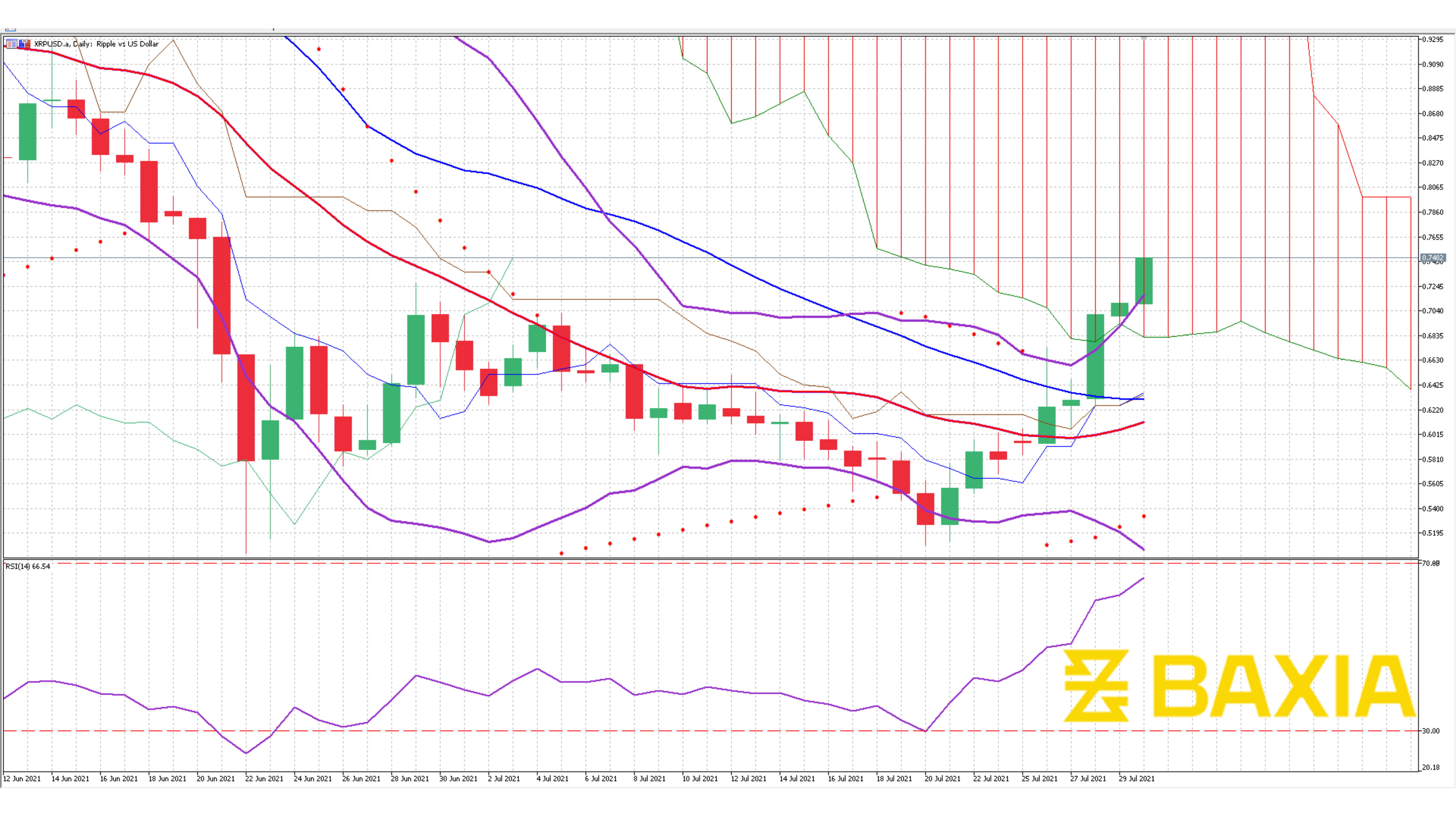

The cryptocurrency has been on an uptrend for eight out of the last ten trading days; it's up more than 45% since July 20th getting a big boost just two days ago; however, this could come to an end soon.

The price rose like foam in the last few sessions, which naturally increases the relative strength index level to 67%; at the current level, we do not believe that the asset will appreciate a lot more before it finds a pullback. The price trades above the upper Bollinger bands, which is often interpreted as relatively high.

The price trades inside the Ichimoku cloud, which is not entirely bad for the price, but we can expect market uncertainty in the upcoming days. Our parabolic SAR suggests that the price will continue climbing, but other technical indicators do not support this signal.

The Bollinger bands are wide as they opened up aggressively on July 27th, allowing more volatility for the crypto. The price could continue getting gains during the trading sessions but keep an eye on the RSI; as it gets closer to that 70% overbought status, we will likely see the price dropping perhaps temporarily; only time will tell.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.