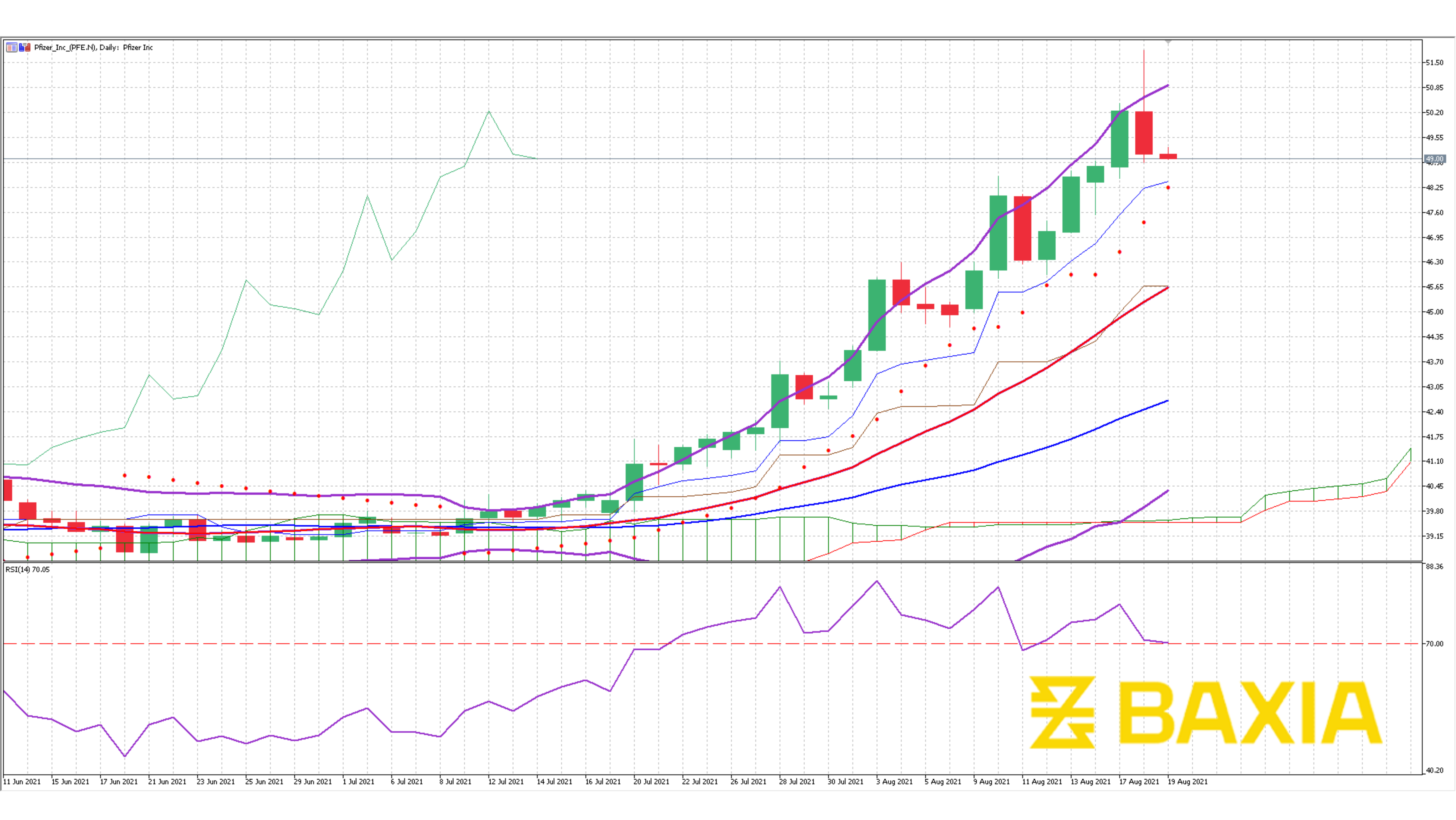

Pfizer climbed about 9% in the four trading days through Tuesday, with retail traders snapping up about $63 million of the shares on Tuesday alone, according to data from Vanda Research. The day-trading crowd sold off more positions than they bought in Moderna and BioNTech.

It marks a sharp change in fortunes. Both Moderna and BioNTech have amassed triple-digit gains this year, a rally the nearly $280 billion-valued Pfizer missed out on with a scant 34% gain, despite being the first -- along with BioNTech -- to win authorization for a Covid shot in the U.S. The U.S. announced today that it would start offering booster shots to the already vaccinated in September.

As Pfizer rallies, BioNTech has tumbled more than 18% from a record high reached on Aug. 9, while Moderna is down roughly 18% from its zenith. All three stocks slumped today, with Pfizer reversing early gains to close down 2.2%.

Pfizer’s stock now trades at about an 8% premium to the average analyst price target, compared to more than 30% for Moderna and 18% for BioNTech.

The recent closing of the gap may not spell the end of the rally. Wall Street is already adjusting its models, with Pfizer getting a new Wall Street high price target of $61 from Cantor Fitzgerald analyst Louise Chen on Tuesday.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.