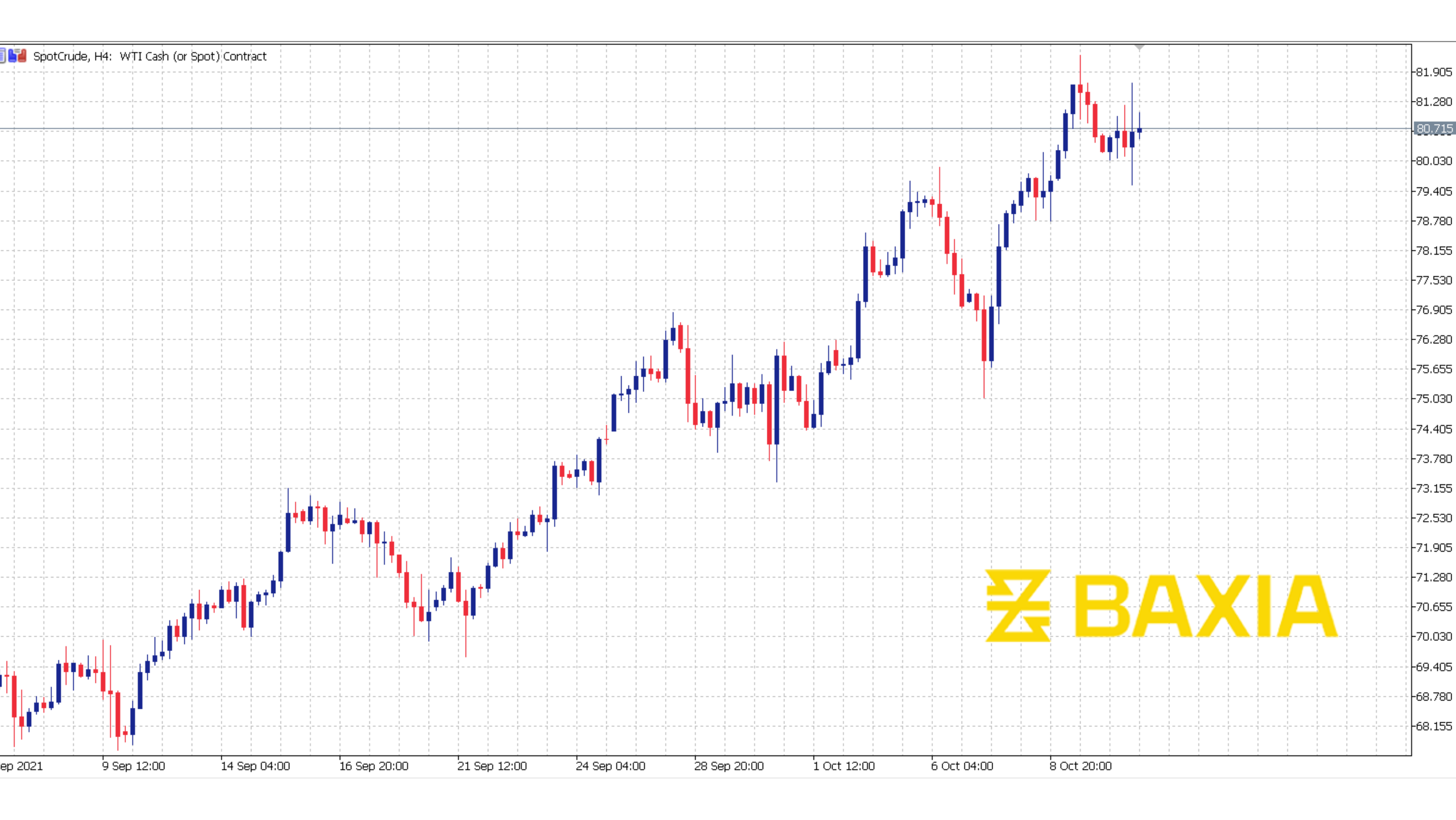

Oil prices have been rising for a long time, but other industrial commodities have lagged behind, reflecting confidence that energy supply bottlenecks will balance any global economic downturn. On Monday, U.S. crude jumped 1.5 percent to $80.52 a barrel, closing above $80 for the first time since late 2014 and extending the year-to-date gain to 125 percent. According to Dow Jones Market Data, oil is on course to outperform copper this year by the most since 2002, and is leading a raw materials index by the widest margin in more than a decade. Natural gas, like oil, is surpassing other commodities.

Fears of slowing development in China, the world's largest commodities consumer and oil importer, have caused several industrial metals to slump. Traders believe that the economic consequences from China Evergrande Group's probable bankruptcy will amplify the slowdown caused by the Delta version of the coronavirus. Because the Chinese economy relies largely on real-estate developers for growth and jobs, this is the case.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.