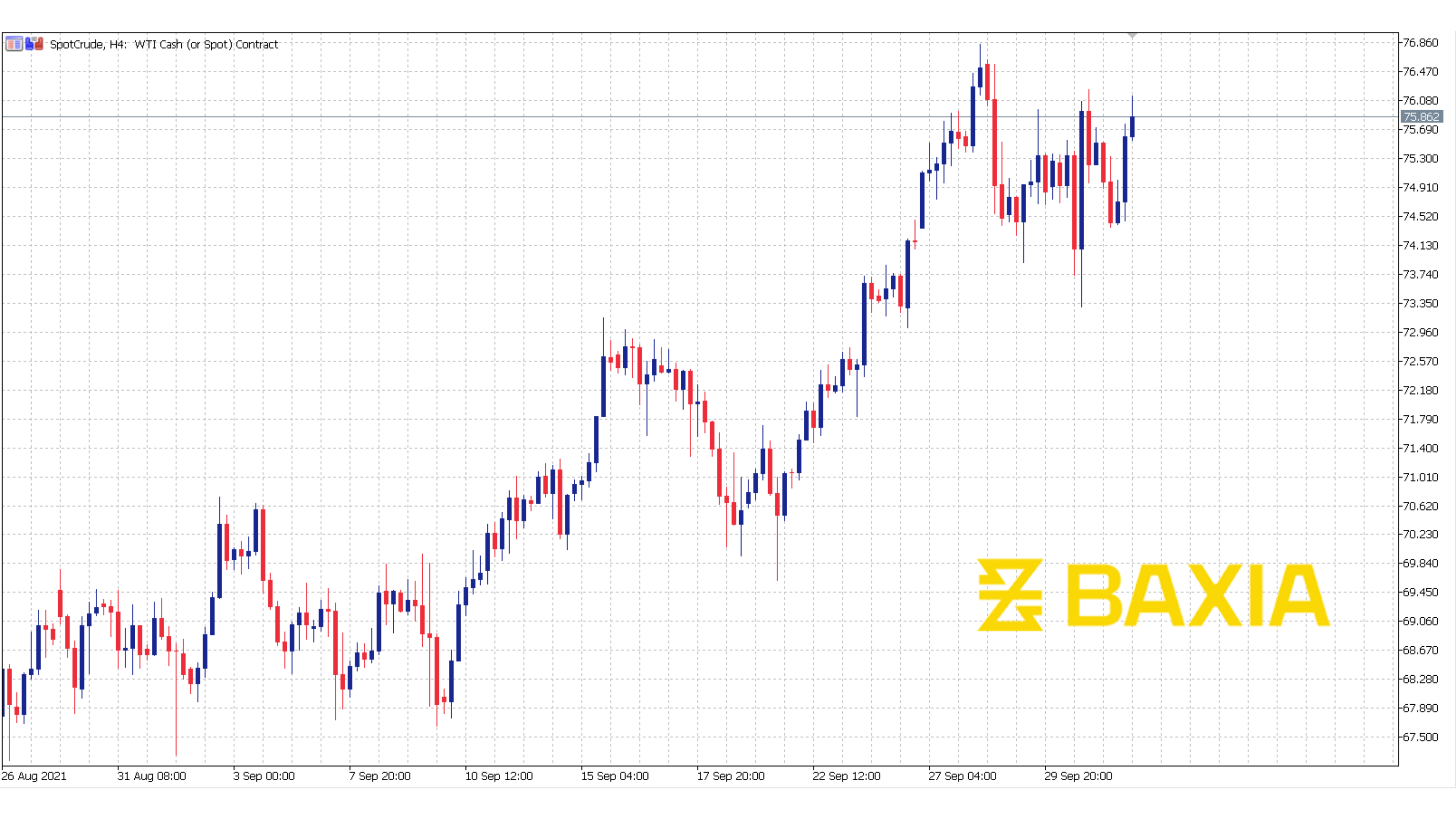

On Friday, oil surged beyond $78 a barrel, approaching this week's three-year high, boosted by tight supplies due to OPEC+ output cuts, recovering demand, and a weaker US dollar. On Monday, the Organization of Petroleum Exporting Countries and Allies, or OPEC+, will convene. The company is gradually reversing last year's record output cuts, while sources suggest it is considering doing more. By 1403 GMT, Brent crude had risen 41 cents, or 0.5 percent, to $78.72, putting it on track for its fourth weekly gain. The West Texas Intermediate (WTI) in the United States gained 24 cents to $75.27, extending its winning streak to six weeks.

Brent has increased by more than 50% this year, hitting a three-year high of $80.75 on Tuesday. Consumers such as the United States and India are pressuring OPEC+ to increase production in order to assist lower prices. Oil is also gaining traction as power producers around the world switch away from natural gas due to rising natural gas prices. In Pakistan, Bangladesh, and the Middle East, generators have begun to switch fuels.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.