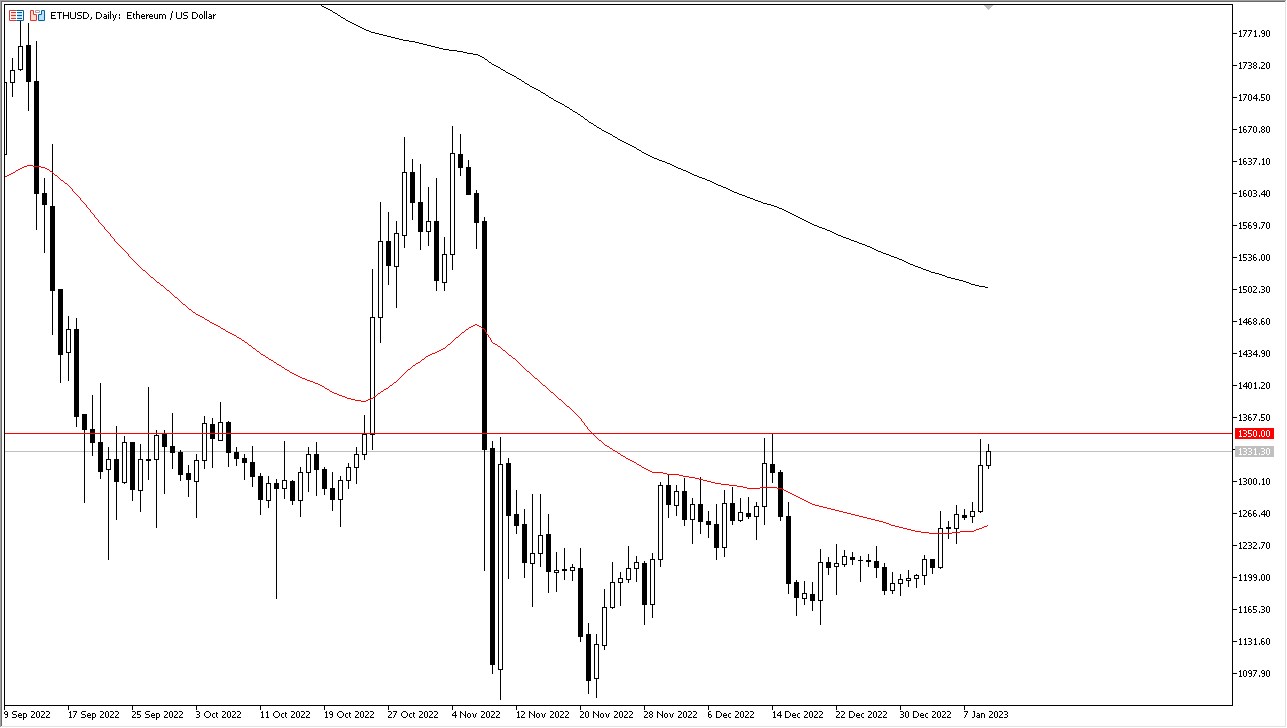

Ethereum markets have rallied the last couple of days, as the risk appetite of traders around the world has picked up. The Ethereum market has had previous action at the $1350 level, and that is the area that the market finds itself approaching right now. Because of this, we could see a situation where the market is either going to break out or confirm that we are still very much in a trading range.

In the first scenario, on a daily close above $1400, it’s very likely that Ethereum will continue to rally, sending markets much higher. That could have another $100 attached to it, as it would unleash quite a bit of optimism. You should also always keep an eye on the Bitcoin chart because it does tend to give us a bit of a “heads up” as to where crypto is going to go in general. Alternatively, Ethereum gives you a bit of a “heads up” as to whether altcoins may rally or start a selloff. In crypto, it’s a bit of a cascading effect.

If the $1350 level does in fact confirm significant resistance, the market could very well pull back to the 50-Day EMA, which is currently near the $1250 level. Ultimately, breaking down below that would be very bearish signal. As things stand currently, Ethereum is one of the better performers in the crypto world, and it probably needs to be noted that with all of the negativity around the crypto world at the moment, including the blowup of FTX and Silvergate, crypto traders have taken it all in stride. Perhaps most of the true bearish and negative behavior in the market is starting to subside.

While it is not necessarily signal to jump in and start buying hand over fist, it does point to the fact that most of the truly negative behavior is probably behind us. At this point, it’s a simple matter of waiting to see whether or not Ethereum can clear the $1350 level significantly as a buying opportunity, or perhaps looking to short the market to head back into consolidation. Let the daily candlestick guide your trading opportunity as we are at a major crossroads.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.