Today's focus is on key economic releases from Germany, including German Business Expectations, Current Assessment, and the Ifo Business Climate Index. All these indicators came in higher than forecasted, supporting the bullish sentiment for EURJPY.

German Business Expectations for April stood at 89.9 against a forecast of 88.9 and previous 87.7. Current Assessment was at 88.9 versus the forecast of 88.7 and previous 88.1. Additionally, the Ifo Business Climate Index came in at 89.4, surpassing the forecast of 88.9 and previous 87.9. Despite the positive data, the market remained flat with no immediate reaction or volatility during the news release.

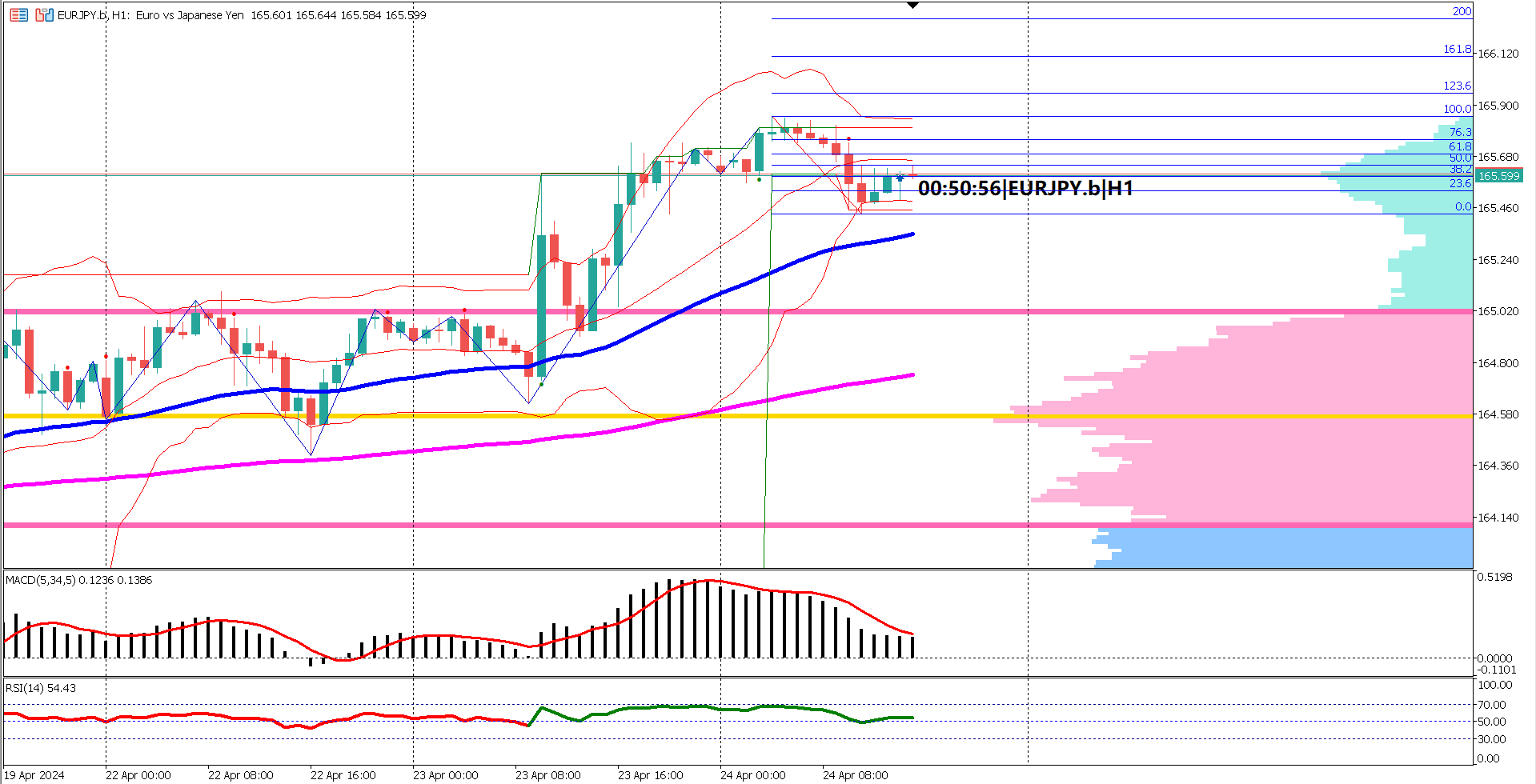

The bullish sentiment is evident as the EMA 50 is positioned above the EMA 200, and the distance between the two is widening, indicating strong momentum. Despite the positive news, volatility remained flat as shown by the contracting Bollinger bands. The lower band remains intact, with a breach potentially indicating a deep pullback.

Key support levels to watch are at 164 Yen, the lower part of the value area, and resistance levels at 166.10 Yen and 166.27 Yen, representing the 161.8% and 200% Fibonacci extensions respectively.

Oscillator indicators support the bullish sentiment, with MACD's signal line above the 0 line. However, the histogram is currently below the signal line, suggesting either a market break or retracement. If the histogram crosses above the signal line, it may signal bullish continuation. The RSI has not yet reached overbought levels, indicating potential for the next bull run.

Overall, EURJPY remains bullish, currently experiencing either a deep or shallow pullback. Once the pullback concludes, the market may target the next key resistance levels at 161.8% or 200% Fibonacci extensions.

In summary, EURJPY remains bullish despite flat market volatility following strong German economic data. Key technical indicators and oscillators support the bullish sentiment, with potential for a bullish continuation once the current pullback concludes. Traders should monitor key support and resistance levels, as well as upcoming economic releases, to navigate the current market conditions effectively.

Actual 3.6% vs Forecast 3.4% vs Previous 4.1%

Actual 1.0% vs Forecast 0.8% vs Previous 0.6%

Actual 89.9 vs Forecast 88.9 vs Previous 87.7

Actual 88.9 vs Forecast 88.7 vs Previous 88.1

Actual 89.4 vs Forecast 88.9 vs Previous 87.9

Forecast 2.5% vs Previous 1.3%

Forecast 1.600M vs Previous 2.735M

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.