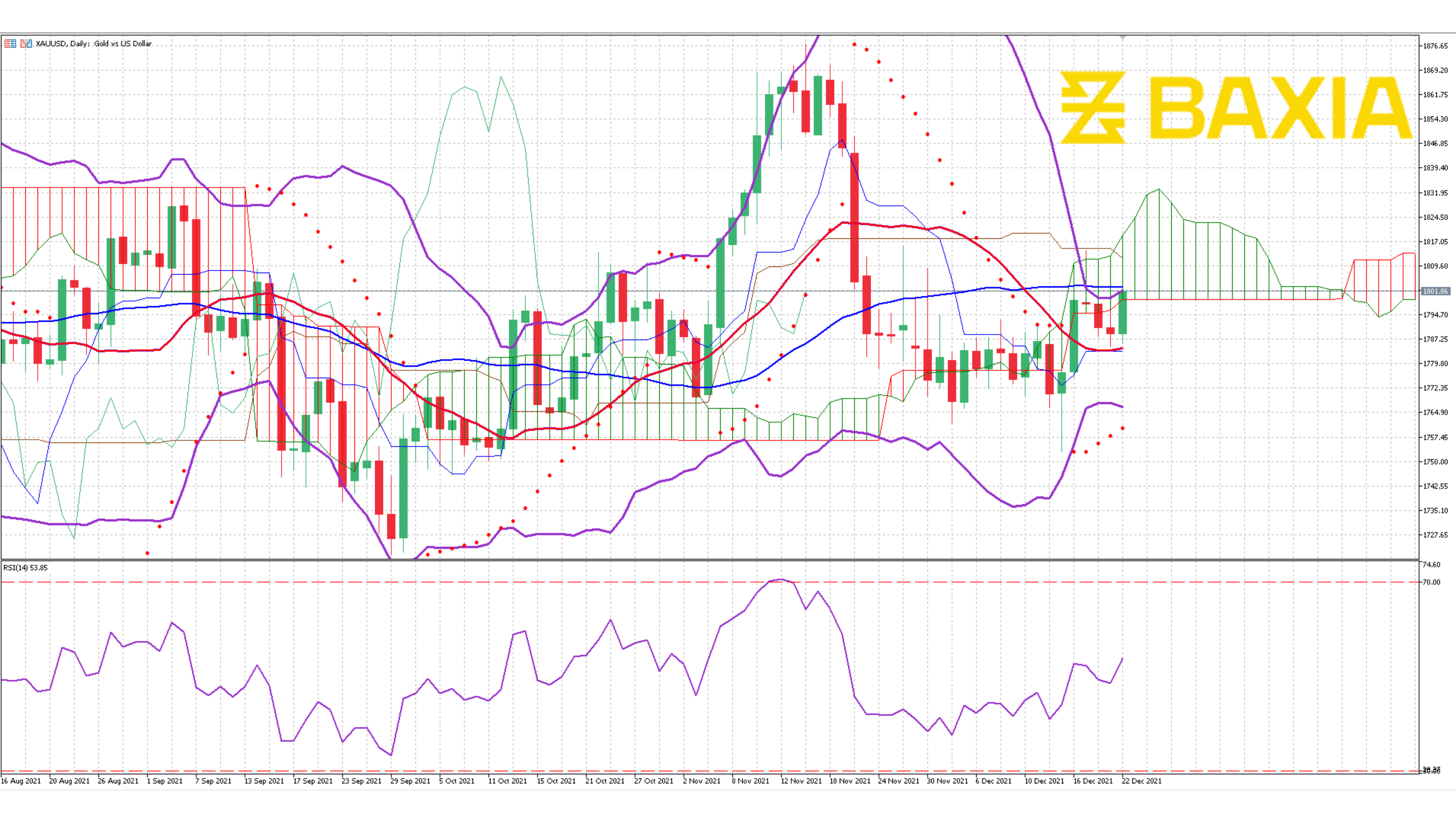

The precious metal broke the 50% Fibonacci retracement at the $1,796 level, ending a three-day losing streak, if the breakout is completed we could see the price continue climbing in the short term, it will enter the Ichimoku cloud and that will create market uncertainty.

The Bollinger bands are opening again after an aggressive close, the pair currently trades at the same level as the upper band, suggesting that the price is relatively high, however since the bands are so narrow, this might not have a big impact on the market behavior.

The relative strength index is at 54% which gives gold enough room to comfortably continue climbing if the market decides to move in that direction. Since the RSI is way below 70% the Bollinger bands are not likely to slow down the uptrend.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.