The midweek trading session witnessed a lack of significant movement in the gold market, reflecting a period of uncertainty as participants weighed the prospects of an upward trajectory. The previous day's trading had seen a distinct candlestick pattern emerge in reaction to the release of the JOLTS Jobs Openings report in the United States, which revealed figures markedly lower than initial projections. This unforeseen data spurred discussions about potential adjustments in the Federal Reserve's strategy. The prevailing sentiment was amplified by a conspicuous 10-point deviation in the Consumer Confidence numbers, further fueling speculation.

This confluence of events has spurred contemplation about the Federal Reserve's course of action, particularly the possibility of a moderation in its current tightening stance. However, as is often the case, market sentiments tend to swing to extremes. There have already been notions circulating that the Federal Reserve might not only halt its rate hikes but potentially even initiate a rate cut. Such notions, while lacking substantial basis, offer insight into the prevailing market psychology.

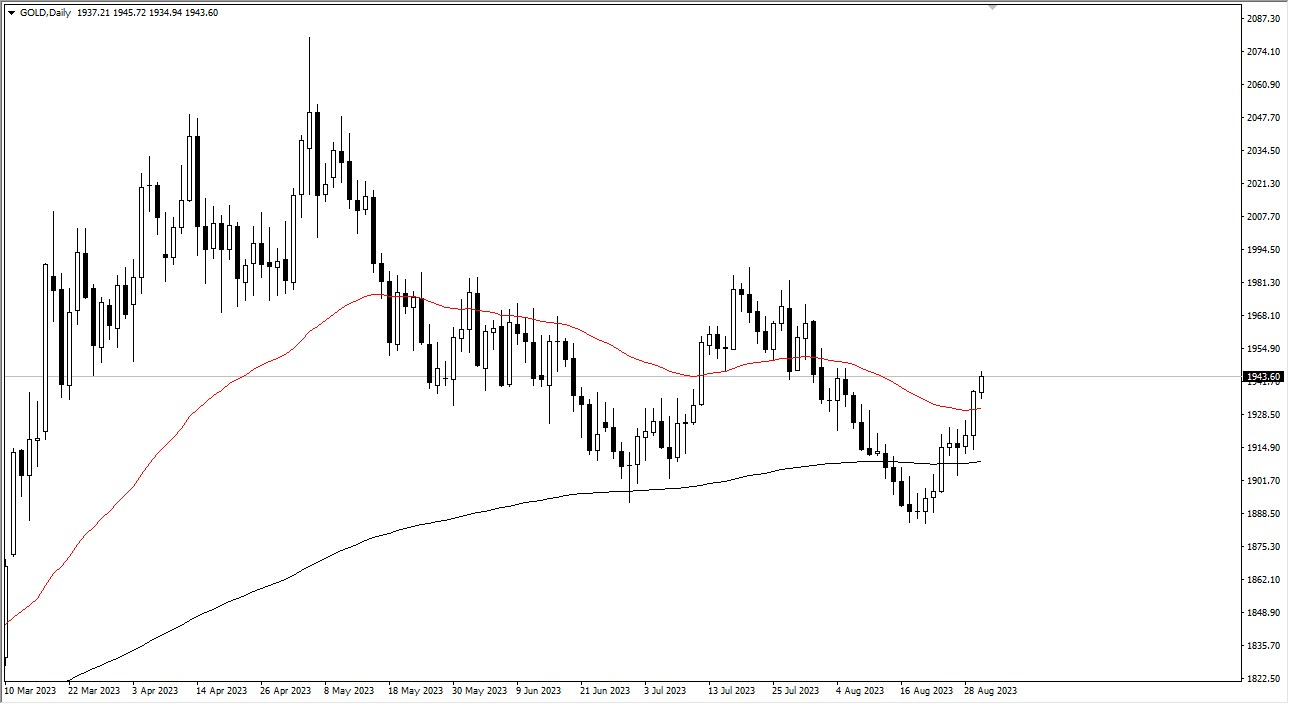

It's notable that the market had established a discernible double-bottom pattern around the 200-Day Exponential Moving Average (EMA), suggesting a level of support. This potentially indicates a high likelihood of the gold market venturing into the realm above the $2000 mark. This figure carries considerable psychological weight and represents a pivotal juncture for traders. Should this barrier be breached, it could set the stage for further upward movement, possibly reaching the $2100 level.

A prevailing trend has been observed where in gold exhibits an inverse relationship with bond yields, with lower yields generally resulting in higher gold prices. The ongoing decline in interest rates across the United States serves to reinforce this dynamic, potentially acting as a driving force for upward movement in gold prices. Additionally, the recent relative softness of the US dollar has lent further support to gold's ascent.

In a broader context, the market appears to be charting a pattern that resembles a distinct "W," reflecting a potential reversal in fortunes. A pivotal milestone in this journey was the breakthrough above the 50-Day EMA, signifying progress in this direction.

As the trading sessions unfold, market participants will be closely observing developments in economic indicators, Federal Reserve pronouncements, and shifts in sentiment. The intricate interplay of these factors will ultimately determine whether the current pattern evolves into a sustained upward trajectory for gold. In the ever-evolving landscape of financial markets, precision and patience are paramount, as traders navigate the complex web of data and emotions that shape market outcomes.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.