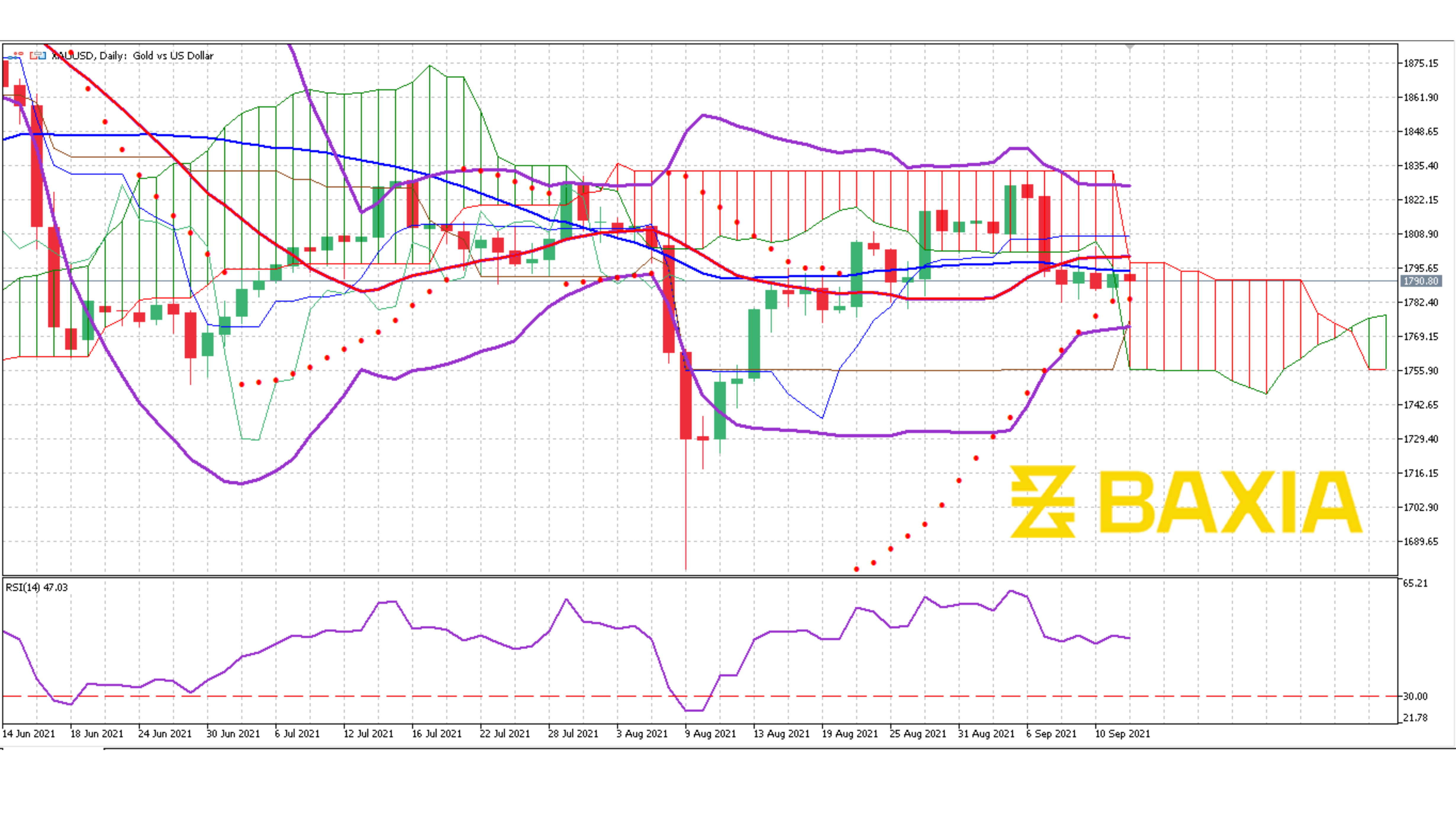

The precious metal tried to break the support level during the last five trading sessions with no success; although it managed to break the 50% Fibonacci retracement, the pair stays above the $1,788 price line.

The Bollinger bands are open and steady; we see that the price is consolidating around this level, which could mean that there could be an exciting movement in the short term. If the price manages to complete the breakdown on the support, we will likely see the price fall to the $1,770 price line; on the other hand, if the price breaks the resistance at the 50% retracement of $1,796, the price could take off and go back to the low $1,800’s.

The relative strength index is at a very vanilla level, 47%, which will allow the precious metals to move freely up or down depending on other factors. The short and long-term moving averages crossed recently, indicating a trend reversal; however, the asset trades below this line, which indicates a downtrend. We will have to wait for a few more sessions before making a trading decision but keep an eye on the commodity as there could be a good trading opportunity.

Our parabolic SAR indicator suggests that the price will continue to fall in the short term. The price trades inside the Ichimoku cloud indicating that the markets are uncertain; buyers and sellers are fighting to move the price in their favorable direction, which is not a good time to open a trade.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.