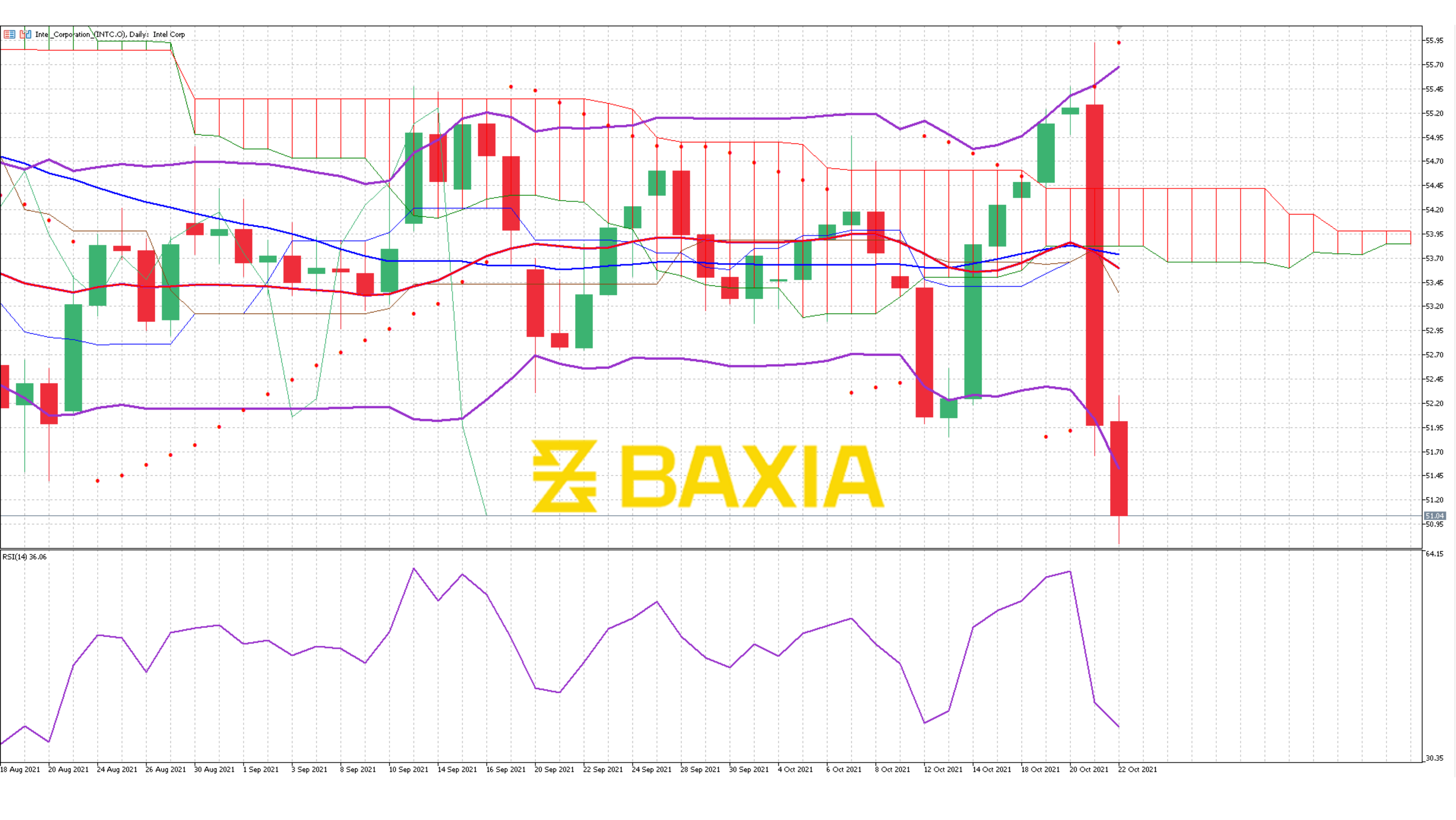

Shares of Intel Corp sank on Thursday as the company reported third-quarter sales that missed expectations, with Chief Executive Officer Pat Gelsinger saying that shortages of ancillary chips needed to make full computers are holding back sales of the company’s flagship processor chips.

The company’s leaders also said that margins will be lower for several years and that it will spend heavily to revamp its chip factories. Shares of Santa Clara, California-based Intel, the world’s biggest maker of central processors at the heart of PCs and data center servers, fell 9% in extended trading.

Gelsinger said Intel has resolved shortages facing its own internal manufacturing operations, but that shortages of other chips such as power management chips and WiFi chips were stopping its customers from shipping PCs and servers, reducing the need for Intel’s chips.

“That’s a direct result of the overall supply challenges of the semiconductor industry,” Gelsinger told Reuters in an interview.

Gelsinger’s plan to remake the company by fixing its internal manufacturing issues while opening its doors to outside customers has largely gone over well with investors, with shares rising about 11% this year before Thursday’s results.

Intel missed estimates for its data center segment, with sales of $6.5 billion compared with estimates of $6.6 billion, according to Refinitiv data. Gelsinger told Reuters some of the data center results were because of Chinese cloud computing vendors - major customers of Intel - adjusting to new rules from the Chinese government.

Intel reported adjusted sales for the third quarter ended Sept. 25 of $18.1 billion, missing estimates of $18.24 billion, according to IBES data from Refinitiv. Intel reported adjusted profits of $1.71 per share, compared with Wall Street estimates of $1.11 per share, according to Refinitiv data.

Intel Chief Financial Officer George Davis, who Intel said on Thursday will retire in May 2022, said about 14 cents of the outperformance came from demand for higher-margin products and operational gains, while the rest came from one-time items like tax restructuring.

Intel forecasted fourth-quarter revenue slightly above Wall Street expectations. The company expects fourth-quarter revenue of about $18.3 billion, compared with analysts' average estimate of $18.25 billion, according to IBES data from Refinitiv.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.