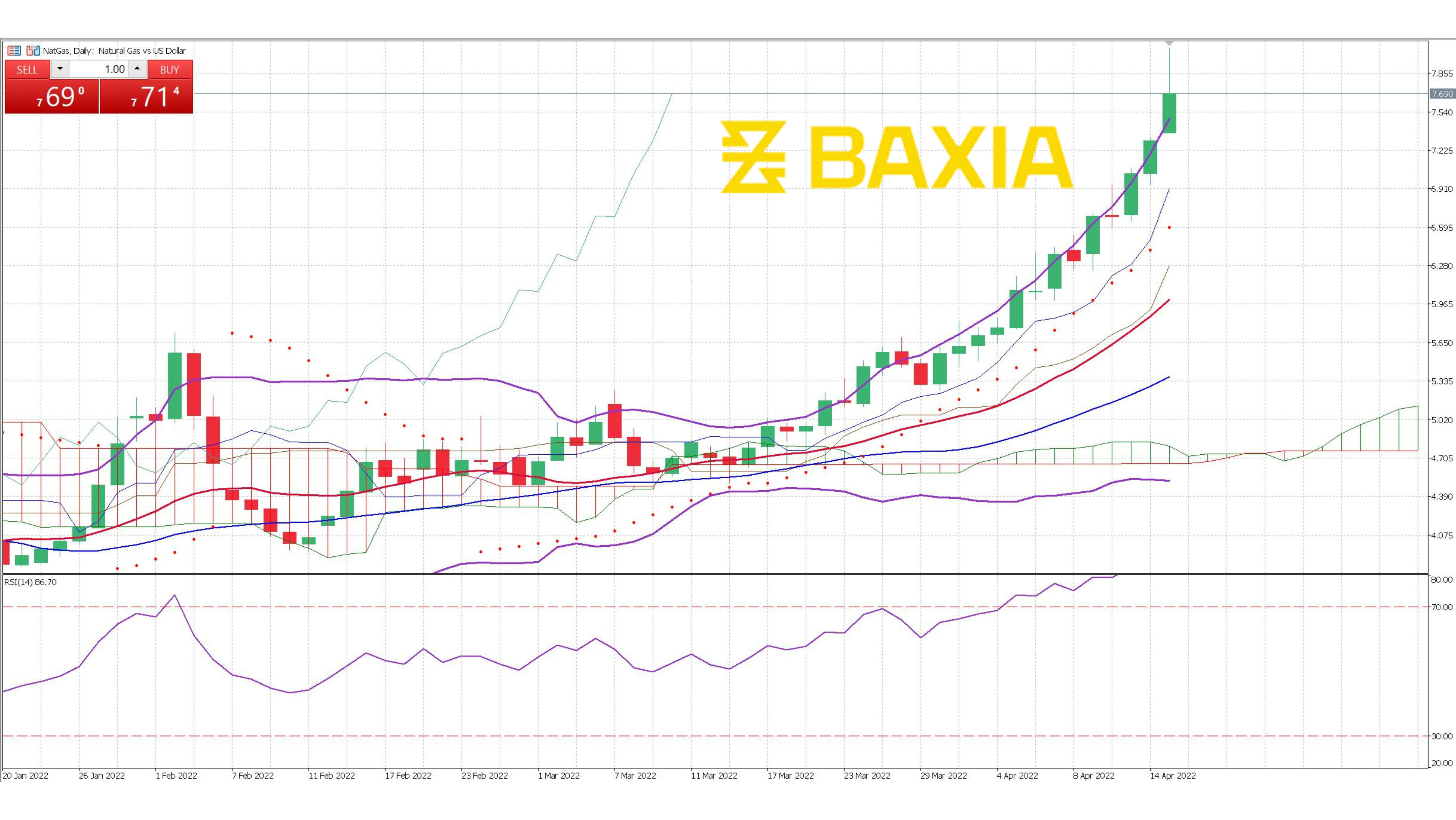

The energy commodity reached $8.179 in the previous sessions, a level we had not seen in almost 14 years. The price continues the uptrend that started in early February, high demand and limited supply settle the price above $8, and we could continue to see higher prices in the short term.

The Bollinger bands are very wide, the upper band expanded very aggressively as the price rallied for a 5th straight day, the pair could start finding a resistance close to the upper band, which from a technical analysis perspective, should start dropping very soon; however, the fundamental factors pushing the price up are stronger than the technical analysis.

The relative strength index is at 86% way above the overbought status, the pair has been over 70% for more than 10 trading sessions. Our parabolic SAR indicator suggests that the price will continue to rally in the upcoming sessions. At this point the only way the surge is gonna stop is if weather conditions change drastically over the next few days, reducing the demand for the energy commodity.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.