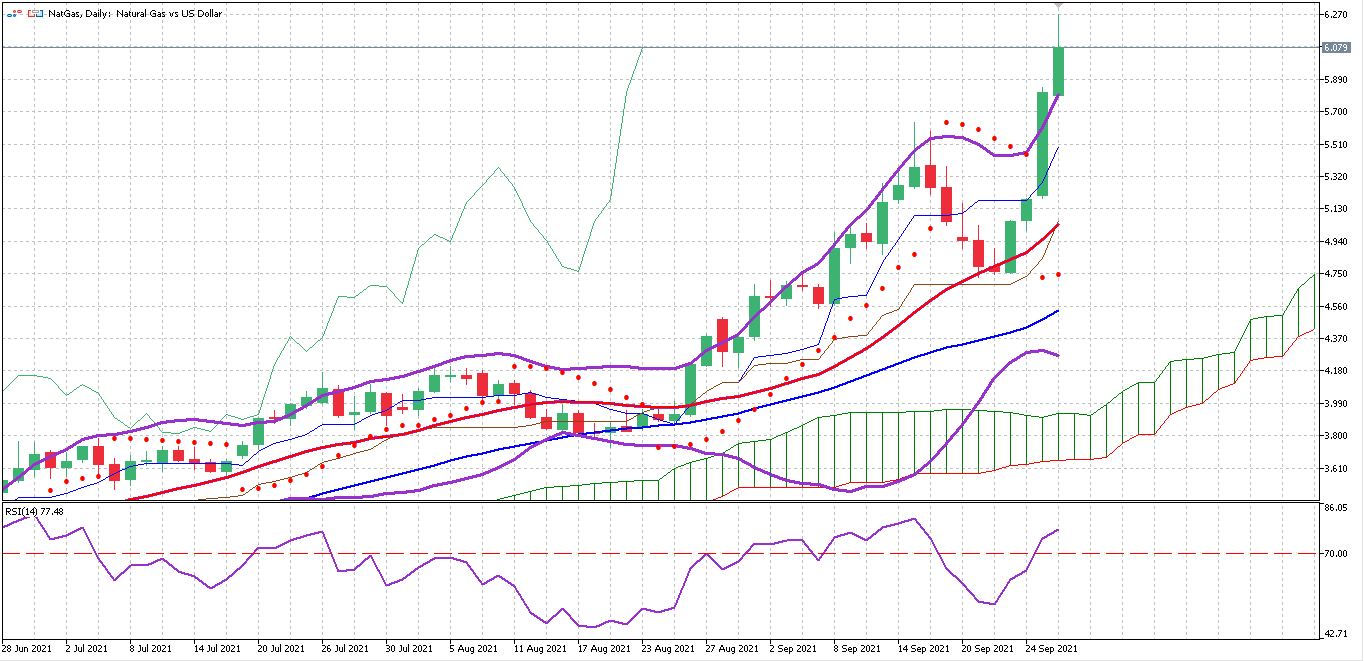

After finding a five-day pullback, the energy commodity price reached its highest level since March 2014, breaking the $6 resistance. In the last four trading sessions, the pair managed to gain more than 27%

We could see a price correction in the next few days as the price is currently overbought.

The Bollinger bands are opening up, but not enough to allow the price to continue climbing much. The price trades way above the upper band, suggesting that it is relatively high; this could scare investors with long positions, as they want to capitalize on their profits.

The relative strength index is currently at 78%; we have seen the RSI stay overbought for up to 15 sessions in recent weeks, indicating that buyers are not scared of maintaining their positions since the demand for the commodity is increasing.

We saw that a bull flag formed in mid-August, and since the breakout reached the size of the flagpole, we believe that the commodity is near reaching a limit on this uptrend; however, this is based only on a technical analysis point of view, fundamental factors continue pushing the price up.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.