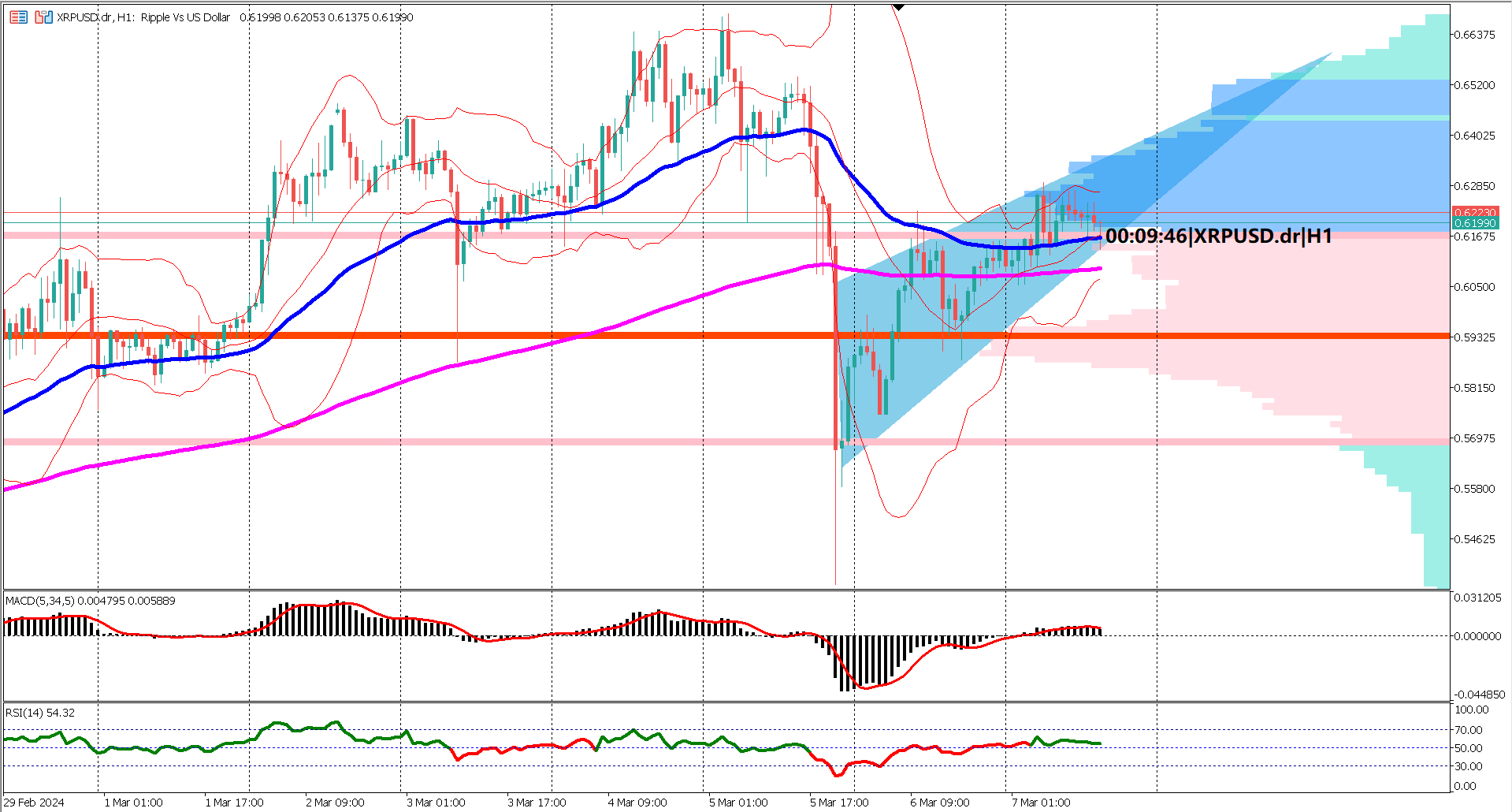

Amidst recent volatility, XRPUSD has witnessed significant price swings, with a flash drop of 20% followed by a remarkable 17% recovery. This recovery has formed a rising wedge chart pattern, indicating a potential trend continuation. However, if prices break below the wedge, further decline could be imminent.

Key indicators, such as the EMA 50 and 200, suggest a mixed sentiment. While the EMA 50 remains above the EMA 200, indicating bullish sentiment, the narrowing gap between them suggests waning momentum and growing bearish pressure.

The Bollinger Bands offer insights into XRP's recent price movements. Following the flash drop, prices breached above the upper band, signaling bullish control. However, shrinking bands indicate decreasing volatility and a temporary sideways trend. Breaks below the lower band could indicate bearish dominance.

Given the recent sideways trading, relying solely on oscillator indicators may not provide clear trend signals. Traders should monitor price action closely for potential breakout or reversal signals.

1. XRPUSD experienced a significant flash drop followed by a strong recovery, forming a rising wedge pattern.

2. EMA 50 remains above EMA 200, indicating bullish sentiment, but narrowing gap suggests weakening momentum.

3. Bollinger Bands show recent volatility, with prices breaching above the upper band post-flash drop, signaling bullish control.

4. Shrinking bands indicate decreasing volatility and a temporary sideways trend, with breaks below the lower band signaling potential bearish dominance.

5. Given recent sideways trading, relying solely on oscillator indicators may not provide clear trend signals; traders should closely monitor price action for breakout or reversal signs.

Forecast 4.0% vs Previous 4.0%

Forecast 4.50% vs Previous 4.50%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.