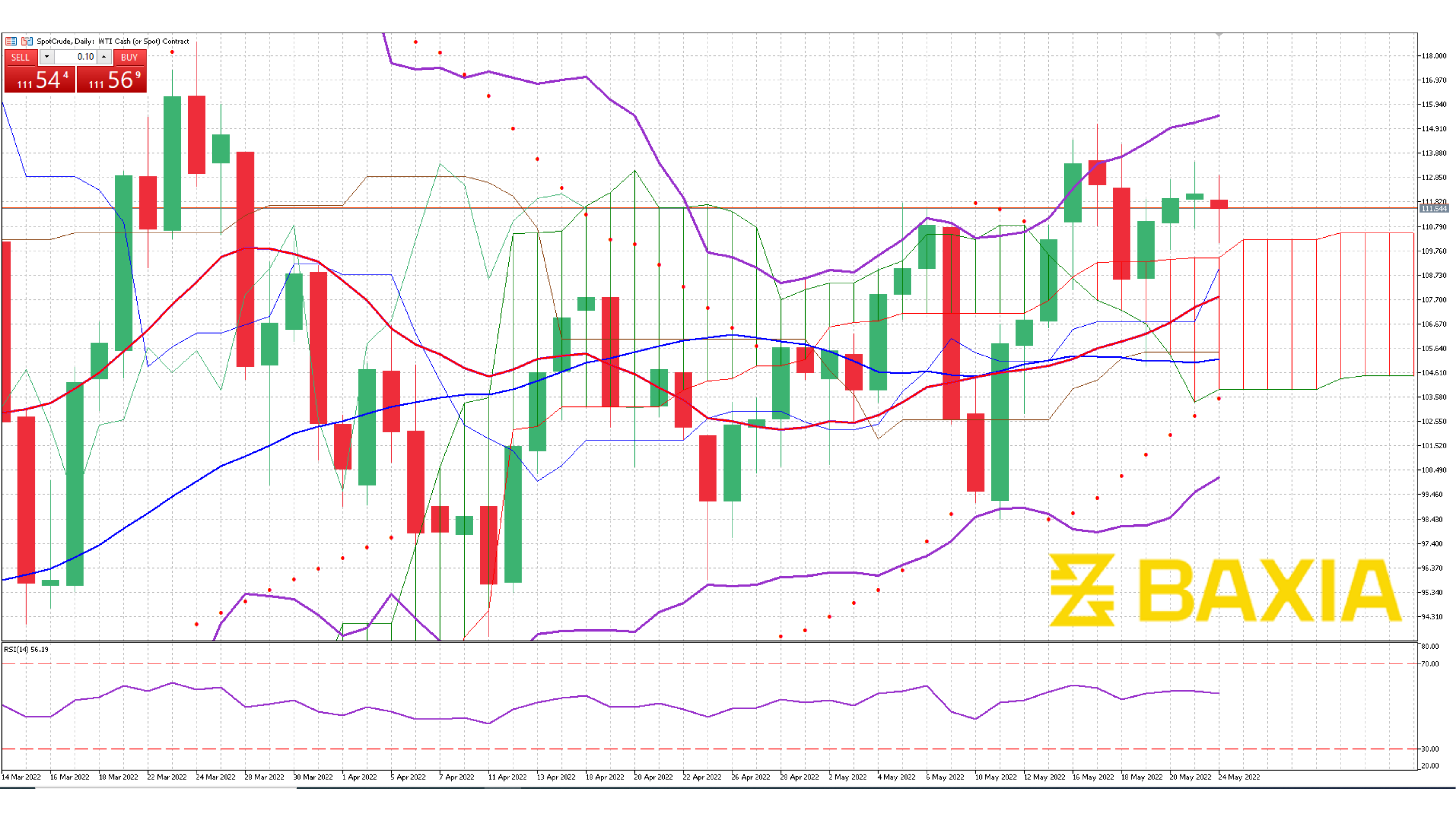

The energy commodity made two breakout attempts on the resistance at $115; the pair could make a third attempt with much more strength than in previous sessions as the price fell back to $111 earlier in the session.

The short and long-term moving averages continue below the price line, strengthening the Buy signals; they crossed eight sessions ago, and the price has responded since. The Bollinger bands are wide, they are not opening, but they are moving upwards almost symmetrically, which also strengthens the Buy signals. The pair trades closer to the upper band; we would need that band to continue moving upwards to prevent it from becoming a resistance in the event of an uptrend.

The relative strength index is at 56%, which is very neutral; this will allow the pair to move in either direction before entering an oversold or overbought status. Our parabolic SAR indicator suggests that the price is likely to continue moving upwards in the short term.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.