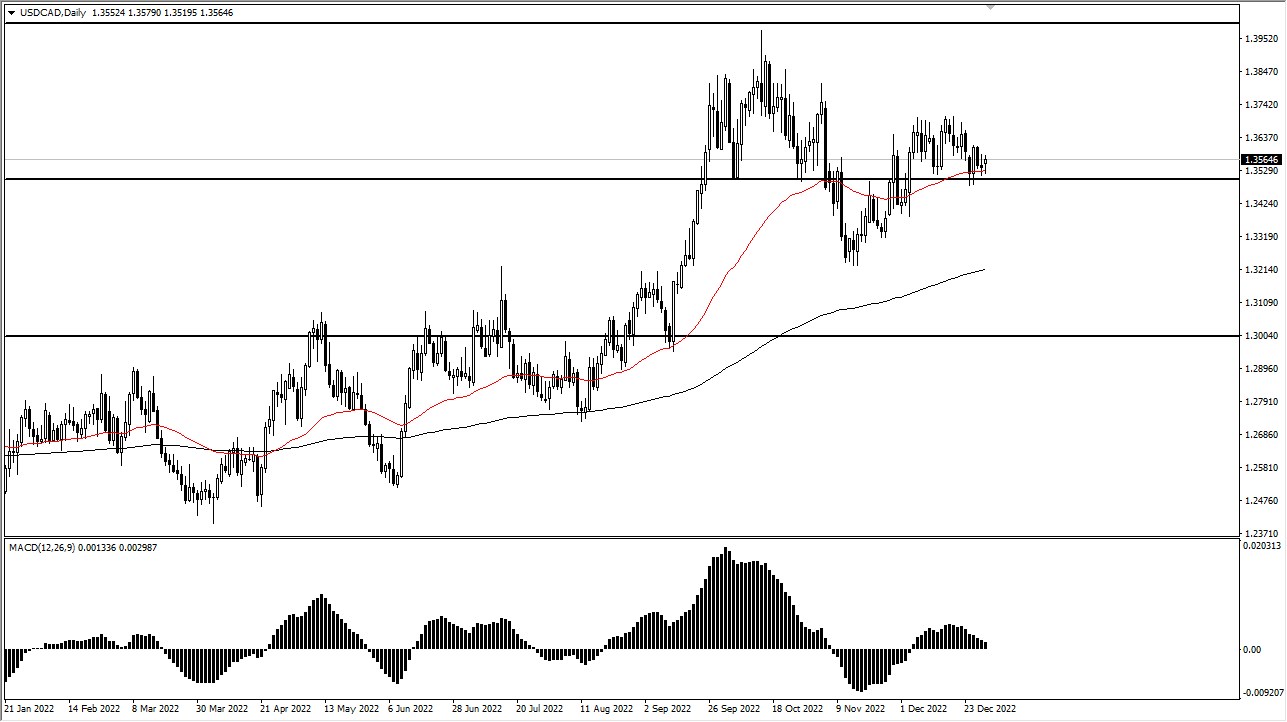

USD keeps building base against CAD with lately moves

USD keeps building base against CAD with lately moves The US dollar has pulled back just a bit during the trading session on Monday, and what would have been relatively thin trading. Keep in mind that a lot of banks around the world were still closed, so most of the action during the 24 hour period would have been probably more out of necessity and transactional value than anything else.

The 50-Day EMA sits just below, and of course, price has recently respected it. That being said, the 1.35 level underneath is an area where we could see a lot of support based upon psychology and previous action, so it’ll be interesting to see how this plays out for the rest of the week. Keep in mind that the next major trading session as far as fundamental news is concerned, as the Non-Farm Payroll announcement comes out. This is especially true in this currency pair because the Canadians also released jobs figures at the same time.

If we were to break down below the 1.35 level on a daily close, then I think it’s probably an attempt to get down to the 1.34 level. Keep in mind that the 200-Day EMA sits just above the 1.32 level and is rising. Somewhere between those 2 moving averages, the 50-Day EMA and the 200-Day EMA, I anticipate that there should be a significant amount of buying pressure. On the upside, if the market were to take out the 1.3750 level, then it’s possible that the market takes all to the 1.34 level after that.

The MACD currently hovers just above the zero line, showing just how much momentum has been taken out of the market. However, oscillators may not be reliable at this point due to the fact that the holiday trading season is extraordinarily thin. Keep in mind that crude oil markets will have to be watched, because there is such a strong correlation between the Canadian dollar and crude. Currently, most oil traders are concerned about global demand, so that could continue to put upward pressure on this market over the long term. At this point, it still looks like a “buy on the dip” type of market going forward, as we continue to see a lot of global concern about risk appetite in general.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.