In the dynamic landscape of forex trading, XAUUSD has undergone notable movements during the Asian trading range. A gap-up followed by a large body bullish candlestick set the tone, yet subsequent smaller candlesticks fueled uncertainty. This hesitation led to a significant price drop, marked by a bearish candlestick. As XAUUSD approaches the ascending trendline, a potential momentum loss is on the horizon. A break below this trendline could signal an early shift from a bullish to a bearish stance.

Against this backdrop, four key US economic news releases, two of which hold high impact across FX pairs, precious metals, and commodities, are set to shape the market.

Initial Jobless Claims: Analysts anticipate a rise to 210K from the previous 205K.

Pending Home Sales (MoM): A positive forecast of 1.0% improvement contrasts with the previous -1.5%.

A mixed outcome in these high-impact economic indicators may result in a more robust bullish move.

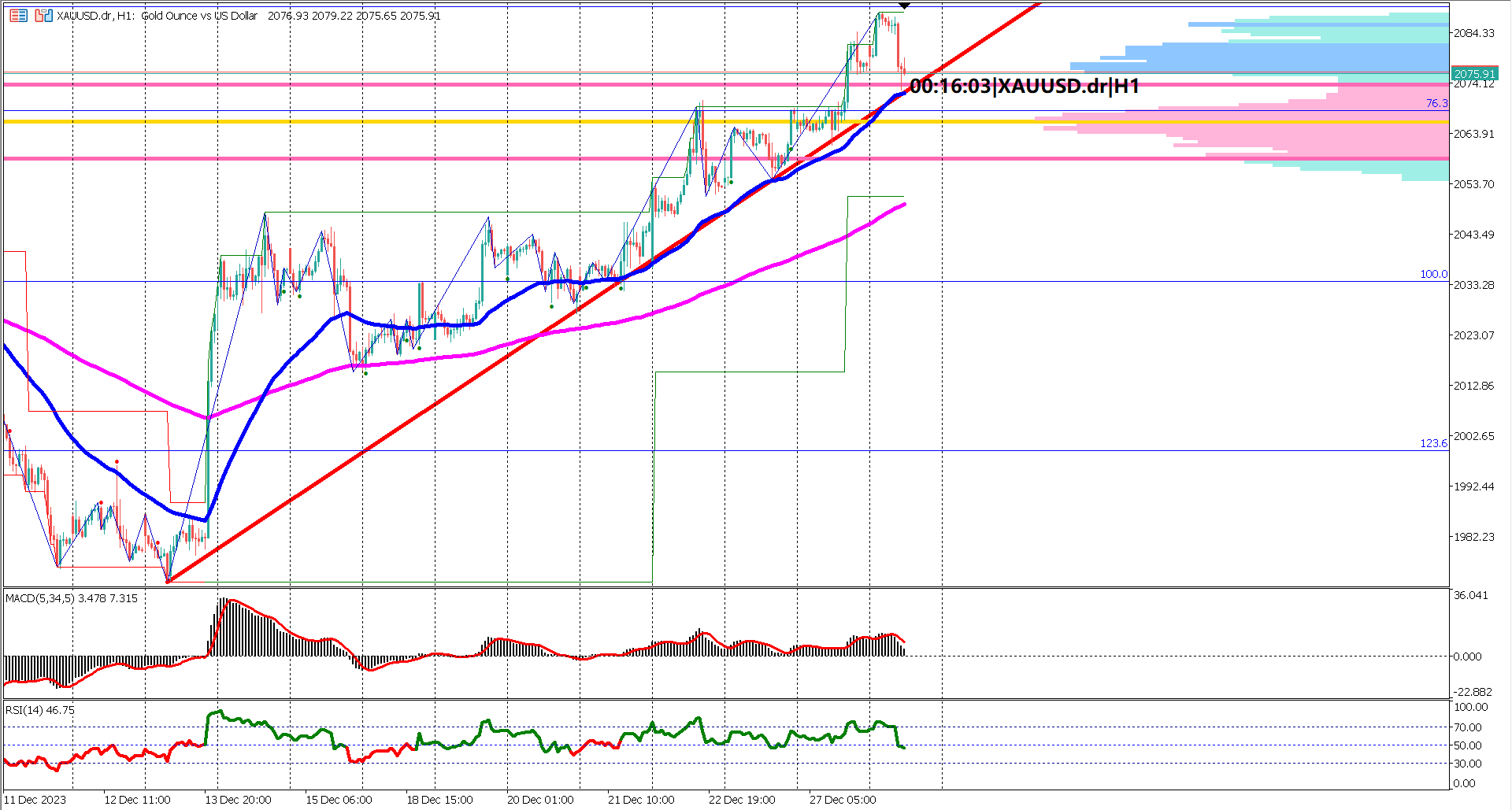

Zooming in on the 1-hour timeframe chart reveals EMA 50 and EMA 200 both pointing towards a bullish trend. EMA 50's divergence from EMA 200 signifies robust momentum. Buyers may find interest near or between these EMAs, acting as potential support zones.

Examining the volume profile indicator, a bullish trend is evident as prices broke above the value area. However, retracement during the early European trading session found support at the top of the value area. A break below the yellow horizontal line of the value area may signal a neutral or weakening bullish momentum.

Delving into oscillator indicators, RSI and MACD offer valuable insights. RSI, floating above 40%, is a positive sign, but a break below this threshold could trigger panic selling. Meanwhile, MACD's histogram decline and crossover below the signal line hint at potential weakness. If both MACD histogram and signal line cross under the 0 line, it may confirm a bearish trend.

In summary, XAUUSD's trend remains bullish, yet caution is warranted. Vigilance is crucial for signs of weakening bullish momentum, particularly monitoring the RSI's interaction with the 40% line and observing if MACD lines defend or breach the 0 line. Navigating these nuanced market dynamics empowers traders to make informed decisions amidst evolving economic landscapes.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.