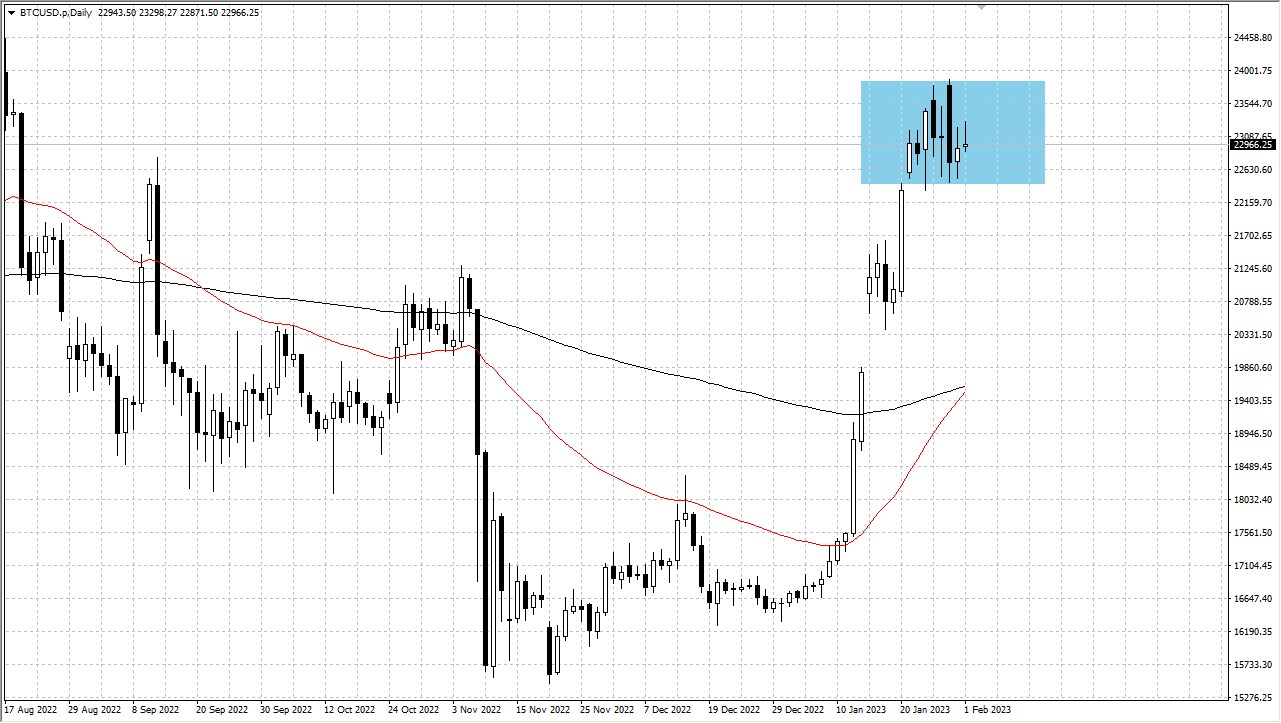

Bitcoin has initially tried to rally during this session on Wednesday, but then turned around to show signs of hesitation. Alternatively, this is a situation that looks as if it is a little overstretched, so it’s very possible that Bitcoin will be facing a bit of a reckoning.

At the end of the Wednesday session, we will see the Federal Reserve statement and of course the press conference. Ultimately, Bitcoin tends to move on monetary policy more than anything else. The idea is that it steps away from the central bank printing that has been such a major feature of monetary policy around the world for the last 15 years. Now that the Federal Reserve is starting to tighten monetary policy, it has worked against the value of Bitcoin quite drastically. Now the question will be what it does going forward?

While BTC certainly has a place in the future, the question comes down to whether or not it will be as speculation, or if it will be something that’s actually used. There are a lot of developers out there, so obviously it makes a certain amount of sense that eventually there will be a real use case scenario. As things stand right now, it has been used as a hedge against central banks, so the fact that we have a major press conference and interest-rate decision on Wednesday will greatly influence where this market goes going forward.

If the market were to break down below the 22,000 level, it’s very likely that will go looking to the 200-Day EMA, which sits just below the $20,000 level. On the other hand, the market can break above the $24,000 level, then it’s possible that we could see BTC raced toward the crucial $25,000 level, an area that has had importance more than once and of course has a certain amount of psychology attached to it. As you can see on the chart, there is a clear rectangle of support and resistance that we are trading at, and breaking out of there on a daily close could give us a bit of a “heads up” as to where we can go next.

rading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.