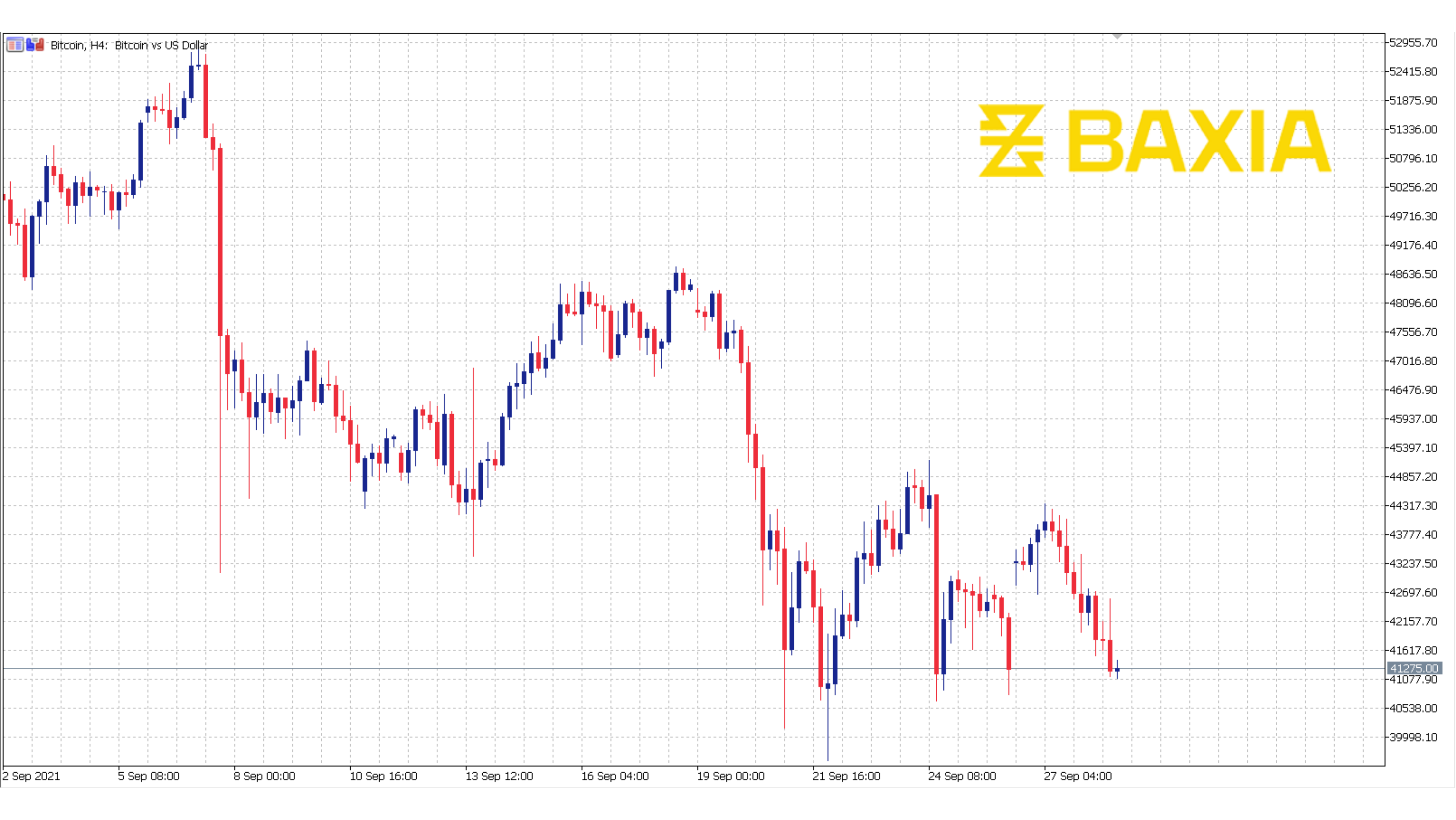

After bouncing from $41,000 to $44,000 over the weekend, the crypto market leader is trading near $41,800 at press time, down 2% for the week. The dollar index, which measures the value of the greenback against other major fiat currencies, has surged to a month-and-a-half high above 93.00, while gold is down 0.5 percent at $1,740 per ounce. According to TradingView data, the 10-year Treasury yield is at three-month highs above 1.5 percent, and the two-year yield is hovering at an 18-month high of 0.28 percent.

The 10-year real yield in the United States has risen 20 basis points this month, although it is still in negative territory at -0.87%, according to Treasury statistics. A rise in real yields might harm gold and put moderate selling pressure on bitcoin among those who use it as an inflation hedge. Furthermore, real yields are likely to remain low, as the rise may result in higher inflation, increasing demand for inflation-hedging instruments.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.