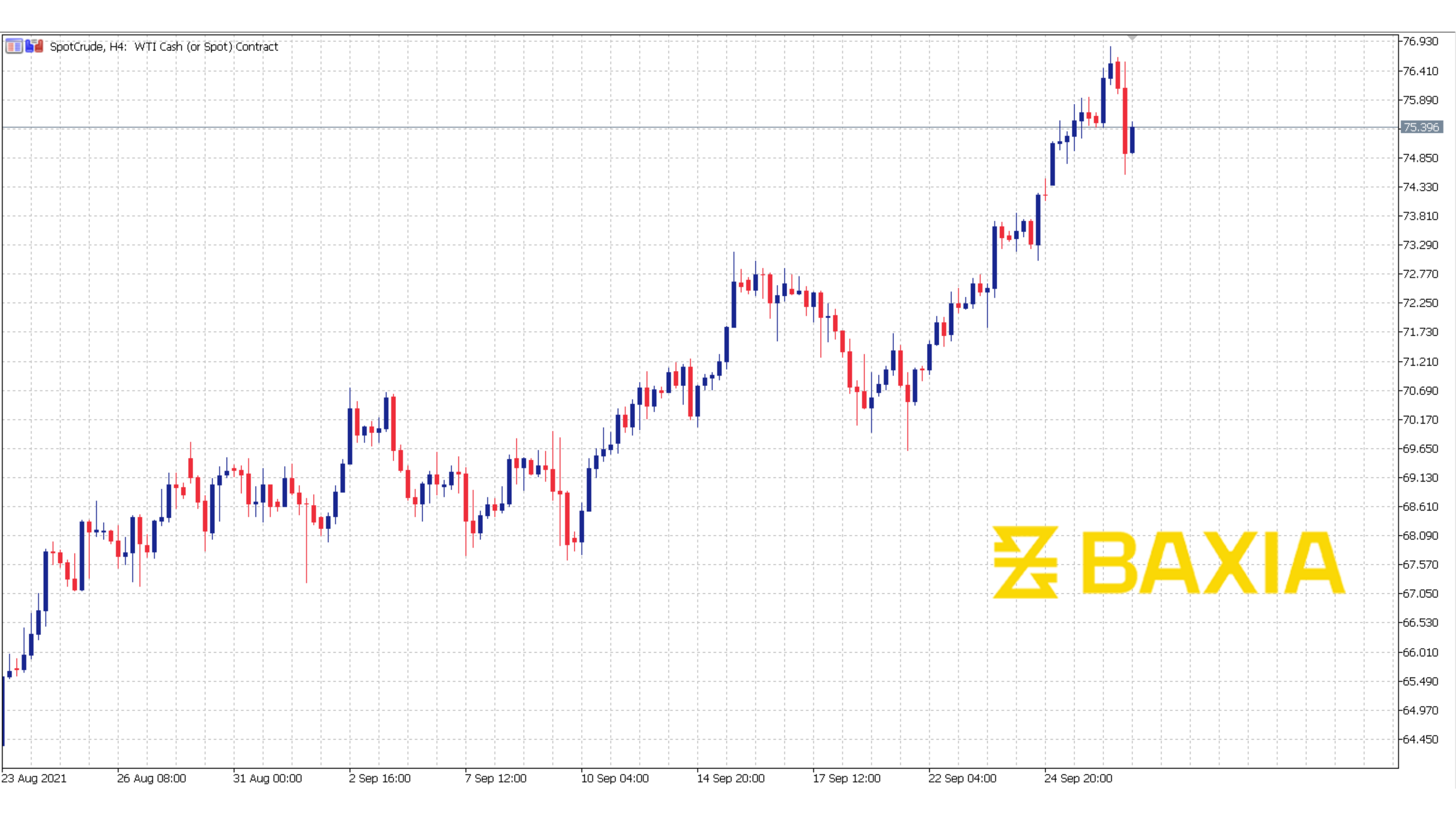

Brent crude oil, the global benchmark, flirted with the $80-per-barrel mark in early trade, and was last up 1% at $79.54 per barrel, on track for its best close since October 2018. Crude oil futures in the United States were up 1.2 percent at $76.36 a barrel, on track to close at their highest level in three years. As part of a broader rally in energy markets, both important benchmarks have risen approximately 11% in the last month.

The Organization of Petroleum Exporting Countries' producer states are a wild card in the oil-price mix. They're still holding barrels back from the market in order to keep prices high enough to profit. However, they have a history of letting more supply into the market to prevent suffocating demand with high pricing. The Organization of Petroleum Exporting Countries (OPEC) is already easing the production limits that supported oil prices throughout the pandemic. It will meet again next week to consider potential output increases.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.