U.S. oil majors Exxon Mobil Corp and Chevron Corp were among the top buyers at a federal auction of oil leases in the U.S. Gulf of Mexico on Wednesday that generated more than $190 million - the highest since 2019.

The auction was a boon for federal coffers, but a potential setback for the climate policies of U.S. President Joe Biden, whose administration tried to suspend federal lease sales to fight global warming before a court forced them to proceed.

The United States was also among nearly 200 nations that adopted the Glasgow Climate Pact this month in a deal that for the first time asked governments to accelerate cuts in planet-warming emissions by limiting support for fossil fuels.

In the sale, the Bureau of Ocean Energy Management, an arm of Biden's Department of Interior, offered 80 million acres accounting for almost all available unleased Gulf of Mexico blocks. About 1.7 million acres were sold.

Chevron was the auction's biggest spender with $47.1 million, followed by Anadarko, owned by Occidental Petroleum Corp., BP and Royal Dutch Shell.

A Gulf of Mexico auction conducted by the administration of former President Donald Trump last year brought in $121 million.

The average price per acre sold in Wednesday's auction was around $112 compared with last year's $233.

Separately, Biden on Wednesday criticized U.S. oil majors for elevated retail fuel prices.

In a letter to the Federal Trade Commission, Biden noted that the nation's two largest oil and gas companies -- Chevron and Exxon -- were on track to double their profits while American families are paying more at the pump.

The drilling auction was the first Interior has held under Biden, whose administration paused oil and gas lease sales earlier this year after campaigning on a promise to end fossil fuel development on federal properties.

But Biden lost a court fight to oil-producing states that sued to reinstate the sales. An appeal is pending. read more

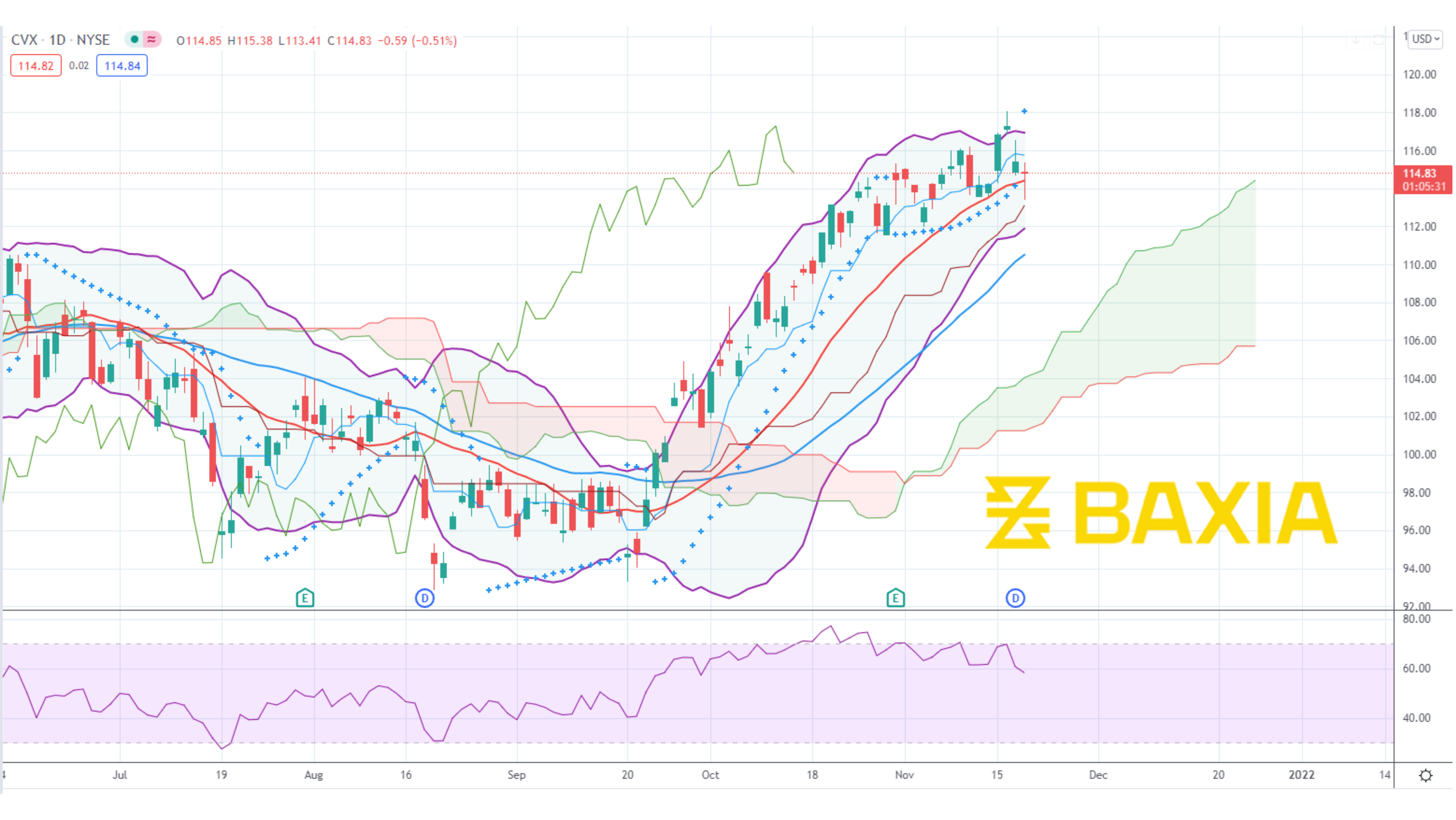

The sale was the first opportunity to test the oil and gas industry's demand for Gulf acreage with energy prices at multi-year highs. U.S. crude futures are up 95% in the last 12 months.

Following the sale, an oil and gas industry trade group, the National Ocean Industries Association, said the government leasing program was "critical to our energy future" because it supports economic growth and jobs and is a "lower carbon energy alternative to oil produced by foreign, higher emitting producers, like Russia and China."

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.