USOIL experienced a minor dip on Wednesday, halting its five-day winning streak, while the US Dollar Index surged ahead of the Federal Reserve's rate decision. Traders observed earlier bullish bets materializing amidst ongoing supply concerns, with attention turning to the Fed's monetary policy announcement.

Crude Oil prices retreated marginally but remained above the $80 mark, bolstered by a recent 5% gain over five trading days. Supply disruptions in Russia and efforts to replenish US crude inventories have buoyed demand, contributing to the recent uptick. However, a strengthening US Dollar exerted downward pressure on prices.

The US Dollar registered a similar five-day winning streak, gaining momentum following the Bank of Japan's rate decision during Asian trading hours. With the focus now on the Federal Reserve, traders are awaiting the monetary policy decision and eagerly anticipating insights from Fed Chairman Jerome Powell's speech, particularly the release of economic projections, including the dot plot.

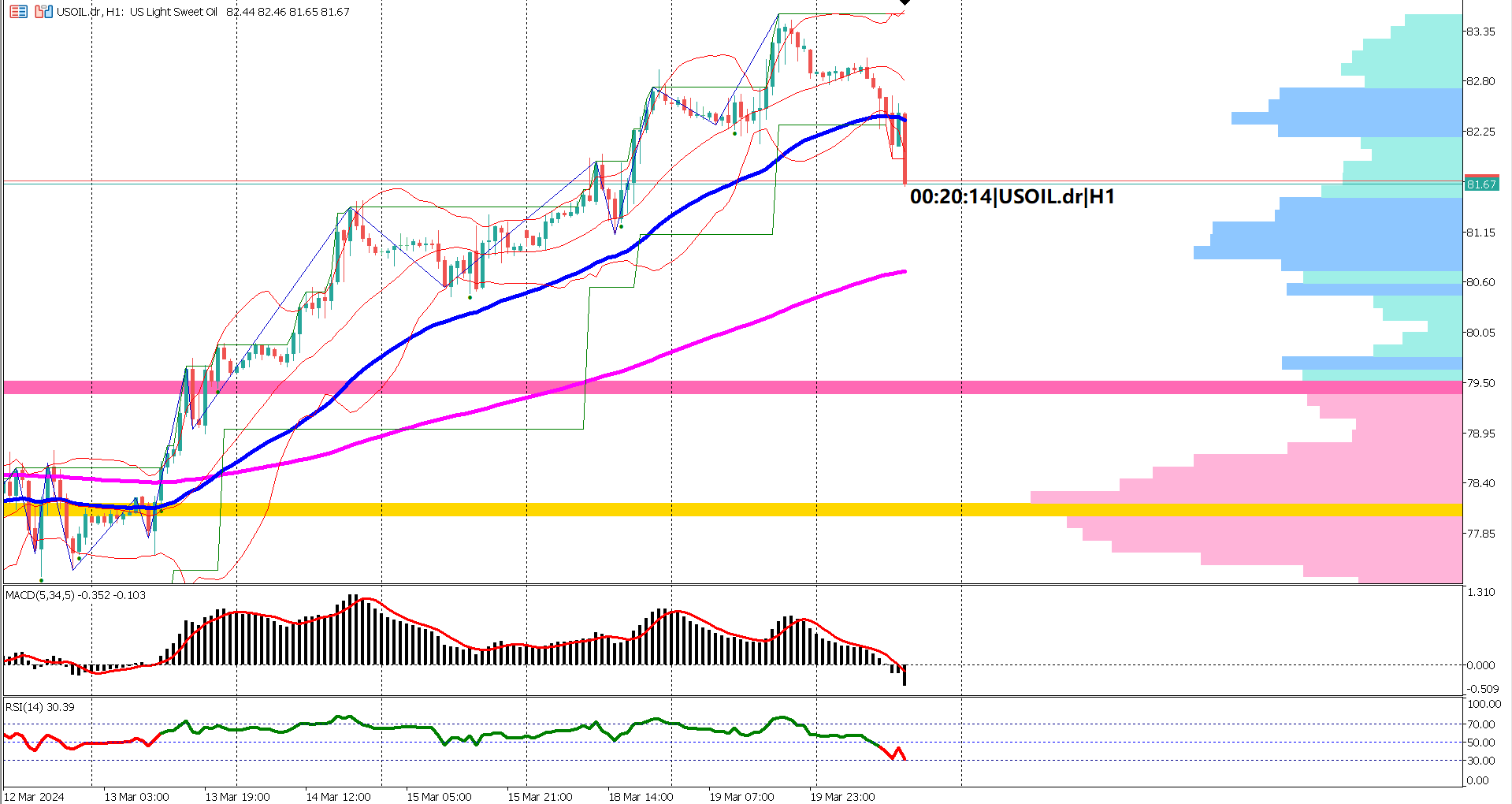

Technical indicators for USOIL suggest a potential weakening in bullish sentiment. The Exponential Moving Average (EMA) 50 has begun to bend, pointing towards the EMA 200, while the market breached the lower band of the Bollinger band. Additionally, the Moving Average Convergence Divergence (MACD) signal line plummeted to the 0 level, accompanied by the Relative Strength Index (RSI) dipping below 40%. Analysts highlight the key support level at the EMA 200, suggesting potential market stabilization at this point.

As traders await further guidance from the Federal Reserve, all eyes remain on USOIL's price action and the Dollar's performance, with market participants poised to react to any shifts in monetary policy and economic outlook.

USOIL Dips: After a five-day winning streak, USOIL experienced a minor decline on Wednesday amidst ongoing supply concerns.

Bullish Bets Materialize: Earlier bullish bets among USOIL traders began to play out, supported by supply disruptions in Russia and efforts to replenish US crude inventories.

Dollar Strengthens: The US Dollar Index surged ahead of the Federal Reserve's rate decision, exerting downward pressure on crude oil prices.

Fed Rate Decision Awaited: Traders eagerly anticipate insights from the Federal Reserve's monetary policy announcement, particularly focusing on economic projections and Chairman Jerome Powell's speech.

Technical Indicators Signal Weakness: Technical indicators for USOIL suggest a potential weakening in bullish sentiment, with the EMA 50 bending towards the EMA 200 and other indicators such as the MACD and RSI pointing towards bearish momentum.

Forecast 0.0% vs Previous -0.1%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.