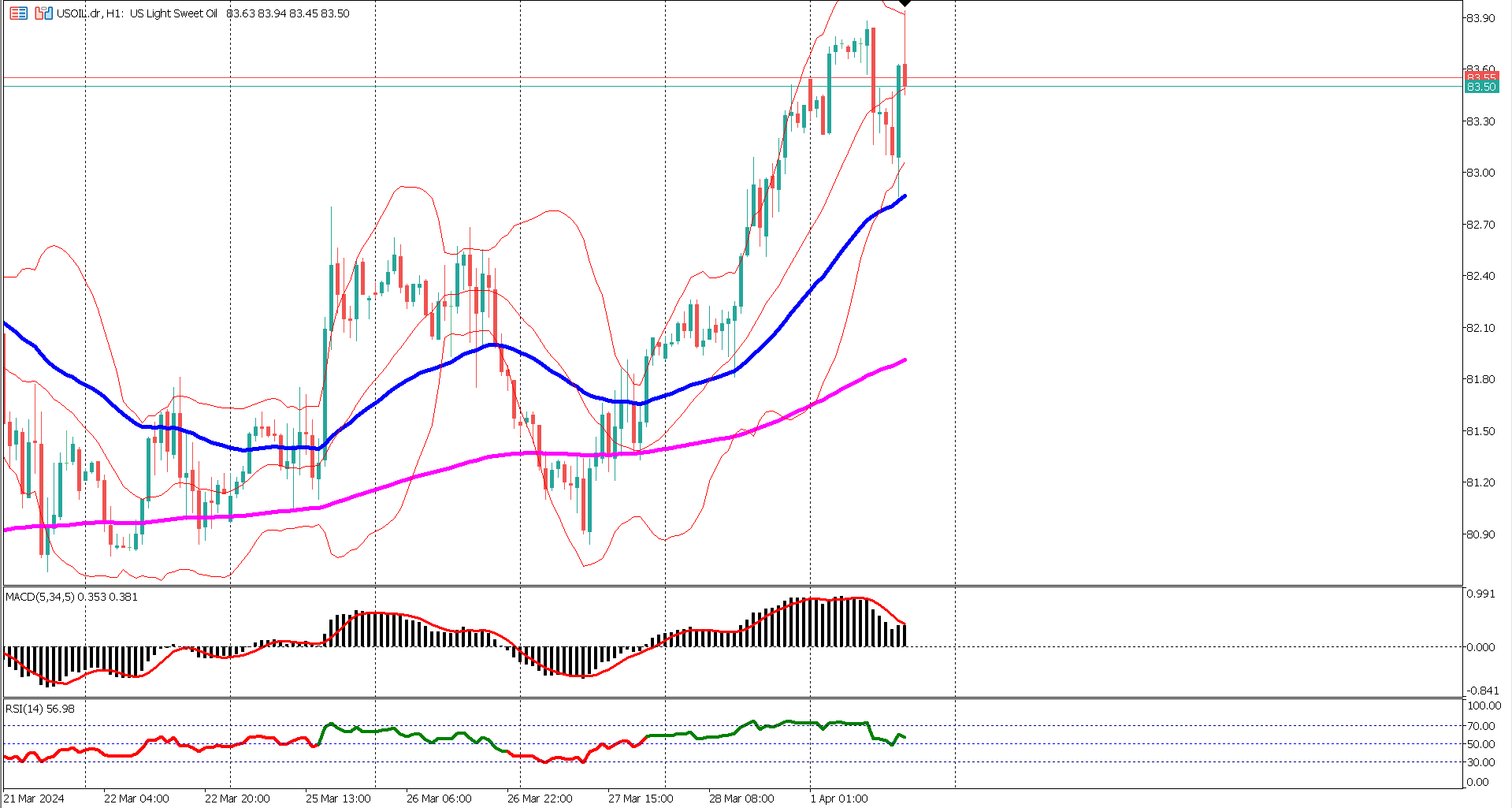

US Oil prices have embarked on a robust bullish streak over the past three days, showcasing resilience in the face of market dynamics. This bullish momentum has enabled prices to maintain a strong position above both the Exponential Moving Average (EMA) 50 and 200. However, today's market saw a brief retracement, finding support at the EMA 50 level. Analysts warn that a break below this key level, coupled with breaching the lower Bollinger band, could signal the onset of a bearish reversal, especially if accompanied by a death cross formation on the EMA 50 and 200.

In terms of technical indicators, both the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) reflect prevailing bullish sentiment. The RSI has repeatedly touched overbought levels in the past 24 trading hours, underscoring the strength of the bullish trend. However, traders are advised to exercise caution as prices approach the resistance level near $84, coinciding with overbought conditions. Meanwhile, the MACD, while still above the baseline, is showing signs of losing momentum, with its signal line pointing towards the zero line. A potential bearish reversal could be signaled if the MACD signal line crosses below zero and the RSI dips below the 40% level.

Overall, the outlook for US Oil remains bullish, with the potential for further highs as long as key technical indicators continue to support the upward trajectory. Traders are advised to closely monitor these indicators for any shifts in market sentiment that could signal a reversal in the prevailing trend.

Forecast 52.5 vs Previous 52.5

Forecast 48.5 vs Previous 47.8

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.