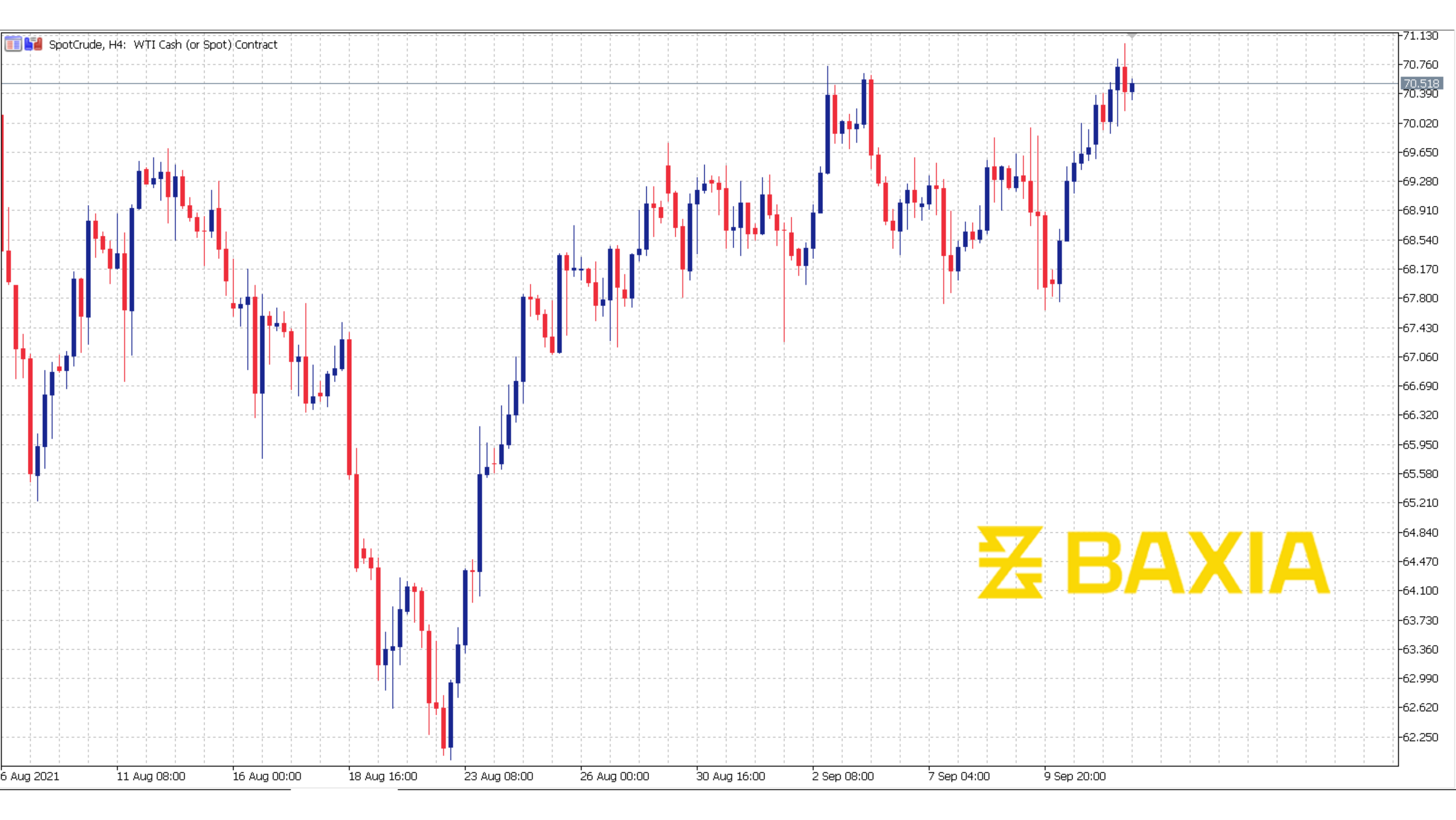

Energy companies were mainly positive as crude oil extended its surge to a six-week high, while U.S. stocks bounced between gains and losses. Bond yields fell, and the dollar's value against its major counterparts remained unchanged. After ending last week in the red, the S&P 500 fluctuated, while the Nasdaq 100 remained in negative territory. On a combination of increased global gasoline use and output issues elsewhere, OPEC expected stronger demand for its crude. Due to supply interruptions, industrial metals increased, with aluminum surpassing $3,000 per ton in London for the first time in 13 years.

Concerns about closed output in the United States due to damage from Hurricane Ida fueled a 1% increase in oil prices on Monday, with Brent crude around $74 a barrel. Analysts also foresee a stable market in the coming months. The bank kept its Brent price projection for the second half of 2021 at $70 per barrel, forecasting range-bound prices, but warned Brent may reach $75 per barrel by year's end due to "increasing upside risks."

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.