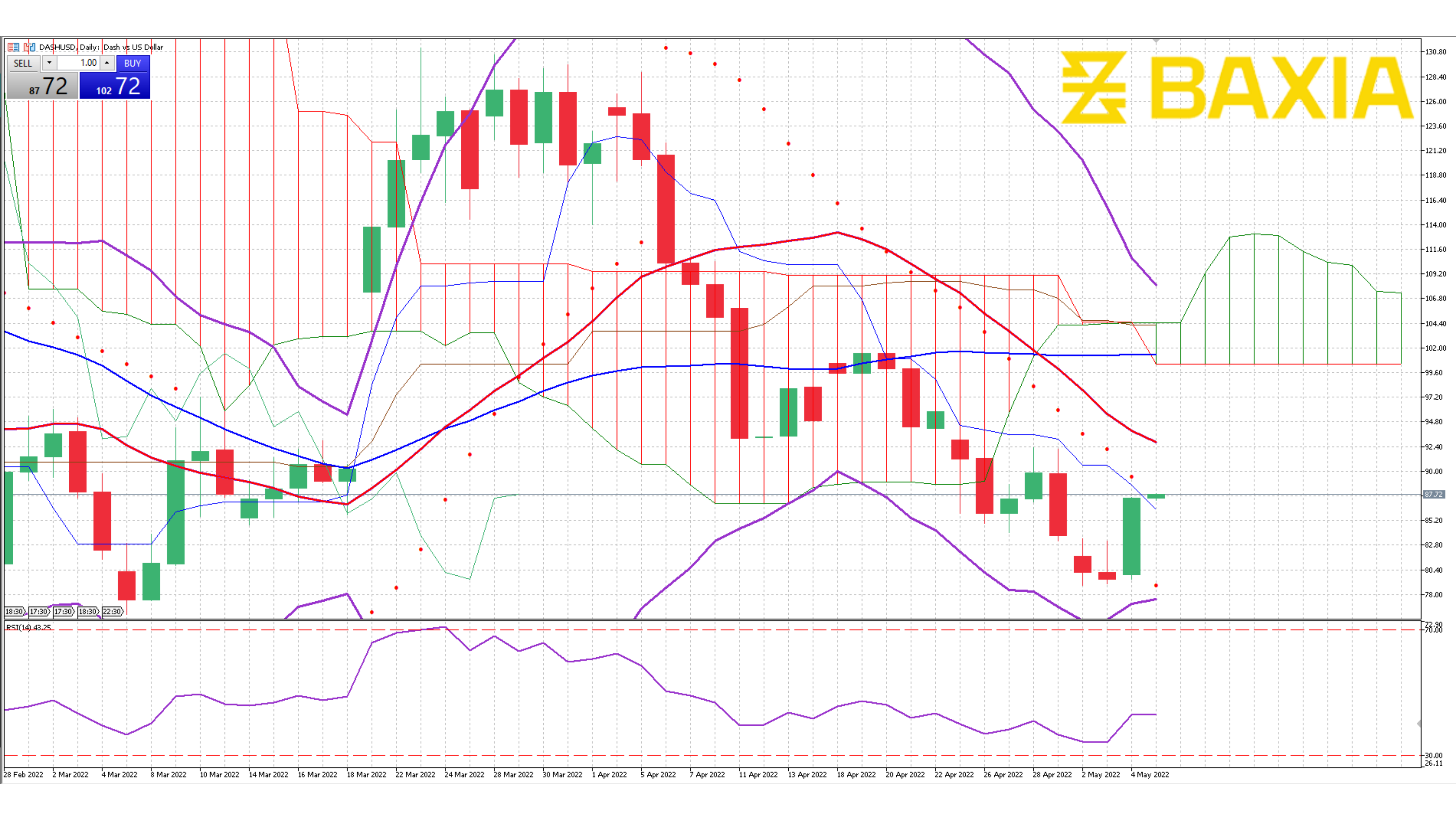

The cryptocurrency is showing some signs of recovery after reaching its lowest level since late February. Dash is 8.43% up in the trading sessions and managed to break the resistance level at $94.45. The short and long-term moving averages crossed in mid-April and the pair has lost more than 12% including today's gains.

The price still trades below the moving averages, indicating that the trend is still downwards; however, if the recent breakout is completed, we could see a trend reversal in the medium term.

The Bollinger bands are wide enough to expect high volatility in the short term, the pair traded below the lower band, suggesting that the price was relatively low, incentivizing traders to open long positions. The lower band expands more than the upper band, which indicates that the price could still move downwards if the breakout is not completed.

The relative strength index is at 43% which will allow the pair to move in either direction before entering an oversold or overbought status. Our parabolic SAR indicator suggests that the price will start to move upwards in the short term.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.