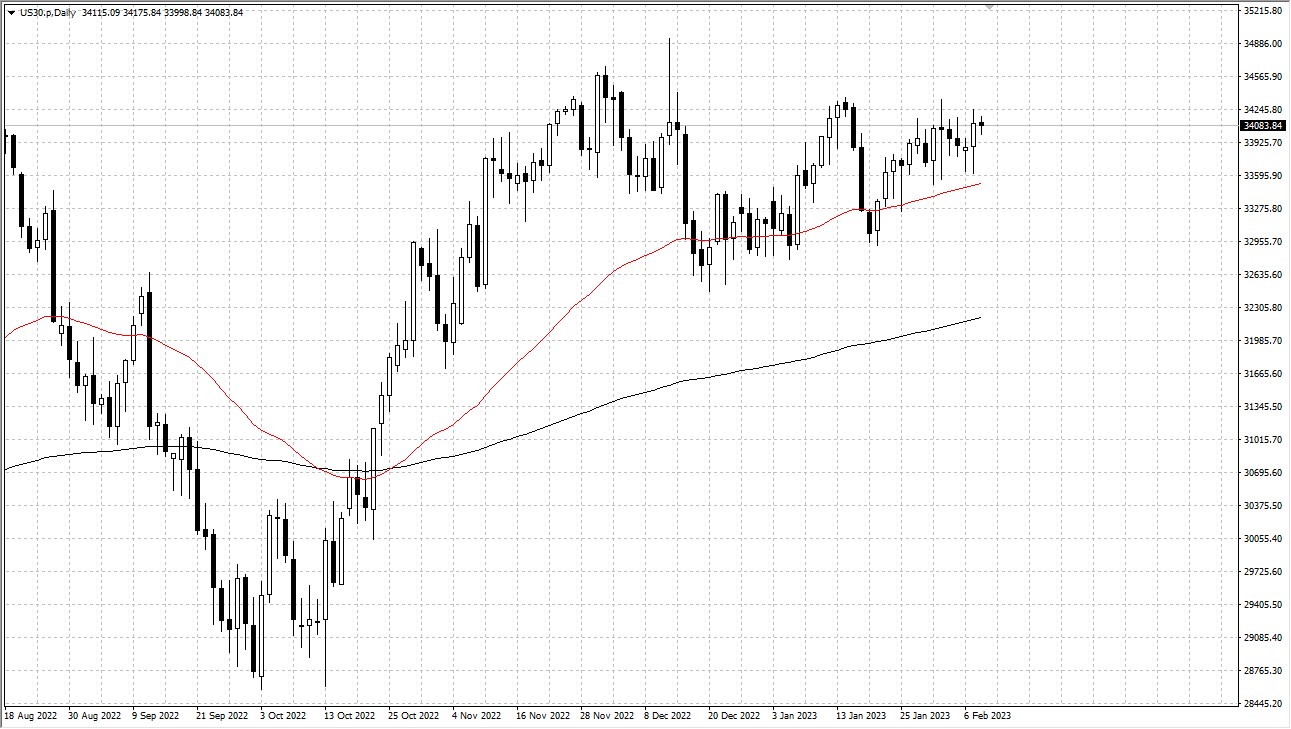

The Dow Jones Industrial Average, the US 30, has been relatively quiet during the Wednesday session, but it’s worth noting that there has been a steady grind to the upside for a couple of weeks. When you look at the longer-term daily chart, you can see clearly that there is an interest in trying to go higher. The recent pullbacks have been rather strong, but the buyers come back and continue to pressure regardless.

Underneath, the market sees a lot of interest near the 33,500 level, which also features the 50-Day EMA. This is your short-term support, while the short-term resistance is somewhere near the 34,500 level but is probably more or less focused on the psychologically significant 35,000 level, where we formed a massive shooting star on December 13. A break above that would obviously open up the door to much higher pricing, but right now it looks as if the market is content to trade in somewhat of a channel.

The United States is in the midst of her earnings season, but it is probably worth noting that this market has remained rather stable throughout that process. The Federal Reserve monetary policy will obviously have a huge effect on how traders play the market, but as things stand right now, it appears that Wall Street believes that the Federal Reserve is going to loosen monetary policy sooner rather than later. There are a lot of conflicting signals out there from an economic standpoint, so volatility could pick up.

Speaking of volatility, this market has done exceptionally well in this very volatile time. A quick comparison between the US 30 and the NASDAQ 100 (NAS100), or the S&P 500 (SPX500) shows just how stable this market has been. For those who are bullish on the US stock market, it may make more sense to be involved in this index as it has been gently grinding higher. In fact, one could almost make an argument for an ascending triangle which of course is a bullish sign as well. Buyers continue to come back on every dip recently, as money flows into industrials.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.