EURUSD opened the Thursday Asian session with a modest bullish uptick, evident in the 4-hour chart's two substantial bullish candles between 2023.19.14 00:00 and 2023.19.14 08:00. Today, all eyes are on the European Central Bank (ECB), which is set to announce its deposit facility rate decision and interest rate decision. Despite economists' expectations of no changes in these decisions, these ECB decisions are poised to drive volatility across Euro-denominated trading pairs.

EURUSD opened the Thursday Asian session with a modest bullish uptick, evident in the 4-hour chart's two substantial bullish candles between 2023.19.14 00:00 and 2023.19.14 08:00. Today, all eyes are on the European Central Bank (ECB), which is set to announce its deposit facility rate decision and interest rate decision. Despite economists' expectations of no changes in these decisions, these ECB decisions are poised to drive volatility across Euro-denominated trading pairs.

Meanwhile, the market is also closely monitoring high-impact news from the US, including Core Retail Sales, Initial Jobless Claims, PPI, and Retail Sales. Economists predict a mix of signals, with only a slight increase in PPI (0.4% vs. 0.3%) as a positive forecast. In contrast, negative forecasts include a decline in Core Retail Sales (0.4% vs. 1%), an uptick in Initial Jobless Claims (225K vs. 216K), and reduced Retail Sales (0.2% vs. 0.7%). These varied forecasts may account for the recent modest bullish movement during the Thursday Asian trading session.

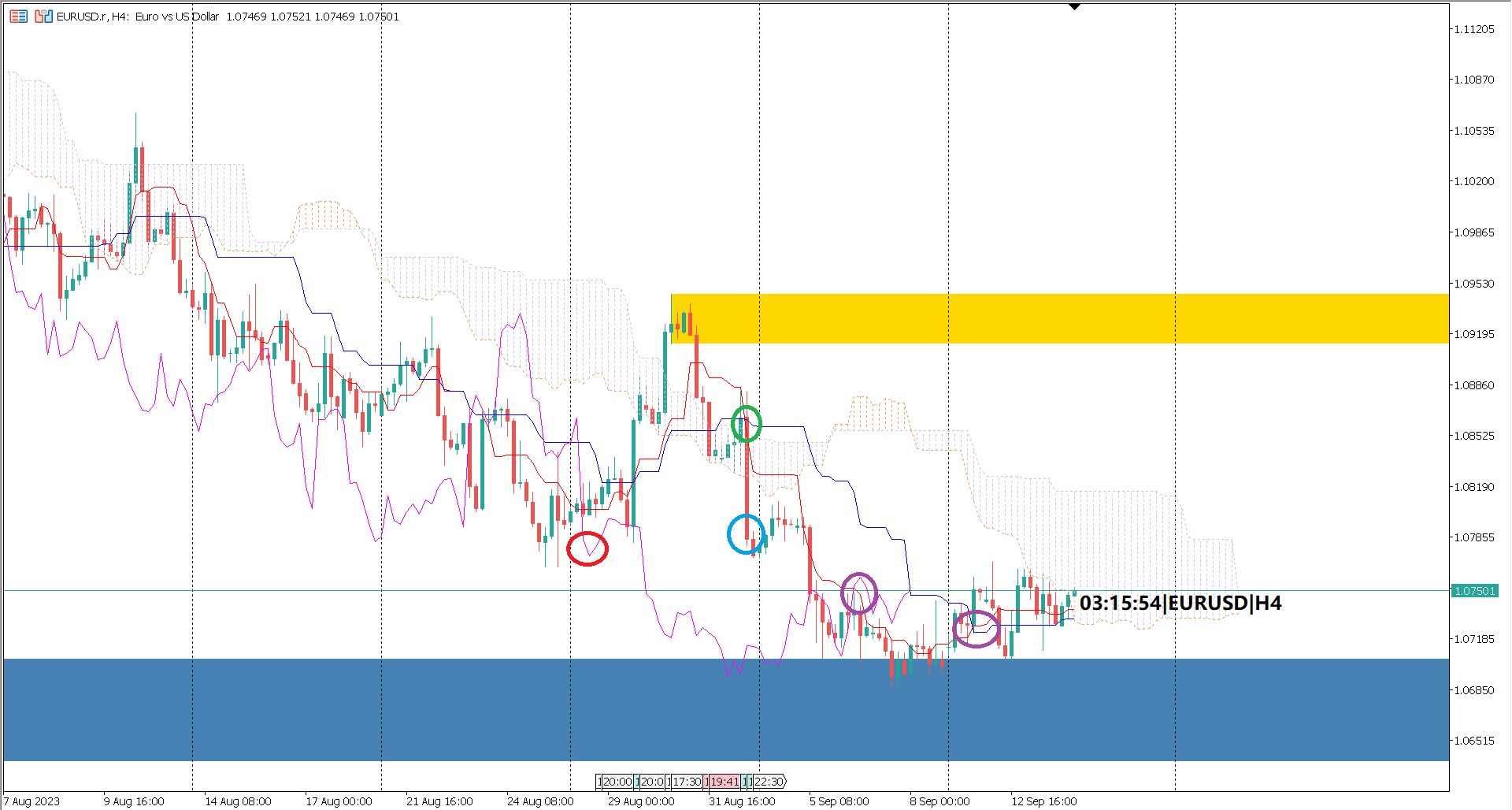

Starting from September 1, 2023, at 16:00 hours, the Ichimoku indicator signaled a bearish trend for EURUSD trading pairs. Several factors contribute to this bearish sentiment:

The Chikou span dipped below the price's low, highlighted within a red circle.

The price's close remained under the cloud, denoted by a blue circle.

The Tenkansen crossed below the Kijunsen line, as indicated by a green circle.

Presently, the Ichimoku indicator presents a mixed signal. The Chikou span intersected the candle's high, and the Tenkansen crossed over the Kijunsen line, both marked by purple circles. However, this does not signify a bullish reversal yet. To confirm a shift in the market sentiment, additional criteria must be met, including a price close above the cloud.

Ultimately, a true turnaround would necessitate substantial volatility driven by robust EU news and a mix of, preferably negative, results from the US. These conditions could potentially break the key resistance zone at 1.09126-1.09455 (highlighted in a yellow rectangle). Key support zone to watch is at 1.06378-1.07052 (highlighted in a blue rectangle). As of now, EURUSD is in a bearish correction phase.

forecast 3.75% vs 3.75%

forecast 4.25% vs 4.25%

forecast 0.4% vs 1%

forecast 225K vs 216K

forecast 0.4% vs 0.3%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.