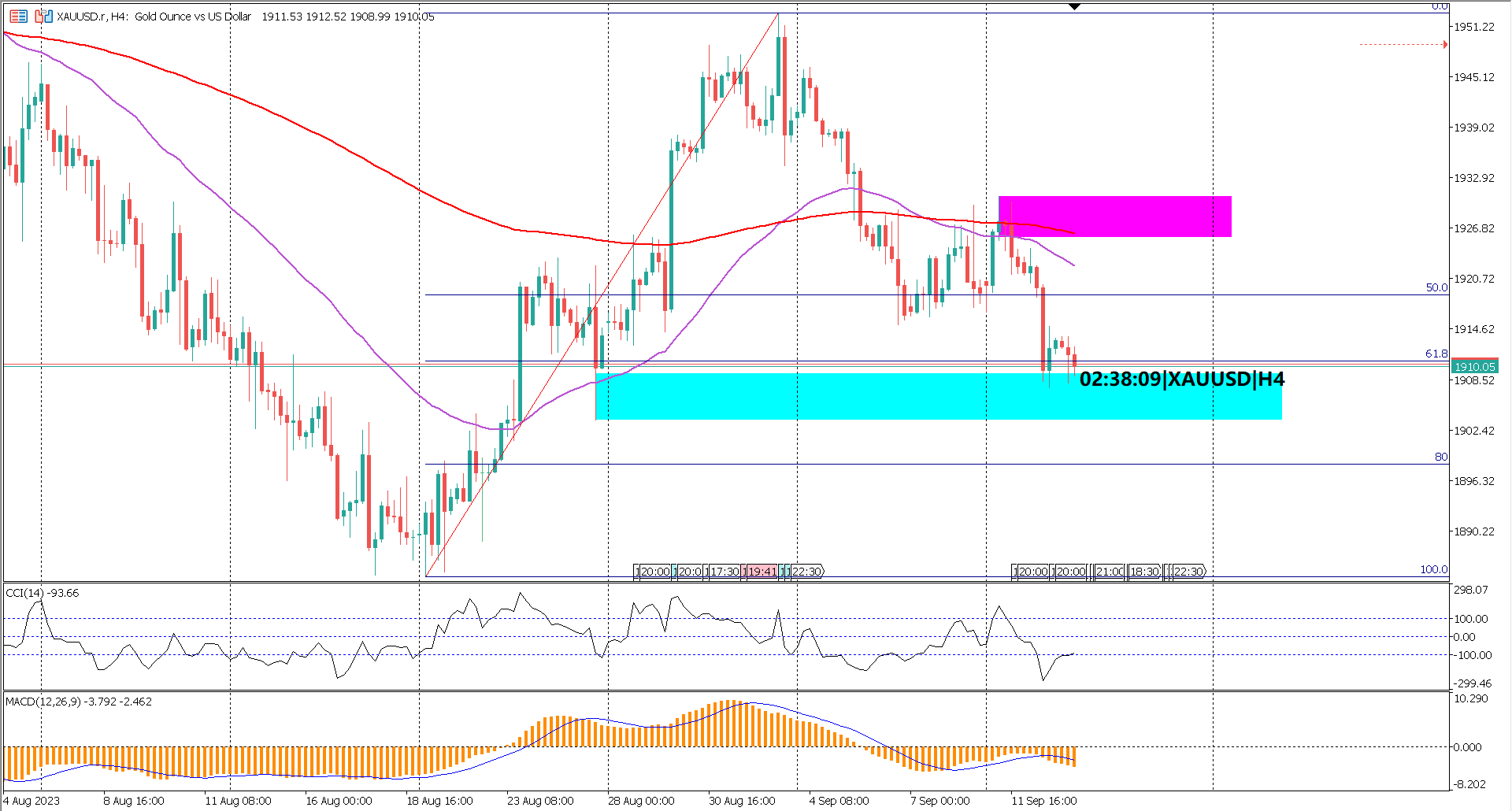

XAUUSD nears key support after a deep 61.8% Fibonacci retracement. Despite its traditional safe haven status, gold faces a strong dollar challenge. Today's US CPI release is pivotal, signaling the Fed's rate hike stance. Economists anticipate lower CPI at 4.3% (previous 4.7%) and no change in US core CPI at 0.2% (previous 0.2%). A better-than-expected CPI outcome could sustain USD strength and boost rate hike prospects.

The key support zone is at 1903-1909

The key resistance zone is at 1925-1930

Technically XAUUSD is Bearish due to several factors

MA 50 is under MA 20

CCI is below 0 level

MACD signal line is below 0 level

The upcoming US CPI and Core CPI announcements carry the potential to induce high volatility in this trading pair. If the results surpass expectations, it may trigger a breach of the key support zone. Conversely, a mixed or lower-than-forecasted outcome could prompt a shift in sentiment for XAUUSD, turning it bullish.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.