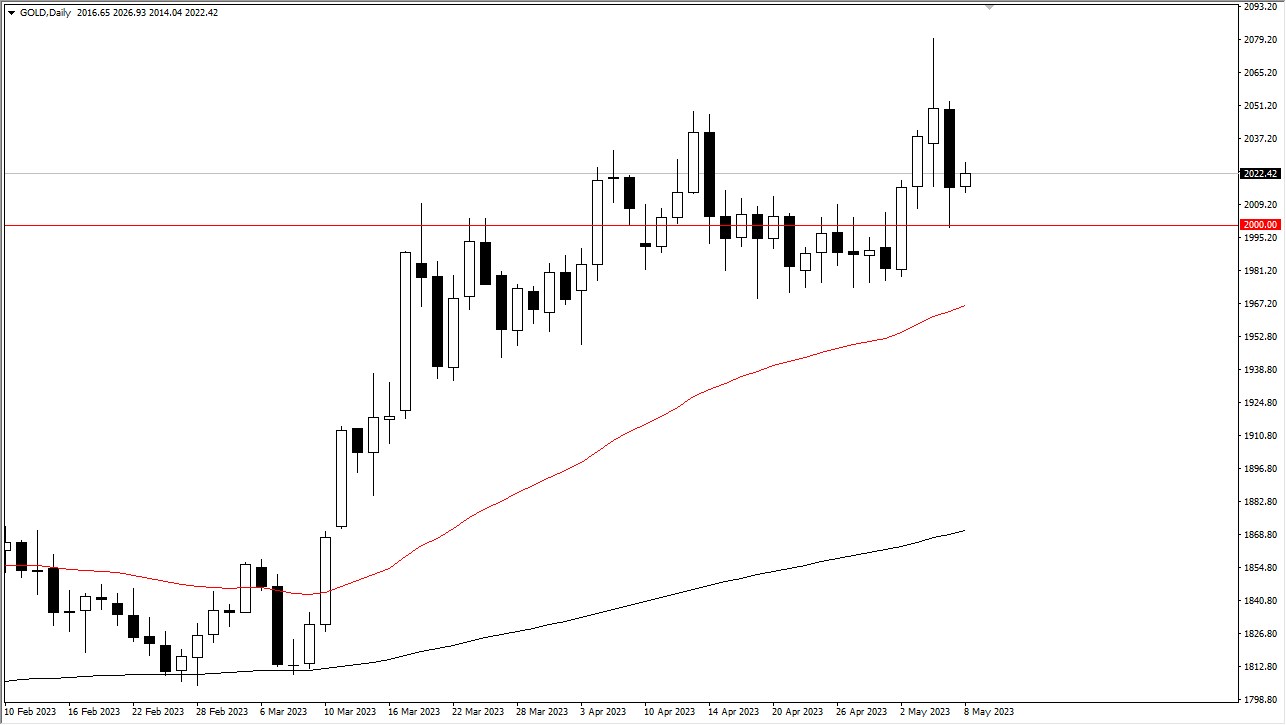

During Monday's trading session, the gold market experienced some stability, with buyers seeking to capitalize on dips. The $2000 level has offered a bit of support for the market, making it likely for buyers to congregate in that area. Additionally, the 50-Day EMA near the $1975 level has provided significant support, indicating a potential resurgence in the market shortly.

Although gold is primarily used for wealth preservation, ongoing concerns regarding global economic movements have made it an attractive investment option. The overall trend in the gold market will eventually assert itself, and buyers are likely to take advantage of cheap gold prices.

The $2100 level is a potential target but reaching it may take some time. The market has seen quite a bit of noisy behavior in general, resulting in back-and-forth movement. However, a bullish trend is expected to emerge over time. The market continues to exhibit choppy behavior, but the US dollar's recent decline is likely to cause issues for anyone trying to short gold. Therefore, it's important to pay close attention to the market's value and take advantage of it as it occurs.

Shorting the gold market is not advisable, given the strong trends and uncertainty. Buyers will likely remain in the market until at least the $1950 level. If the market breaks below this level, it could lead to a further drop to the $1900 level, although this scenario is unlikely to happen anytime soon.

In conclusion, the gold market experienced some stability during Monday's trading session, with buyers seeking to capitalize on dips. The $2000 level and the 50-Day EMA near the $1975 level have provided significant support for the market. Although the market has exhibited choppy behavior, a bullish trend is expected to emerge over time. Investors should pay close attention to the market's value and take advantage of it as it occurs, as gold's value as a safe haven during economic uncertainty remains significant.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit