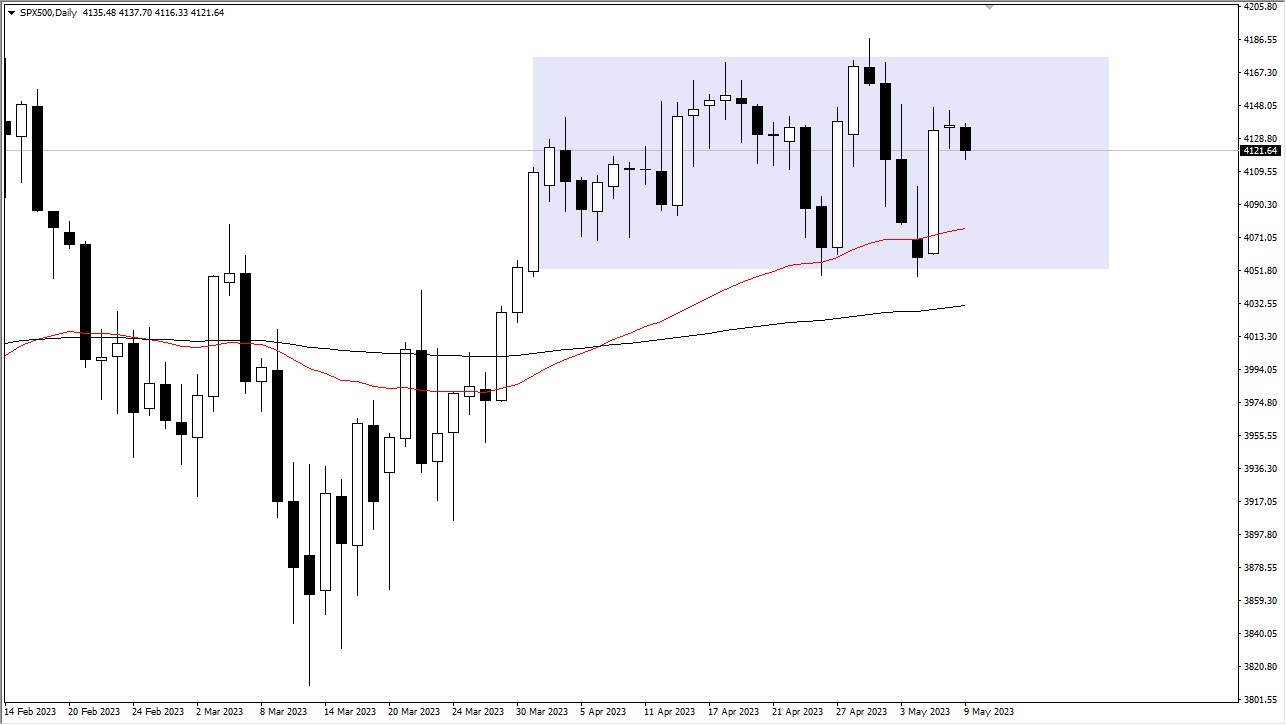

The S&P 500 continues to exhibit choppy and range-bound behavior as traders try to figure out the market’s direction amidst concerns about central banks tightening globally, global slowing, and uncertainty surrounding the Federal Reserve's actions. The market is expected to remain choppy throughout the summer, with traders viewing the 4200 level as a significant resistance barrier and the 4000 level as a crucial support level.

Investors should pay attention to the market's behavior near the 4200 level, as a potential exhaustion point could allow traders to exit the market and continue playing within the same range. On the other hand, if the market breaks above the 4200 level, it could move up to the 4300 level, where the next significant resistance barrier is.

The market's behavior will also be influenced by traders' risk appetite and whether or not they believe the Federal Reserve will bail out the market. Wall Street firms are in consensus about this, but the market continues to exhibit choppy and range-bound behavior. The market will be paying close attention to the CPI numbers coming out on Wednesday, which could influence the market's behavior and traders' expectations of the next Federal Reserve meeting, currently pricing only an 8% chance of an interest rate hike in June.

Investors are advised to monitor market conditions closely and approach them from a range-bound perspective, as holding onto a trade will be challenging. With ongoing earnings reports and a lot of noise in the market, it is best to exercise caution when investing.

The 50-Day EMA is situated around the bottom of the Friday candlestick, while the 200-Day EMA is close to the 4000 level, offering significant support. If the market falls below the 4000 level, it could experience a substantial drop, opening up the possibility of a move down to the 3800 level.

The S&P 500 witnessed quiet trading on Tuesday following economic announcements. The market is expected to remain choppy throughout the summer, with concerns about central banks tightening globally, global slowing, and uncertainty surrounding the Federal Reserve's actions. Traders view the 4200 level as a significant resistance barrier and the 4000 level as a crucial support level. Investors are advised to monitor market conditions closely and approach them from a range-bound perspective, exercising caution when investing in the market.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit