Gold traders are closely watching today's key economic releases from the US, including the S&P Global US Manufacturing PMI, S&P Global Services PMI, and New Home Sales. Economists are forecasting improvements in the US economy. However, mixed results could suggest a weaker USD against Gold's price.

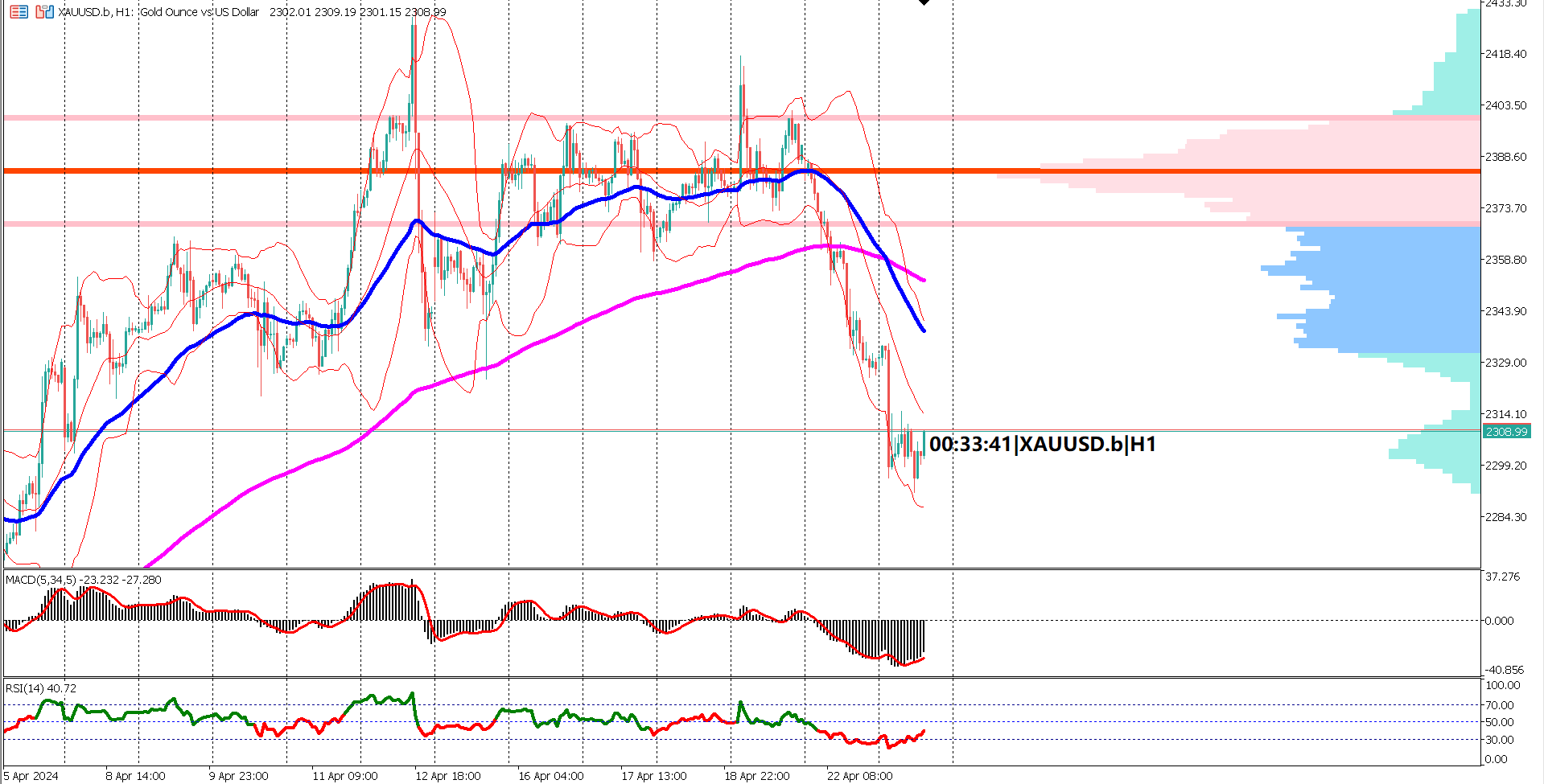

On the 1-hour timeframe, XAUUSD is currently showing a very bearish sentiment. The EMA 50 is positioned below the EMA 200, confirming a bearish trend. A death cross on the EMA further confirms this bearish reversal, suggesting a long-term bearish sentiment.

Both MACD and RSI indicators support this bearish sentiment. The MACD's signal line has sunk deep below the 0 level, while the RSI has penetrated the 30% oversold level without any rebound. Additionally, prices are trading well below the low of the value area at $2368, standing $770 below today's low at $2291.

If today's key economic news comes with mixed results, gold may rebound and look for resistance. The key resistance levels to watch are the EMA 50 and EMA 200.

Overall, XAUUSD is showing signs of potential rebound amid mixed US economic data and strong technical bearish signals. Traders should monitor key support and resistance levels, as well as the upcoming economic releases, to navigate the current market conditions effectively.

In summary, XAUUSD is eyeing a potential rebound amid mixed US economic data and strong technical bearish signals. Traders should be cautious and monitor key support and resistance levels, as well as the upcoming economic releases, to make informed trading decisions. A break above the EMA 50 and EMA 200 could further confirm the bullish outlook for XAUUSD.

Forecast 52.0 vs Previous 51.9

Forecast 52.0 vs Previous 51.7

Forecast 668K vs Previous 662K

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.