Microsoft Corp. becomes the second U.S. public company to reach a $2 trillion market value. Its dominance in cloud computing and enterprise software will expand more in a post-coronavirus world.

Its shares rose as much as 1.2% in New York on Tuesday, enough for the software company to briefly join Apple Inc. as one of only two companies trading at such a high value.

Chief Executive Officer Satya Nadella has reshaped the company into the largest seller of cloud-computing software, counting both its infrastructure and Office application cloud units.

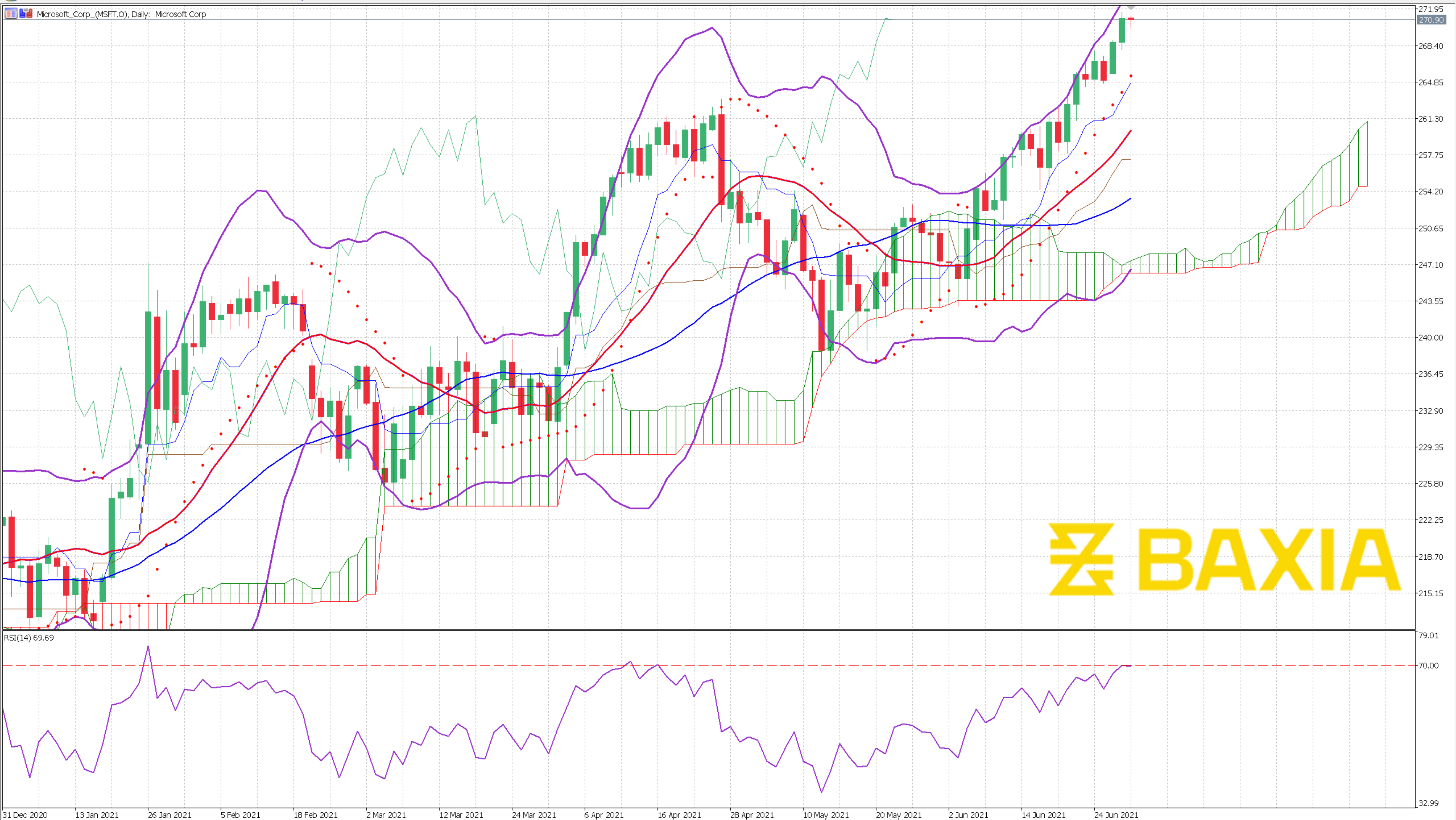

Microsoft has gained 19% this year, outperforming Apple and Amazon.com Inc., as investors piled into the stock on long-term growth expectations for both earnings and revenue and expansion in areas like machine learning and cloud computing. The company’s third-quarter results, released in late April, topped expectations and demonstrated strong growth across its business segments.

More than 90% of analysts recommend buying Microsoft, while none has the equivalent of a sell rating on the stock. The average price target points to an upside of about 11% from current levels.

Microsoft’s cloud-computing business has been a central force behind the advance. The Intelligent Cloud business accounted for 33.8% of Microsoft’s 2020 revenue, making it the largest of the three major segments for the first time, and up from 31% in 2019. The division showed revenue growth of 24% last year, compared with the 13% growth in Productivity and Business Processes and the 6% growth of Microsoft’s More Personal Computing unit.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.