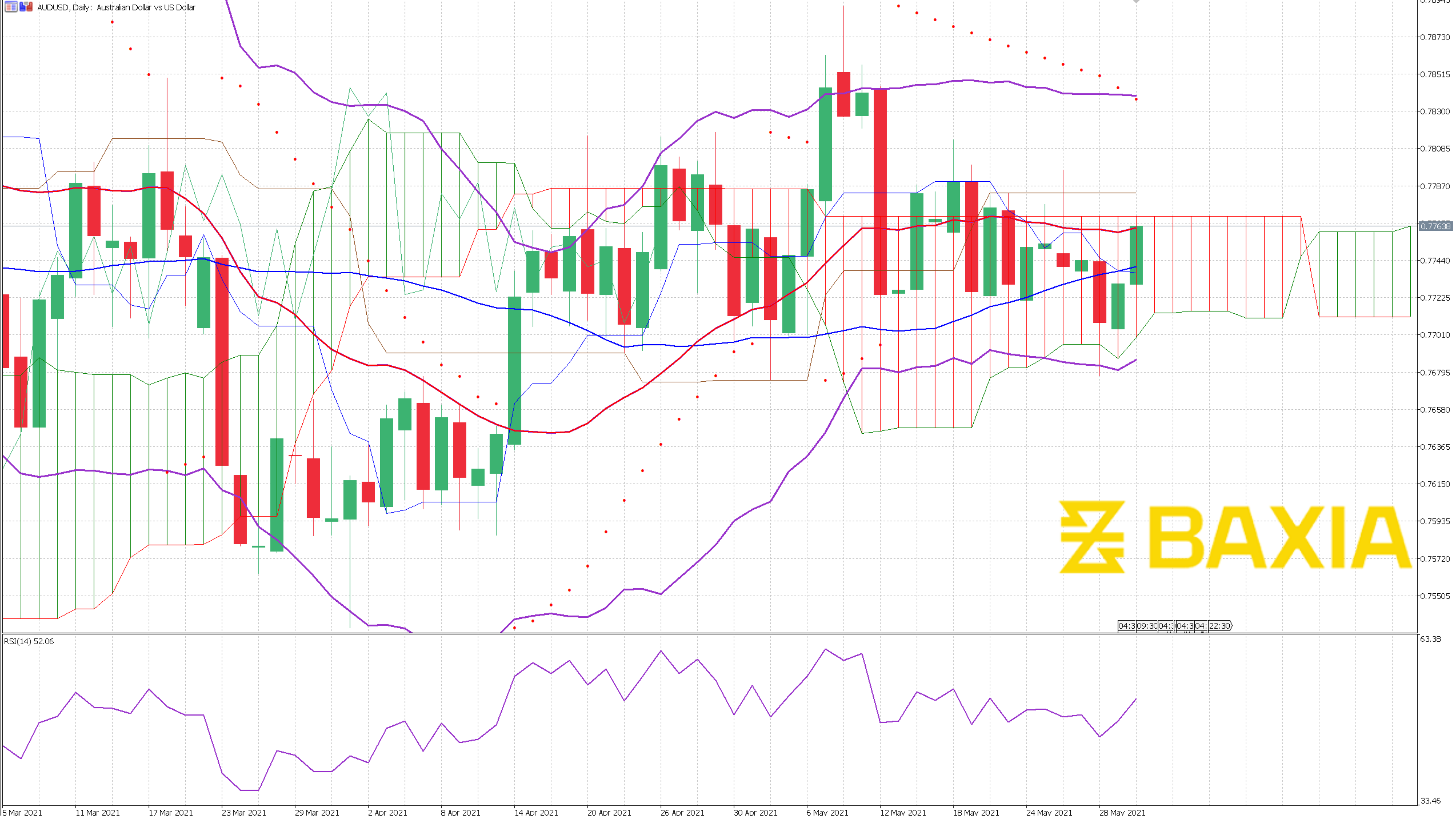

The Reserve Bank of Australia maintains Interest rates unchanged; they have stated that there are no plans to increase the interest rates until 2024. The RBA acknowledged that there had been a strong recovery in its quarterly update earlier in May, which might force the RBA to change the rate earlier than anticipated.

Higher inflation rates mean lower actual interest rates; usually, this means a weaker currency, but spikes in U.S. inflation make traders build a case for a weaker U.S. dollar. Even with the RBS maintaining interest low, we do not see a stronger U.S. dollar in the short term.

The Australian dollar is considered a pro-risk currency, and it is very tied to commodity price inflation. Australia is primarily a commodity exporter, but they are a net importer of crude oil. Some investors might believe that rising crude prices could support AUD. Still, the only way higher oil prices could benefit AUD would be as a sign of an economic recovery. Higher crude oil prices affect Australia's trade balance and thus its currency.

If commodity prices were to roll over again, this would affect AUD/USD; its trade balance would compress, affecting risk sentiment and expectations for future inflation rate differences. Lower commodity prices are interpreted as favorable for USD against the AUD

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.