Today's economic calendar forecasts indicate a mixed outlook across various key indicators. Core Retail Sales are anticipated to rebound by 0.5%, signaling potential strength in consumer spending, while Initial Jobless Claims are expected to remain stable at 218K, suggesting continued labor market stability. The Producer Price Index is forecasted to hold steady at 0.3%, indicating minimal inflationary pressure in producer prices. Conversely, Retail Sales are projected to rise by 0.8%, reflecting potential growth in overall retail activity. Overall, the forecasts paint a picture of resilience in consumer spending and economic stability, with some indicators showing signs of improvement while others maintain their current levels.

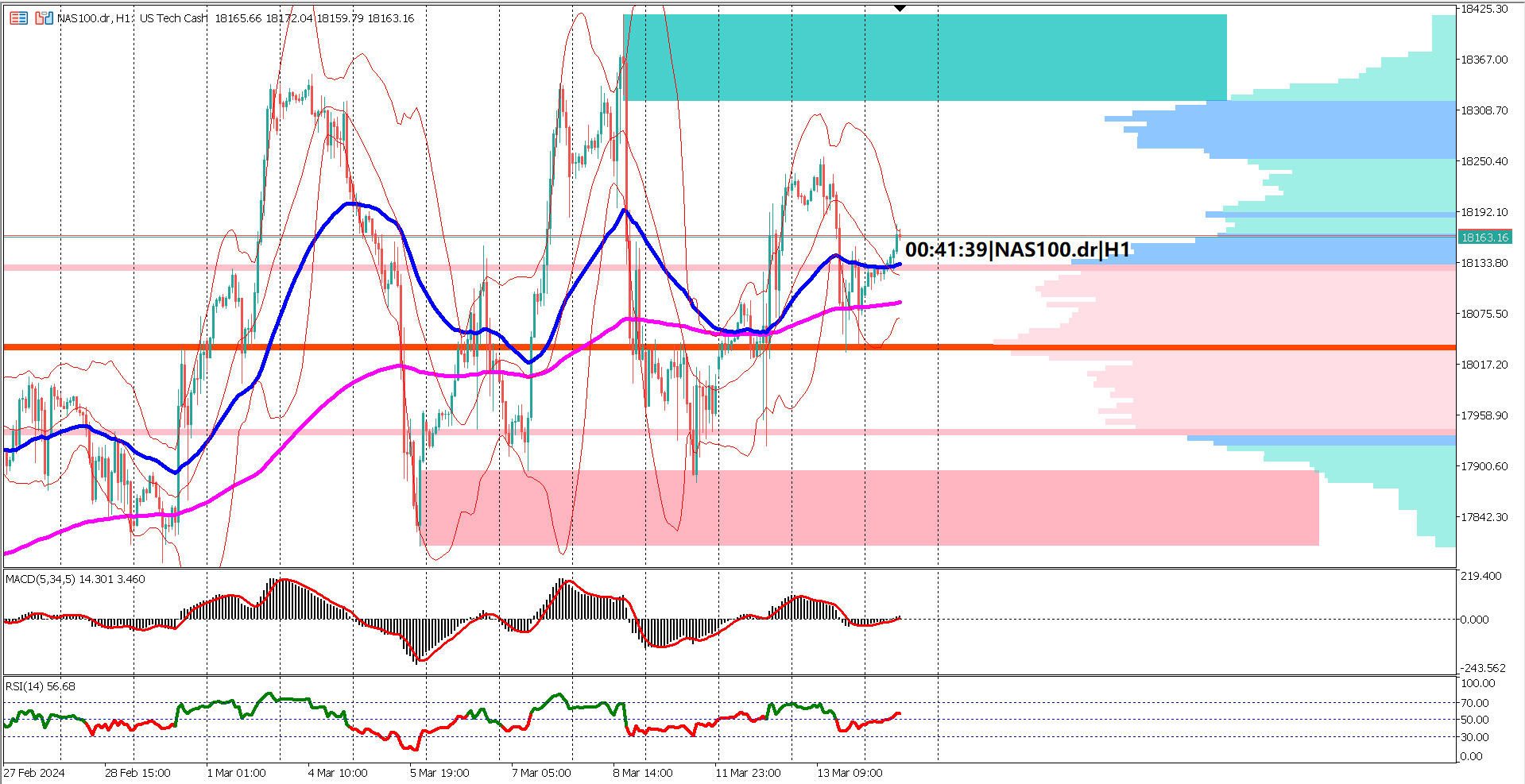

Amidst this economic backdrop, NAS100 has charted a sideward course over the past 8 trading days, forming what looks like a potential triple top chart pattern. Key support rests at $17810, marked by the low of the triple top pattern, while resistance lies at $18418. Despite the mixed economic outlook, the volume profile indicator suggests continued bullish sentiment, with prices yet to breach the value area at $17395.

Currently, NAS100 is testing the upper Bollinger band's strength, a pivotal point that may signal a continuation of the bullish trend or a retracement to $17395. While the EMAs 50 and 200 show no signs of a death cross, the diminishing distance between them hints at waning bullish momentum. As the market remains choppy, relying solely on oscillator indicators like RSI and MACD may offer limited insight.

Ultimately, NAS100's trajectory hinges on today's economic releases. A strengthening of bullish sentiment may occur if forecasts are met, potentially driving prices towards the $18418 resistance level. However, a failure to meet expectations could see a retracement towards key support at $17810, shaping the short-term direction of NAS100.

1. Mixed Economic Outlook: Today's economic calendar forecasts present a mixed picture, with some indicators pointing to potential strength in consumer spending while others suggest stability.

2. NAS100 Sideways Movement: NAS100 has been trading sideways over the past 8 days, forming a potential triple top chart pattern with key support at $17810 and resistance at $18418.

3. Bullish Sentiment: Despite the mixed economic outlook, the volume profile indicator indicates ongoing bullish sentiment, with prices yet to breach the value area at $17395.

4. Upper Bollinger Band Test: NAS100 is currently testing the strength of the upper Bollinger band, signaling a pivotal moment that may determine the continuation of the bullish trend or a retracement to $17395.

5. Waning Bullish Momentum: While the EMAs 50 and 200 show no signs of a death cross, the diminishing distance between them suggests a potential weakening of bullish momentum.

Overall, NAS100's short-term trajectory depends on today's economic releases, with outcomes potentially shaping near-term price action towards either key resistance or support levels.

Forecast 0.5% vs Previous -0.6%

Forecast 218K vs Previous 217K

Forecast 0.3% vs Previous 0.3%

Forecast 0.8% vs Previous -0.8%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.