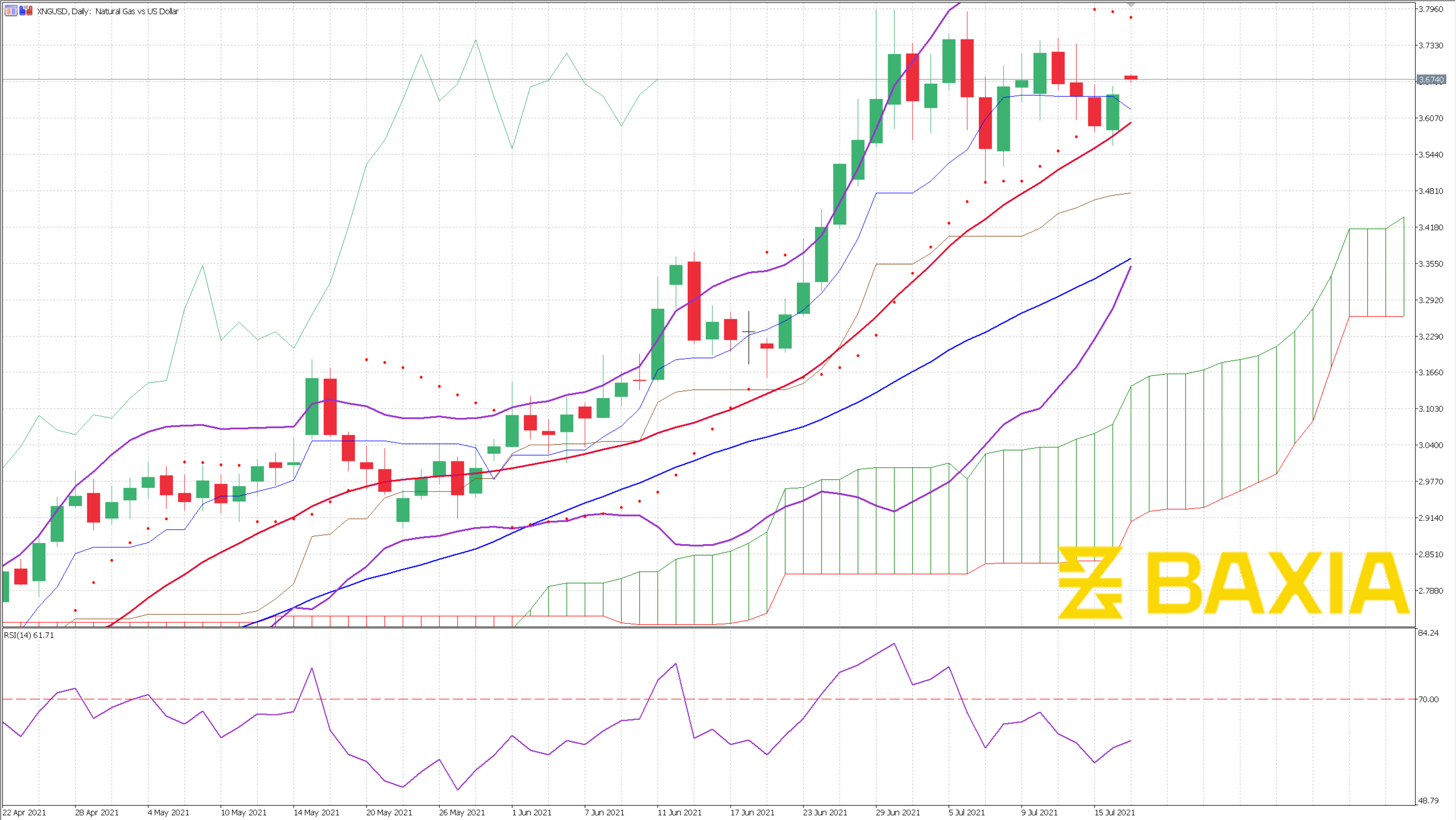

XNGUSD resumes its uptrend after closing with a loss in three consecutive trading sessions; this might be a temporary uptrend, and it is possible for the price to find a pullback in the upcoming sessions.

The Relative strength index is at 62%, as the price continues to increase. The RSI could enter an overbought status; this will cause a price drop that could be temporary; however, we have seen the RSI levels stay above 70% for eight sessions in the past weeks. There is a chance that the price will continue to increase even if the overbought status is reached.

The Bollinger bands are closing up, but they are still very wide; high volatility can be expected in the upcoming days.

The short and long-term moving averages continue moving up, and the gap between the lines is still increasing, which is a buy signal.

Our parabolic SAR indicator suggests that the price will fall; it has been signaling a Sell for the last eight sessions; however, the price has not been falling too much.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.