Amidst recent market movements, XRPUSD experienced a notable surge on Monday, witnessing a staggering 25% increase within a single day. However, this bullish momentum appears to have been short-lived, with the cryptocurrency now retracing as investors opt to capitalize on short-term gains.

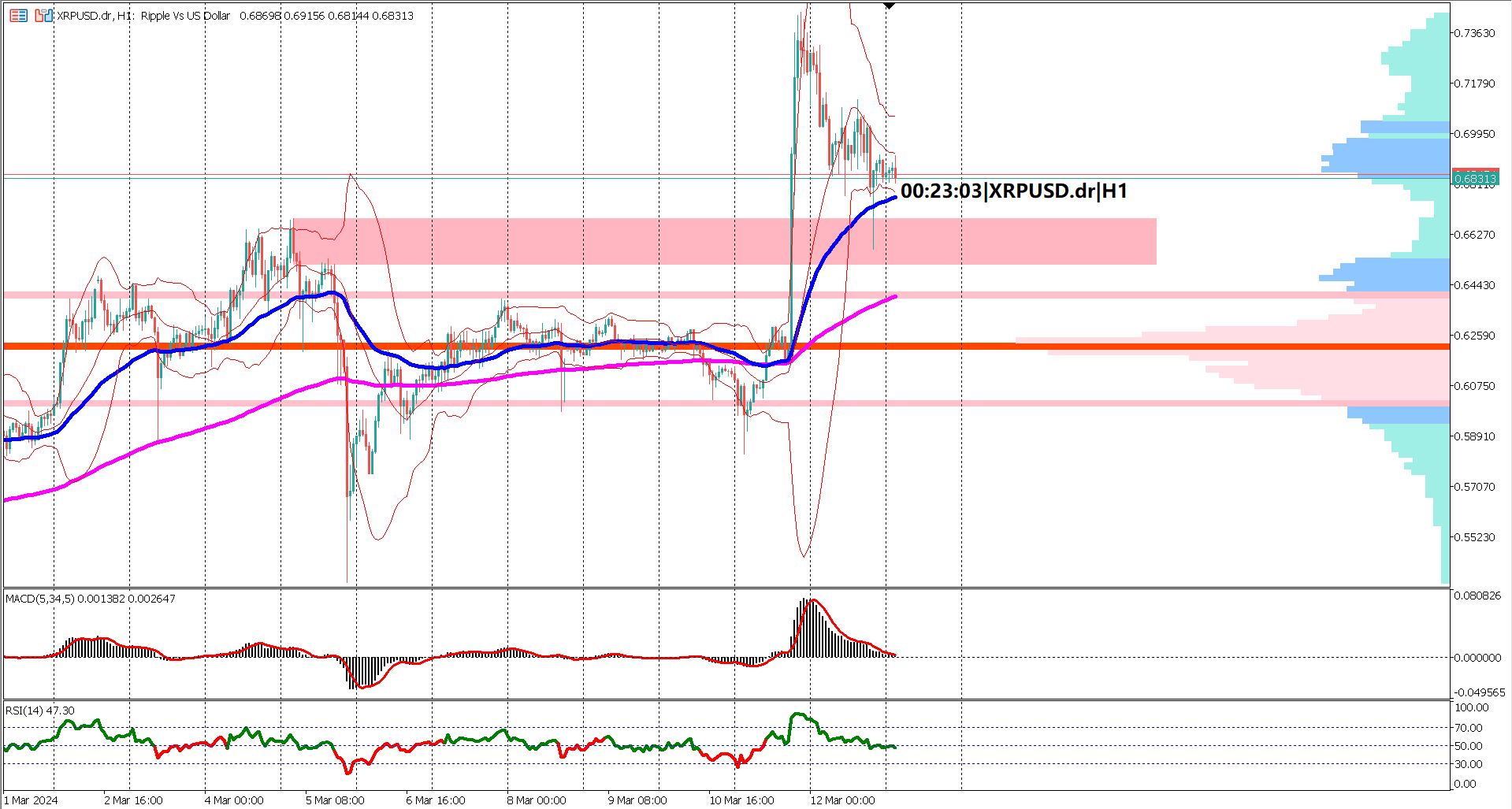

Currently, prices are soaring above both the EMA 50 and 200 indicators. Although the market briefly tested the EMA 50, potential support may have been found nearby. The momentum remains robust, evidenced by the widening gap between the two EMAs.

The Bollinger bands are showing signs of contraction, indicating a decrease in volatility. While low volatility can prompt retracements, the overall bullish sentiment persists, provided prices do not breach the lower band of the Bollinger band.

Moreover, prices continue to trade above the volume profile value area, underscoring the strength of the bullish trend. A crucial support level is identified at 0.6000; any retracement to this level and subsequent downward movement could potentially challenge the bullish trajectory.

Analyzing oscillator indicators, particularly the MACD nearing the 0 line, suggests a potential mean reversion. Similarly, the RSI is retracting from overbought levels towards the 50 mark, indicating a return to fair value prices. This scenario implies a likelihood of the bulls resuming control and continuing the rally.

In summary, the overall outlook for XRPUSD remains bullish, with the market likely experiencing a temporary profit-taking phase or consolidation before potentially reaching new highs.

1. Recent Surge: XRPUSD witnessed a remarkable surge, soaring by over 25% in a single day on Monday.

2. Short-Lived Momentum: However, this bullish momentum appears short-lived, with the cryptocurrency now retracing as investors capitalize on short-term gains.

3. Strong Technicals: Despite the retracement, XRPUSD continues to trade above both the EMA 50 and 200 indicators, showcasing strong technical support levels.

4. Bullish Sentiment: The Bollinger bands suggest decreasing volatility, but the overall bullish sentiment remains intact, provided prices stay above key support levels.

5. Potential for Resumption: Oscillator indicators, like the MACD and RSI, hint at a potential mean reversion, signaling a possible resumption of the bullish trend after a brief consolidation phase.

Forecast 0.2% vs Previous -0.1%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.