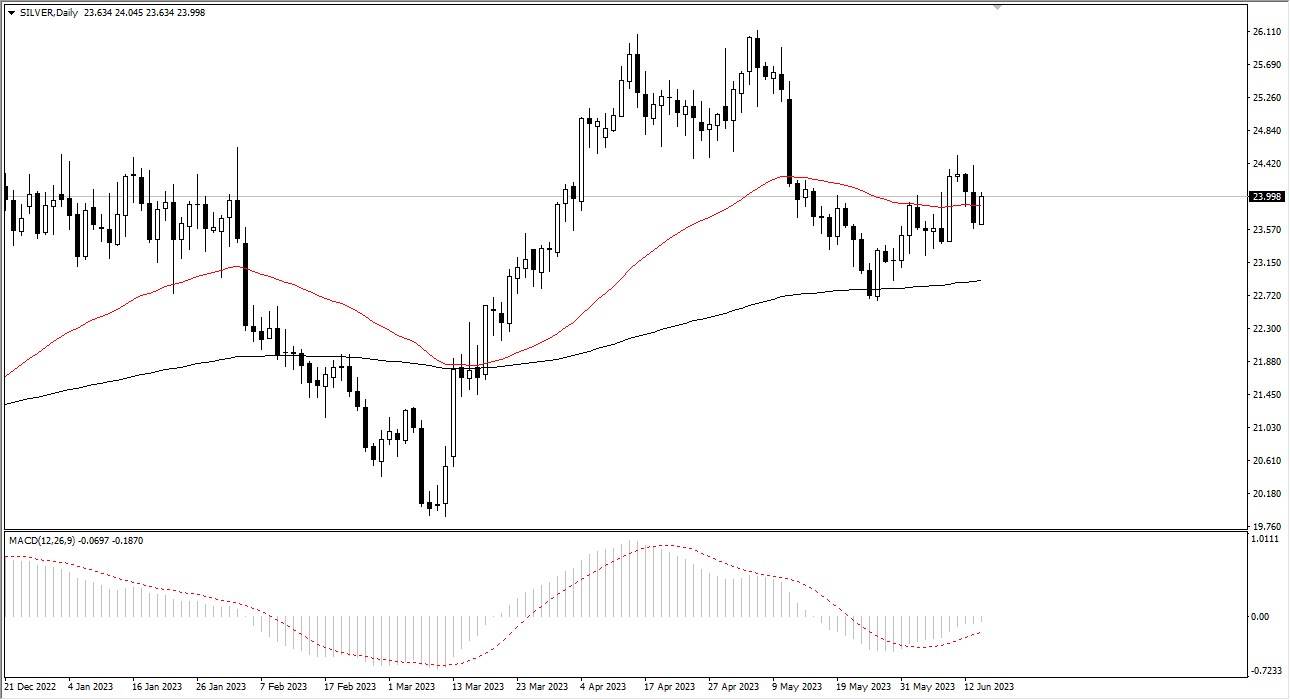

Silver experienced a modest rally during Wednesday's trading session, indicating a resurgence in market activity as it continues to hover around the 50-Day Exponential Moving Average (EMA). With this development, the silver market is expected to maintain a degree of volatility, especially considering the impending Federal Reserve announcement later in the day. Previously utilized for wealth preservation, the question now arises as to whether the potential "bottoming pattern" will continue to materialize.

Beneath the surface, the 200-Day EMA provides support near the $23 mark. However, breaching the 200-Day EMA would signify a significantly negative turn of events, potentially paving the way for a test of the $22 level and, subsequently, the $20 level. Notably, the $20 level has acted as a launching pad in the past. Therefore, if the market were to fall below the 200-Day EMA and the 61.8% Fibonacci level, it would likely become the target for traders.

Conversely, should the market surpass last week's highs, it would create an opportunity for movement towards the $25 level. This level holds psychological significance due to its round figure and has previously served as a crucial support level, potentially resurrecting "market memory" and introducing complications. However, if the $25 level is breached, there is a possibility of reaching as high as $26, or even $26.40, where previous peaks were observed.

Nonetheless, participants should approach this market with caution, considering the inherent volatility. Careful consideration of position sizing is crucial, and one should exercise discretion when deciding whether to adopt an aggressive stance in terms of adding to positions. At present, the overall outlook appears somewhat bullish. However, it is essential to closely monitor the Federal Reserve's statement and the subsequent press conference following the interest rate announcement. These events might provide valuable insights into the market's future behavior.

At the end of the day, silver's recent performance has shown signs of life, accompanied by an element of volatility. The awaited Federal Reserve announcement adds to the market's unpredictability. Traders and investors should exercise prudence in their approach, mindful of the potential opportunities and risks that lie ahead. By closely analyzing the statement and press conference, market participants can gain valuable insights into the future trajectory of the silver market once the dust settles.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit