XAUUSD has remained within a narrow consolidation range since the conclusion of Wednesday's New York session. Today, significant high-impact news is set to be unveiled in the United States, encompassing the US GDP, personal consumption expenditures, initial jobless claims, and pending home sales. Economists are predominantly anticipating stability in the US 2nd quarter GDP, maintaining the figure at 2.1%, along with core personal expenditures. However, there is an expectation of slight job sector weakness, with initial jobless claims potentially rising to 215K from the previous 201K. Economists are also anticipating a decrease in Pending Home Sales, forecasted at -0.8% compared to the previous 0.9%. A mixed outcome in these reports could result in a bullish sentiment for XAUUSD.

XAUUSD has remained within a narrow consolidation range since the conclusion of Wednesday's New York session. Today, significant high-impact news is set to be unveiled in the United States, encompassing the US GDP, personal consumption expenditures, initial jobless claims, and pending home sales. Economists are predominantly anticipating stability in the US 2nd quarter GDP, maintaining the figure at 2.1%, along with core personal expenditures. However, there is an expectation of slight job sector weakness, with initial jobless claims potentially rising to 215K from the previous 201K. Economists are also anticipating a decrease in Pending Home Sales, forecasted at -0.8% compared to the previous 0.9%. A mixed outcome in these reports could result in a bullish sentiment for XAUUSD.

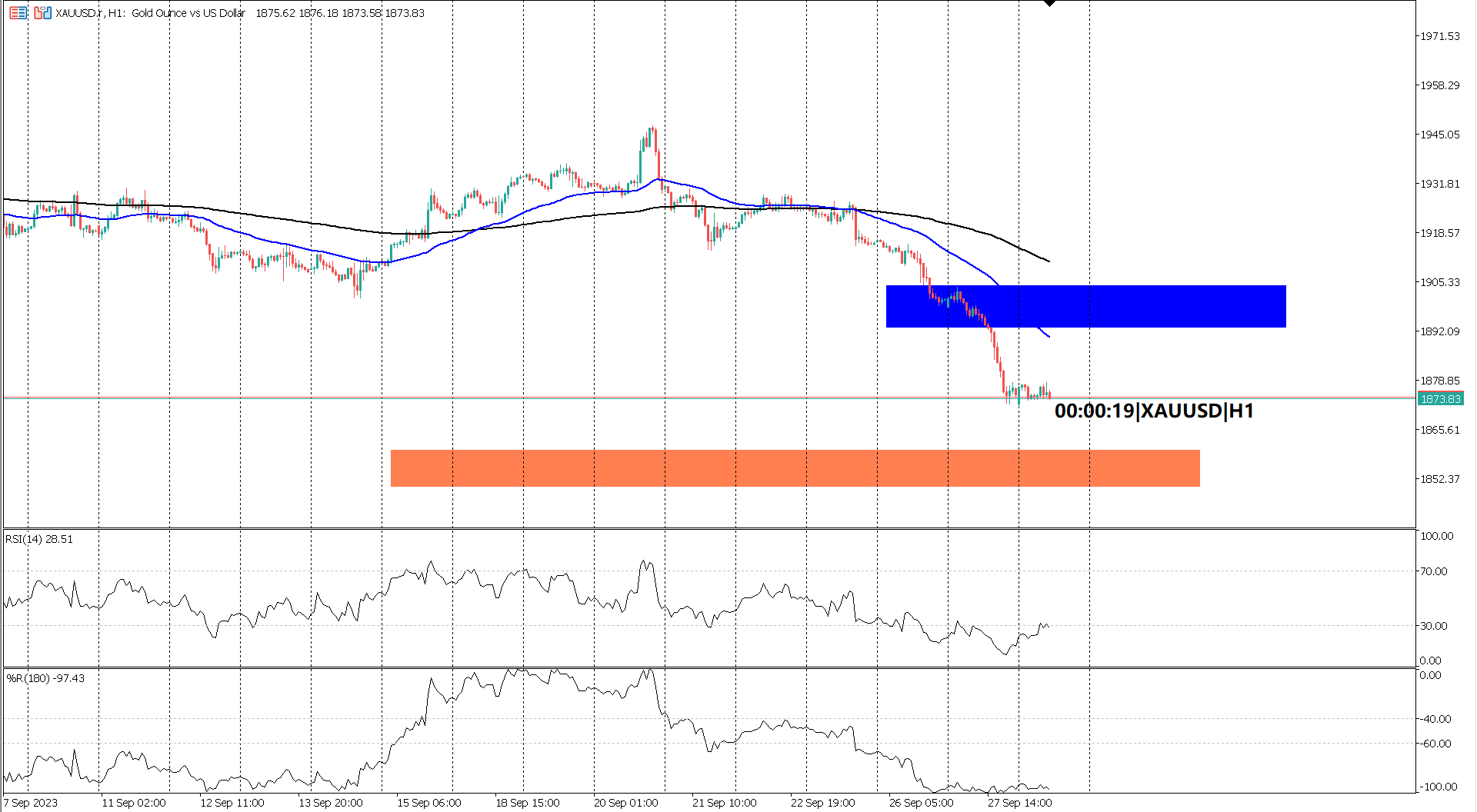

Analyzing the 1-hour timeframe chart, XAUUSD appears to be adopting a bearish stance:

Crucially, the key resistance level is identified at 1890-1900 drawn in a blue rectangle, while pivotal support is evident in the 1950-1970 range plotted in an orange rectangle. This dynamic market situation is poised to be influenced by the impending economic data, offering opportunities for traders to navigate the evolving landscape of XAUUSD.

Forecast 3.7% vs Previous 3.7%

Forecast 2.1% vs Previous 2.1%

Forecast 215K vs Previous 201K

Forecast -0.8% vs Previous 0.9%

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.