U.S. equities rose Monday as the Covid-19 immunization drive was bolstered by U.S. regulators granting full approval for the vaccine made by Pfizer Inc. and BioNTech SE.

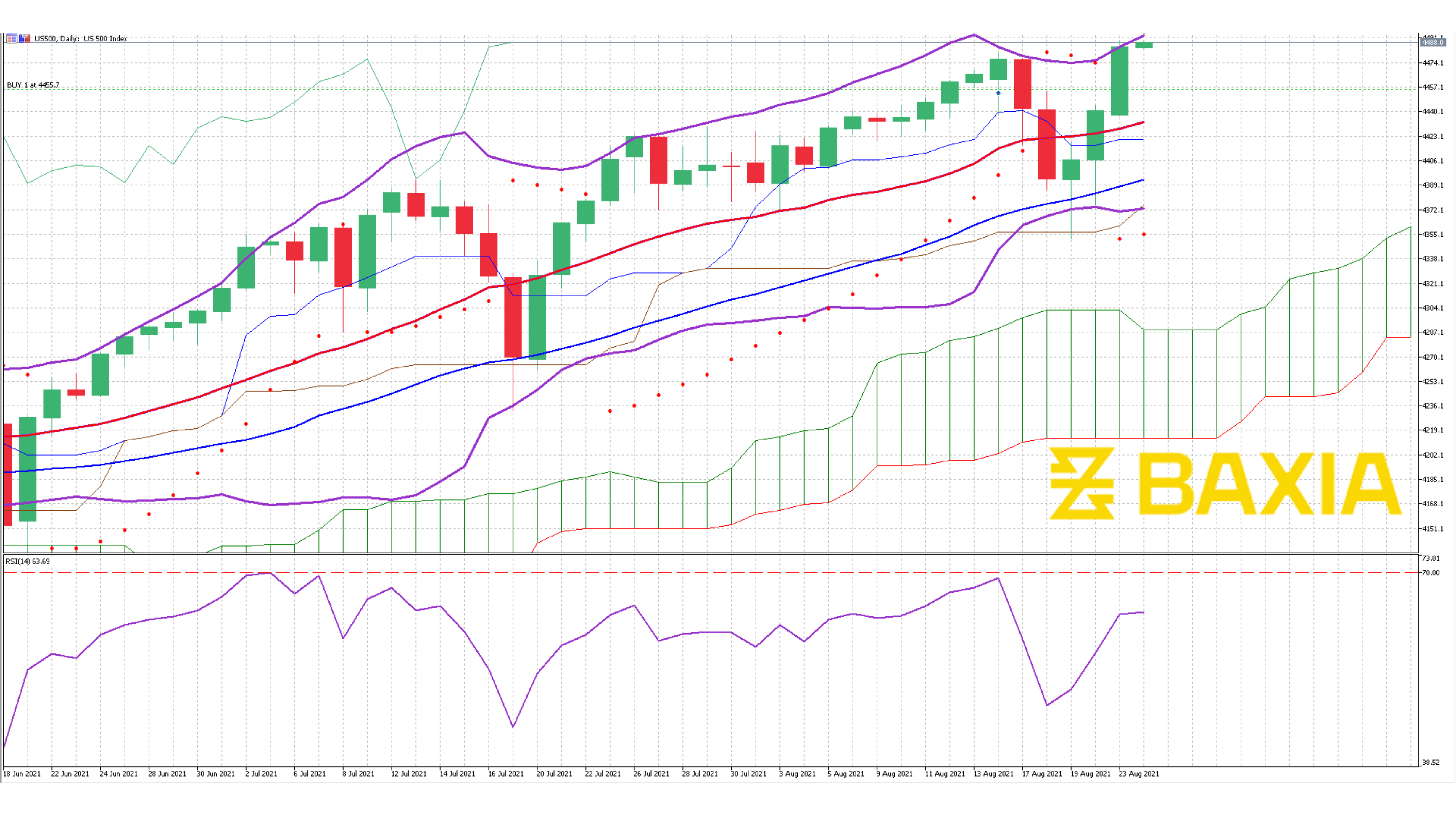

The S&P 500 and Nasdaq 100 rebounded from lows last week as the approval could lead to more vaccine mandates amid a surge in delta variant cases that threatened the global economic recovery momentum. Mixed U.S. data Monday showed July home sales coming in higher than expected while growth at U.S. services and factories slowed to an eight-month low.

Energy shares led the gains as oil rose above $65 a barrel in New York on improving sentiment. Treasuries were little changed, and the dollar was weaker as investors also looked ahead to the Jackson Hole symposium Thursday, which may offer insights into how and when the Federal Reserve plans to taper its asset-purchase program. The tech-heavy Nasdaq Composite closed at a record.

If the delta strain persists, Dallas Fed President Robert Kaplan said he’s open to adjusting his view that the Fed should start tapering sooner rather than later. Meanwhile, Treasury Secretary Janet Yellen endorsed Jerome Powell for a second term as Fed chair, which could reduce uncertainty about the path for monetary policy.

Aside from Fed comments, traders will be looking for the latest U.S. data on manufacturing, gross domestic product, and jobs this week. The U.S. House of Representatives will also be holding critical votes related to President Joe Biden’s $4.1 trillion economic agenda.

In Europe, the Stoxx Europe 600 index increased for a second day. In Asia, equities in China and Japan also gained. China has once again brought local Covid-19 cases down to zero.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.