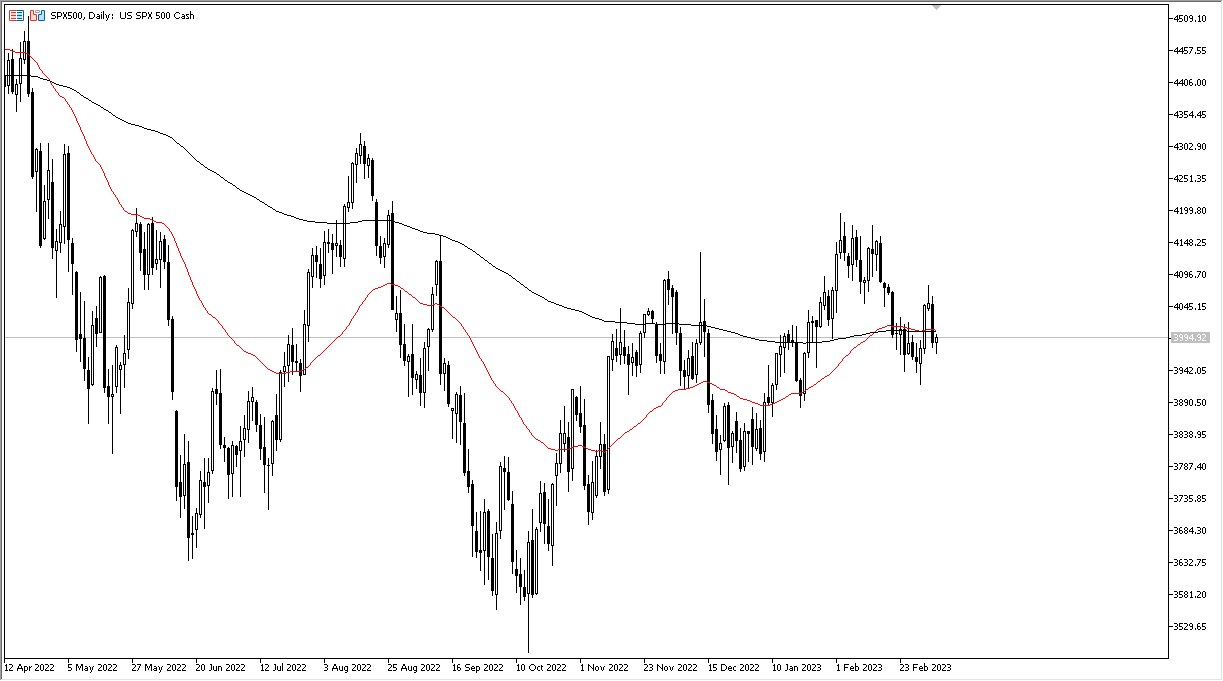

The S&P 500 futures market experienced a dip overnight but managed to recover some ground during the day. However, uncertainty remains following the sharp sell-off on Tuesday as investors grapple with Jerome Powell's recent statements about raising interest rates, potentially even quicker than anticipated. Tuesday's chaos has led to a pause on Wednesday, but the market is now searching for a reason to move.

If the market falls below the day's lows, it could move towards the 3900 level, then potentially to the stronger support area of 3800. Any rallies at this point should be approached with caution, as they are likely to be short-lived. The pattern of buying dips during a sell-off may continue, but if the 3900 level is broken, it could bring significant downward momentum. Conversely, a break above the 4100 level could see the market move towards the bullish 4200 level, although breaching this level may prove challenging.

It's important to note that uncertainty surrounding global growth and interest rates persists, and the market is still trying to find direction amidst the chaos. Powell's statements have created some turbulence, but the market seems to be settling down slightly. However, investors should remain cautious and expect some choppiness before the market finds a clear direction. Position sizing is important in protecting your account. The US stock markets continue to be very noisy, but at the same time, its worth nothing that no matter what the Federal Reserve says, Wall Street seems to find one reason or another to buy stocks. The markets continue to look as if they are looking for some type of bigger move. With this, short-term trading should be the best way forward. The longer-term analysis is still very mixed, and therefore you need to keep on your toes at this point.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.