Wall Street ended firmer on Wednesday in a partial rebound from the previous day's broad sell-off, with remarks from U.S. Federal Reserve Chairman Jerome Powell and the ongoing debt ceiling debate keeping a lid on gains.

The S&P 500 index and the Dow Jones Industrial Average advanced, but the Nasdaq Composite closed lower as Treasury yields halted their ascent. Defensive sectors took the lead as investors sought stability in the volatile market.

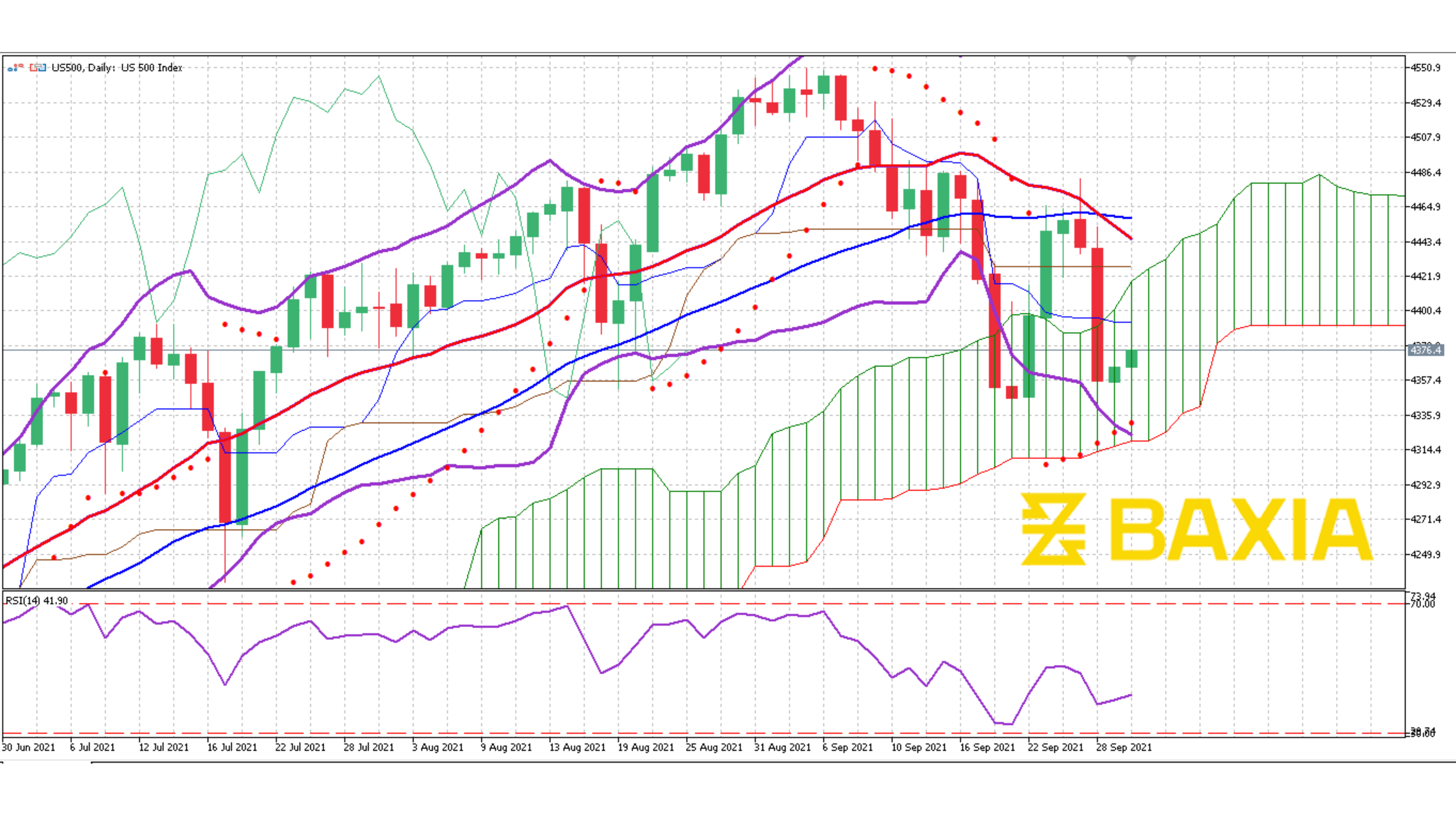

All three remain on course to post monthly declines, with the bellwether S&P 500 snapping a seven-month winning streak.

"Investors are concerned about three things: the eventual taper of bond purchases by the Fed, ongoing inflation with Chairman Powell saying it's going to stick around longer than initially expected, and the debt ceiling issue that congress is grappling with."

Speaking at a European Central Bank event, Powell expressed frustration over persistent supply chain woes, which could keep inflation elevated for longer than expected.

The wrangling continued on Capitol Hill over funding the government as the Friday deadline to prevent a shutdown approached, with mounting concerns over a U.S. credit default. read more

The Dow Jones Industrial Average (.DJI) rose 90.73 points, or 0.26%, to 34,390.72; the S&P 500 (.SPX) gained 6.83 points, or 0.16%, at 4,359.46; and the Nasdaq Composite (.IXIC) dropped 34.24 points, or 0.24%, to 14,512.44.

The S&P 500 posted seven new 52-week highs and two new lows; the Nasdaq Composite recorded 38 new highs and 151 new lows.

Volume on U.S. exchanges was 11.42 billion shares, compared with the 10.45 billion average over the last 20 trading days.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.