The S&P500 rallied strongly last week, driven by robust Non-Farm Payroll (NFP) data, and managed to breach the key level resistance at 4319-4332 (highlighted within an orange box). Interestingly, this resistance zone has now transformed into a pivotal support level as the price surged to a new high, inching closer to the new key resistance area at 4385-4395.

The S&P500 rallied strongly last week, driven by robust Non-Farm Payroll (NFP) data, and managed to breach the key level resistance at 4319-4332 (highlighted within an orange box). Interestingly, this resistance zone has now transformed into a pivotal support level as the price surged to a new high, inching closer to the new key resistance area at 4385-4395.

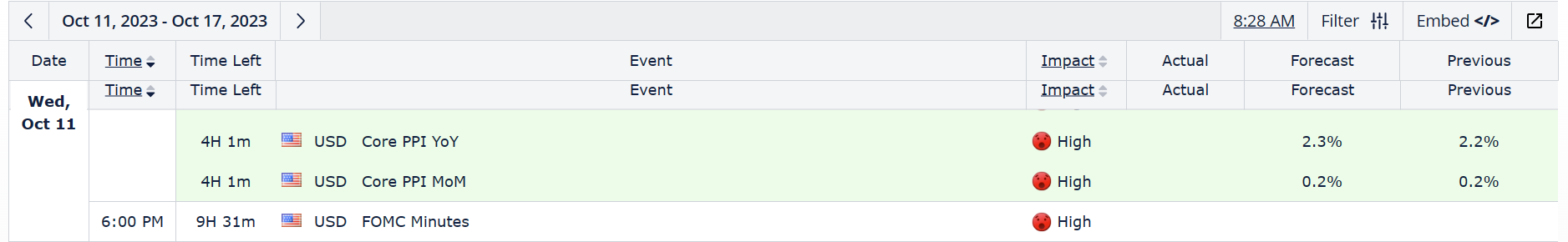

Looking ahead, the US economic calendar will feature the release of the Producer Price Index (PPI) data for September. Nevertheless, investors are likely to downplay the significance of the PPI readings as they await the highly-anticipated Consumer Price Index (CPI) data scheduled for Thursday. Furthermore, during the American session, the Federal Reserve will release the minutes of the September policy meeting. Given that this meeting occurred before the surge in US yields in late September and early October, market participants are expected to be more responsive to officials' statements than the PPI data. The market will be closely monitoring these minutes for potential reactions, which could result in a breakthrough of either the key support or resistance levels.

From a technical standpoint, the S&P 500 is currently in a bullish phase, with key indicators signaling this trend. The EMA 50 and EMA 200 have demonstrated a golden cross, a bullish reversal indicator. Additionally, the MACD line and histogram are both positioned above the zero level, further corroborating the bullish sentiment. Furthermore, the Anchored VWAP, which began tracking on Monday, reflects a bullish sign as the price successfully breached the first upper band. Notably, the key support level for the Anchored VWAP lies between the blue VWAP line and the first lower band, presently situated at 4286.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.