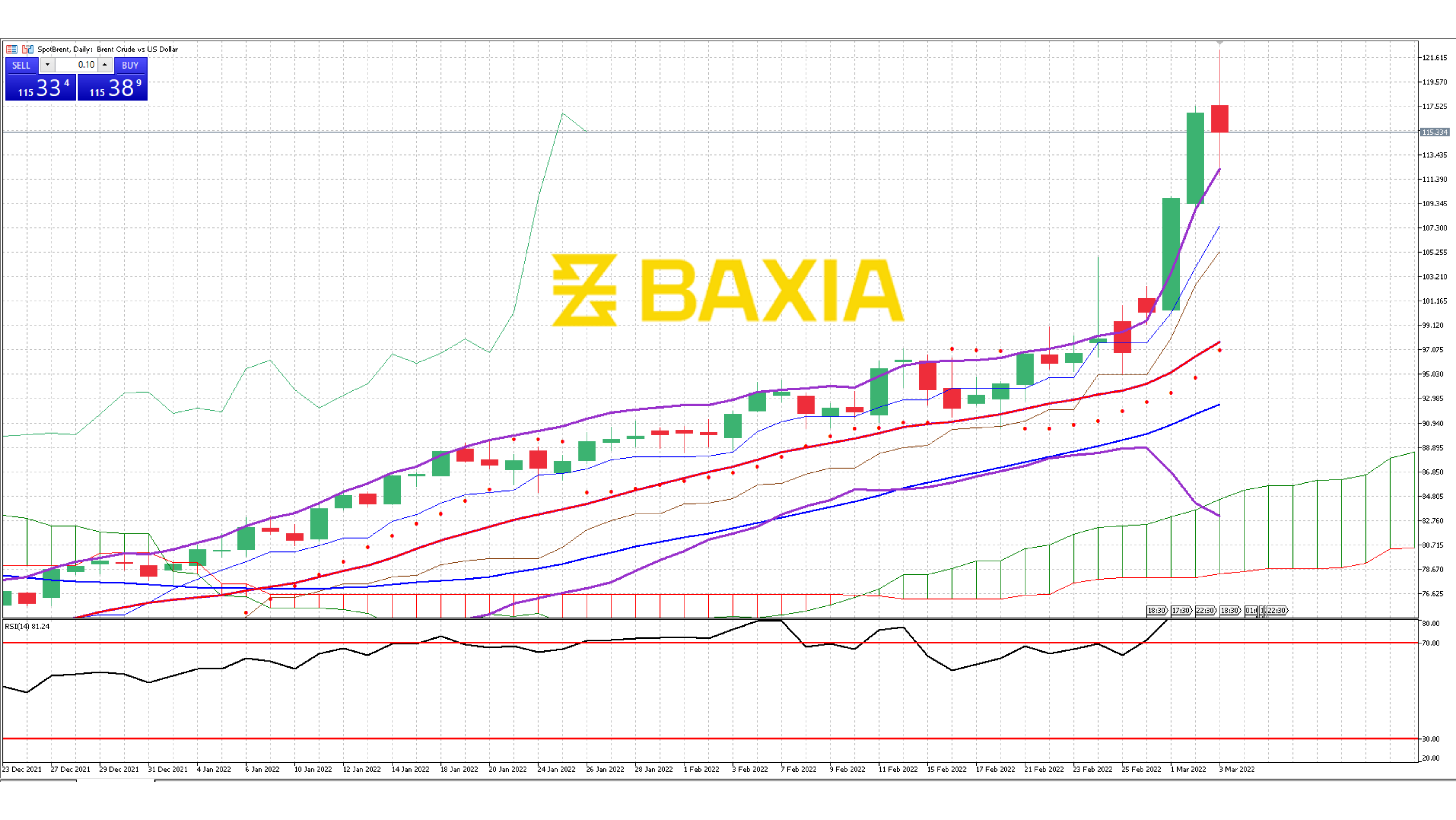

The energy commodity continues the rally and managed to reach 119.78 earlier in the session, the price is pulling back but sets a stepping stone for the future of Oil prices, after gaining more than 15% in the two previous sessions the pair climbed 4% more but retraced as the price was not able to break the 120 barriers.

The Bollinger bands are opening up aggressively but not at a pace fast enough to keep up with the price as it currently trades above the upper band which suggests that it is relatively high, we might see the price pullback to the support at 107 in the upcoming sessions and then take off again.

The relative strength index is at 79%, it continues being on an overbought status, which could last a few more trading sessions, the RSI is falling slightly as the price drops, the fundamental elements continue creating a high impact on the price of the commodity and will continue to do so for as long as there is uncertainty with the production and a possible shortage.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.