U.S. equities declined, and Treasury yields rose as investors are worried about inflation risks and the impact of corporate tax that could allow foreign governments to impose levies on big American companies.

U.S. equities declined, and Treasury yields rose as investors are worried about inflation risks and the impact of corporate tax that could allow foreign governments to impose levies on big American companies.

Ten-year U.S. Treasury yields rose from the lowest since late April after Treasury Secretary Janet Yellen said that a slightly higher interest-rate environment would be a plus on Sunday.

Investors are trying to balance the potential decision of a higher interest rate and not missing out on a rally pushed by massive government stimulus. The U.S. consumer price index report due Thursday will be one of the last major economic indicators released before the Fed’s rate decision later this month.

Meanwhile, the Group of Seven rich nations secured a landmark deal that could help countries collect more taxes from prominent firms and enable governments to impose levies on U.S. giants such as Amazon and Facebook.

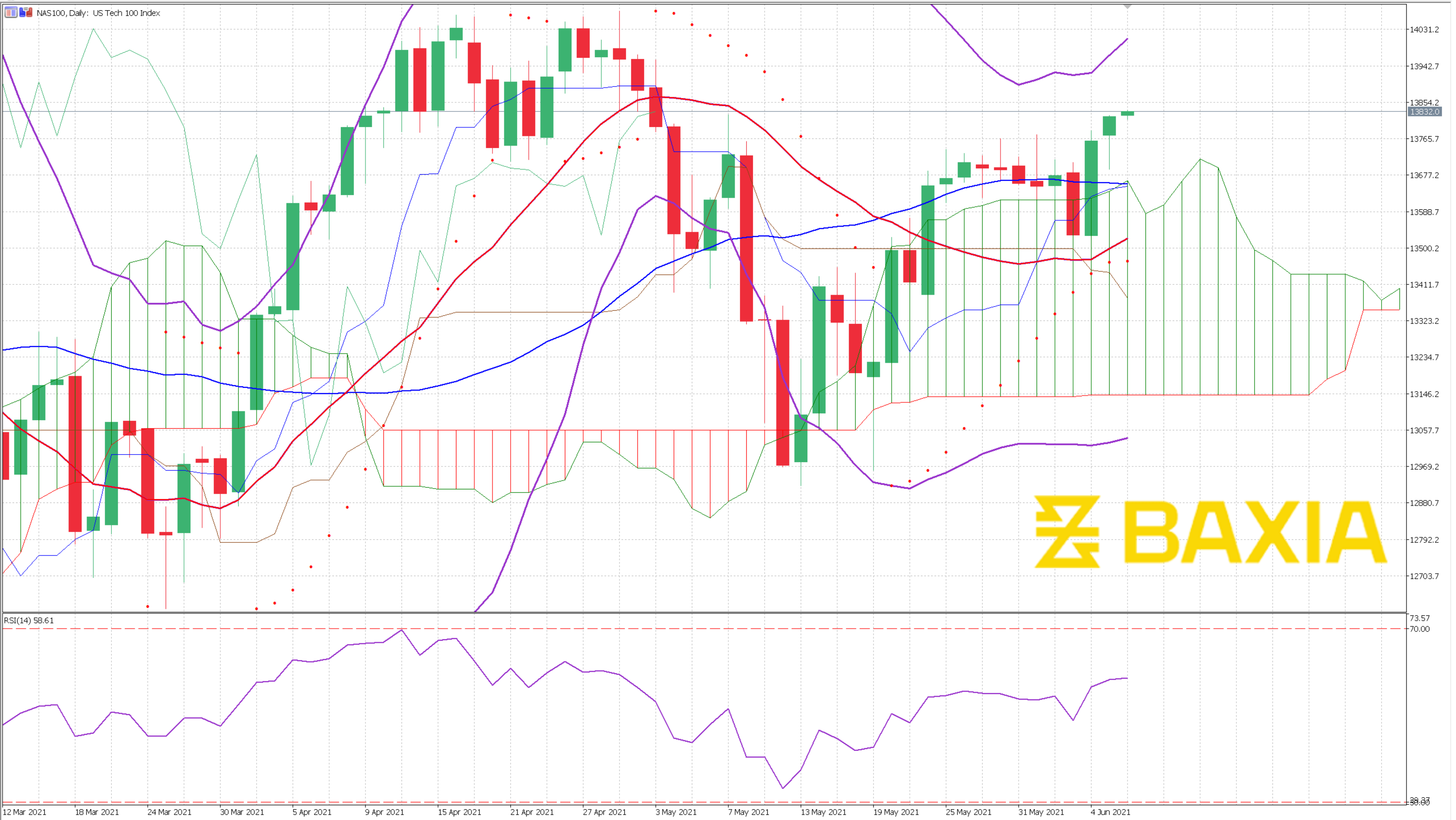

Underperformance by the tech-heavy Nasdaq 100 suggested investors are looking beyond pure growth narratives to sustain gains. The Russell 2000 Index rose for the third straight session on Monday, but it remained more than 2% below the June all-time high.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.