The major U.S. equity indexes rose Thursday, and the S&P 500 set a new record closing high as energy and travel stocks bounced back ahead of a key labor market report.

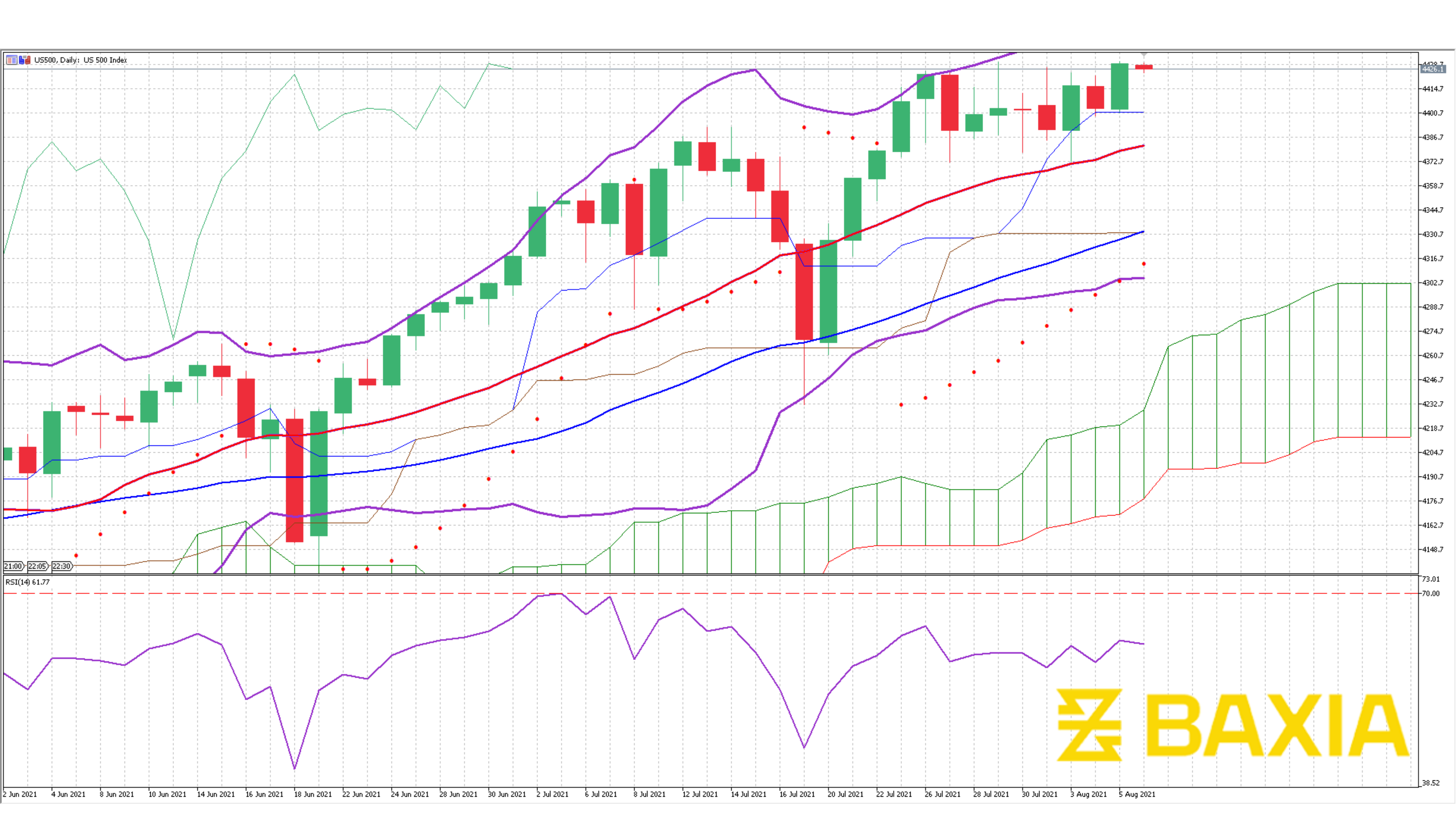

The Dow Jones Industrial Average rose 271.58 points, or nearly 0.8%, to close at 35,064.25. The S&P 500 added 0.6% to finish at a new all-time high of 4,429.10, while the Nasdaq Composite rose about 0.8% to 14,895.12. The moves in the stocks came after a mostly lower regular session on Wednesday, in which the Dow dropped more than 300 points.

Weekly initial jobless claims came in at 385,000 on Thursday, in line with expectations. The claims data was the last reading before the critical July jobs report, released on Friday morning. There is a wide range of estimates from economists about what the information will show, and some metrics for employment gains have disappointed despite a high level of reported job openings.

The jobs report will be a crucial data point for the Federal Reserve to consider when to tighten monetary policy.

The results of an ADP private payroll survey released Wednesday showed a gain of 330,000 jobs for July, well short of the consensus estimate of 653,000. Kourkafas said that the ADP miss showed that there was a downside risk to Friday’s report. Economists expect the reading will indicate the U.S. added 845,000 in non-farm payrolls in July, about even with the previous month, according to Dow Jones estimates.

Travel stocks, including airlines, bounced on Thursday after struggling over the past week amid the spread of the delta variant of Covid 19. American Airlines rose 7.5%, while casino stock Caesars Entertainment jumped 6.4%.

However, the earnings season has been strong overall. Goldman Sachs raised its year-end target for the S&P 500 to 4,700, representing a 7% upside, in part due to an improving earnings outlook.

The Dow has gained nearly 0.4% for the week so far, while the S&P 500 has climbed close to 0.8%. The Nasdaq rose 1.5% since Monday. The small-cap Russell 2000, which gained 1.8% on Thursday, is up about 0.4% this week.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.