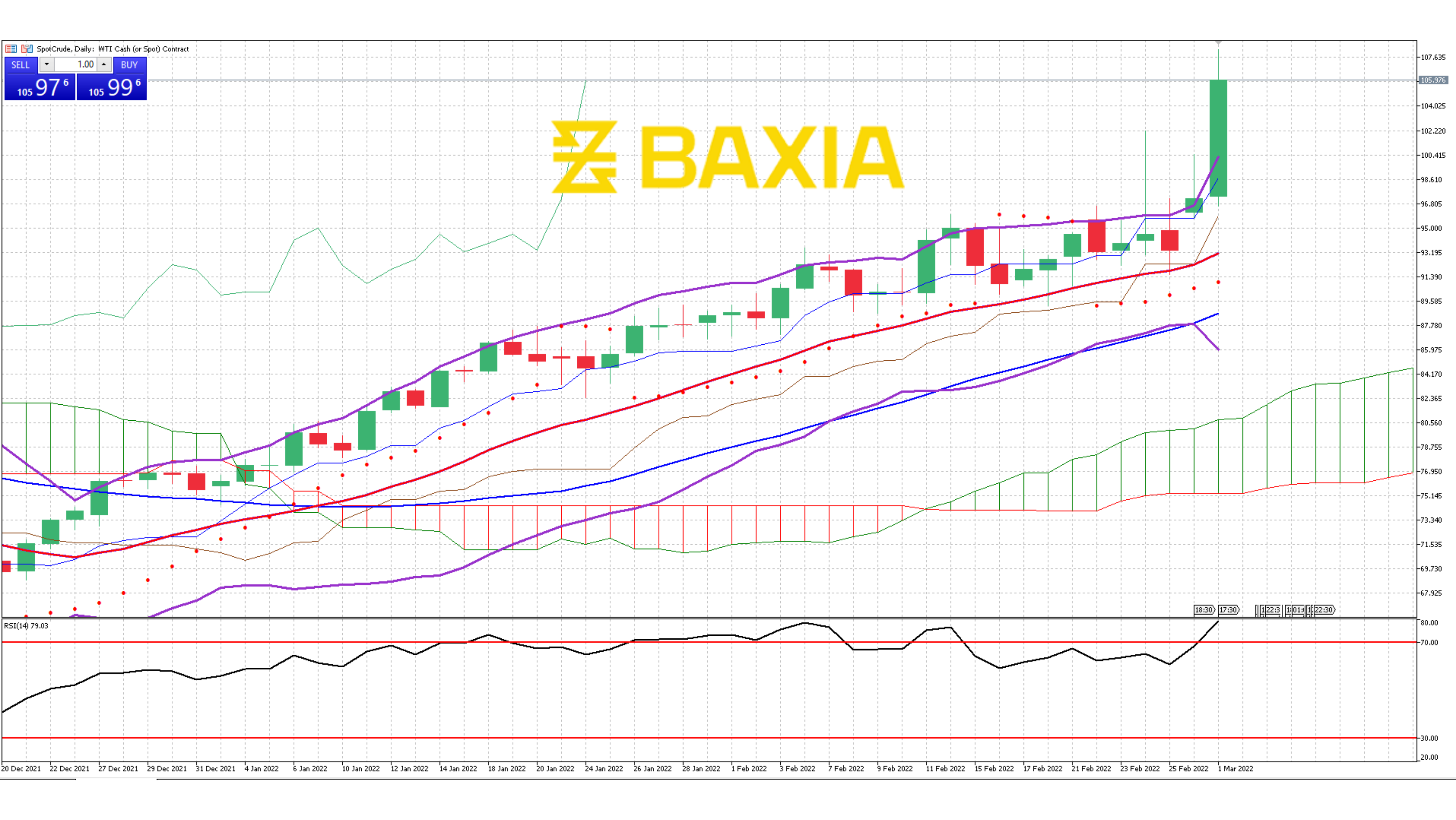

The energy commodity continues finding new 7 year highs as the markets worry about supply constraints, the international energy agency agreed to release 60 million barrels of oil from global reserves as an effort to ease those limitations; however, that does not seem to be enough to absorb the loss of supply from Russia and investors continue worrying about future supply issues.

From a technical analysis perspective, the price of oil is way above what it should be, the Bollinger bands are opening up aggressively but the price moved faster and passes the upper band, suggesting that the current price is high. Again, from a technical perspective, the price should be dropping very soon, but the fundamental forces pushing the price up are way beyond the technical capabilities of the asset.

The relative strength index is overbought at 77%, we have seen XTIUSD stay overbought for a few sessions before seeing a price correction, it could take a few sessions for Oil to settle back in the high 90s levels.

We love to hear new ideas from traders and want to know what you think!

If you like this topic and want to suggest future topics that you find helpful, let us know by clicking the ‘submit your feedback’ button below.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Nothing contained in this website should be construed as investment advice. Any reference to an investment's past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.